Prior to the GameStop and AMC meme stock saga, short interest was often times an overlooked and misunderstood stock metric by most retail traders and investors. Short interest is an important factor to look at if you plan to day trade or swing trade equities. Let’s take a look at how to interpret short interest, the common risks associated with different short interest levels, as well as some important examples to help make sense of it.

Summary

- The short interest is the amount of shares of a stock that have been sold short, but not yet covered or bought back,

- The short interest is often expressed as a percentage and is used as a gauge for market sentiment

- When short interest is high, it typically signals negative market sentiment about the future performance of a stock

- The short interest ratio represents the number of trading days it takes shorts to cover their existing positions, usually over the last 30 days

Short Interest in Stocks Explained

Short interest represents the number of shares that have been sold short but not yet covered or bought back. When you “short a stock” or bet against the price of the stock going down, you borrow shares from your broker and pay a “borrow fee”. When you close your short position, you buy back those shares from your broker, also known as “covering your short”.

The short interest is often times used as a gauge to understand how the market may perceive the stock. A high short interest percentage indicates that traders and investors have a negative outlook on the performance of the stock. A low short interest percentage can be a sign that investors are positive about the potential of a stock. However, it shouldn’t be used as the sole marker of future performance. In addition to this, it’s important for investors to pay attention to large changes in the short interest percentage because it can signal a change in the market sentiment for a stock.

Short Interest Formula

To calculate the short interest, you need to find the total shares sold short divided by the stock float (total number of shares available for trading). This is also commonly referred to as short float percentage.

Short Interest = Total Shares Sold Short / Total Float

For example, let’s assume a company has a 50 million stock float and 10 million shares sold short. The short interest calculation is as follows:

10 million / 50 million = 20% Short Interest

Short Interest Ratio

The short interest ratio (also commonly referred to as the “days-to-cover ratio”) is expressed as a number. It represents the number of days it takes bears or “short sellers” to cover their existing short positions.

Short Interest Ratio = Short Interest/ Average Daily Trading Volume

The short interest ratio is calculated by dividing the number of shares sold short by the average daily trading volume, typically over the last 30 days. By understanding the implications of changes in the short interest ratio, investors and traders can identify price patterns and trends. The short interest ratio should not be used as a sole determining factor for entering and exiting trades.

Important Note: It’s worth noting that the short interest ratio and short interest are not the same. This is commonly misunderstood by many retail investors or traders.

How to Interpret Short Interest

The short interest can give you insight into the public perception of a particular stock and the level of degree of how bullish or bearish they are. If a stock has a rising level of short interest, it doesn’t necessarily mean the price of the stock will fall. It simply means that a higher number of traders and investors are making a bet that the stock will go down in price.

In addition, it’s worth mentioning that certain investors will short a stock as part of the risk management strategy. This is typically done to hedge their long exposure. If you happen to find a stock that has a very high short interest, keep in mind that if the price can go up. If the price of the stock continues to go up it could trigger short to begin covering. This will in turn cause the price of the stock to go up much higher and much faster.

How To Tell if a Stock is Heavily Shorted

Investors sell stock short because they expect the price of the stock to go down. One way to see if a particular stock is heavily shorted is by looking at its financial statistics on Yahoo.com. This can be found on the “Share Statistics” page. For example, take a look at the short percentage of REV.

You can see that the short percentage of REV is over 36% with a short ratio of 11.57. Generally, any stock with a short ratio of over 20% is considered heavily shorted. Anything over 40% is considered very heavily shorted.

What Happens When Short Interest Is High

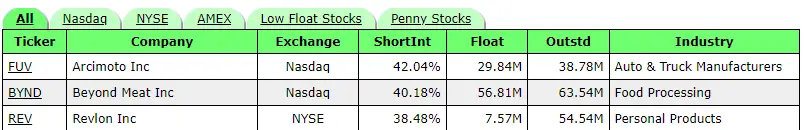

When the short interest of a stock is high, you may notice that the price of the stock is generally trending down. For example, take the following 3 stocks below that have a high short interest.

Data Courtesy of HighShortInterest.com

You can see that each stock is trending down in price consistently. This is typical price behavior from stocks that are heavily shorted. However, it’s important to mention that they may experience periods of upward price spikes, which is usually due to shorts covering.

The Impact of Stock Float on Short Interest

An important factor to consider when analyzing short interest is the stock float. If a stock has a low float it means that a small percentage of shares are available for trading. When a high short interest is combined with a low float stock, the sensitivity of that stock is much higher when there are changes in the short interest.

For example, if shorts begin covering their positions on a low float stock, the stock price can experience very volatile short-term swings. These types of stocks will typically have higher bid-ask spreads which can impact your execution if you’re a day trader. As such, it’s important to be aware of the stock float in relation to the short interest, if you plan on shorting a stock.

Where To Find The Short Interest Of Stocks

There are many sources online where you can find the short interest of stocks. Below are a few different sources where you can find the short interest as well as the short-interest ratio.

Short Interest Example

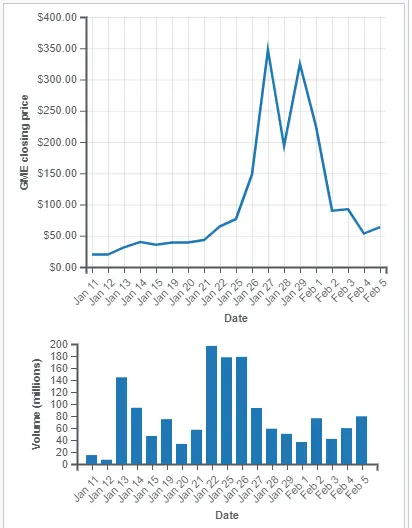

An unforgettable example of a heavily shorted stock was GameStop. In January 2021, GameStop hit a peak 140% short interest. The short interest on the stock was more than the available float. How can this even happen? This occurred by massive short borrowing by exchanges and execution venues that allowed it to get so high.

This created a very risk trading scenario for short sellers as a short squeeze was triggered by the popular subreddit r/wallstreetbets. Other hedge funds and larger retail investors also participated and triggered a Sigma 5 trading event.

As the Wall Street Bets subreddit army teamed up and started buying shares of GameStop, it slowly triggered short sellers to begin covering their positions. This further fueled additional short-covering by hedge funds which sent the price of GameStop surging to record highs. Although this was an extremely risky and volatile scenario, it showcased the impact of short interest and short selling to the wider public.

Conclusion

As you can see, the short-interest can be an important metric to pay attention to when investing or day trading equities. High short interest is not always indicative of poor stock performance in the future as it is subject to change. Short interest should be looked at as an additional metric to understand the market sentiment of stock. However, it shouldn’t be used as the main factor for your investment decisions.