You may have noticed that even if companies happen to beat analyst earnings expectations the price of the stock goes down. Naturally, most investors and traders think that if a company happens to beat earnings the price of the stock should pop up. There is no guarantee that the price of the stock will go up just because a company beats earnings. In this post, we will take a look at 7 reasons why stocks go down after good earnings releases.

Summary

- The price of a stock can drop despite companies reporting positive earnings and future guidance

- The behavior of a stock’s price does not always line up with the reported results due to different underlying factors

Reason 1) Positive Move Was Priced In Before Earnings Were Released

There are many instances in which the price of the stock rises significantly a few weeks or days prior to an earnings release. After the earnings are released the price of the stock ends up declining despite positive news.

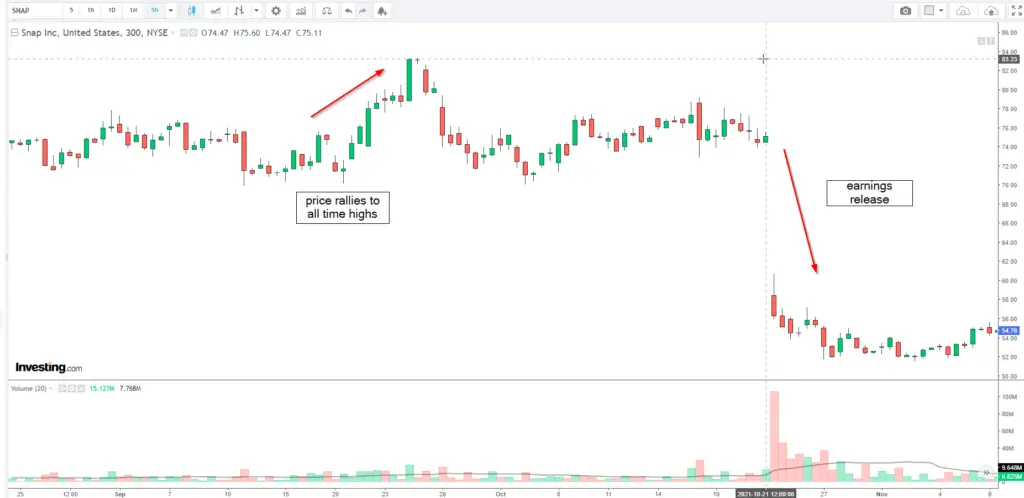

This happens because institutions and individual traders are so confident that the earnings release is going to be positive that they start buying up the stock in anticipation of it. Check out the example below for Snapchat (SNAP) and their earnings release which took place on October 21st.

Although Snapchat beat earnings and had positive guidance, the stock price tanked after their earnings announcement. From our example, you can see that Snapchat rallied to a high of $82.23 per share a month before, and once earnings were released they dropped over 30%.

Once the news is released investors and traders use that as their opportunity to exit their trades and capture profits. This push right up to the date of earnings is used as a catalyst to exit their trades. As you can see with Snapchat, this drop was significant. It’s important to be aware of massive price rallies leading up to an earnings release.

Reason 2) Management Changes

When an earnings call is done, a company may announce a shift in management, such as a CEO, CFO, or COO that may be leaving the company or getting replaced. If traders and investors interpret this as a negative, the price of the stock may fall despite a beat in earnings.

The move to the downside may be larger depending on how long a certain member of management has been with the company or the impact they have had in the past.

Reason 3) Stock Buybacks

Stock buybacks are another reason why a stock price may fall after an earnings beat has been announced. Buying back shares in the company will increase the price of the stock in the long term and improve the company’s financial statements.

As a result of a stock buyback, a company’s EPS is artificially inflated which can cause the earnings report to be slightly misleading. This news can cause the price of the stock to drop despite a positive earnings beat. Although stock buybacks are mainly positive, the price of the stock can decline temporarily in the short term.

For example, AIZ recently announce a stock buyback of $600 million starting on 1/12/2021 on their last earnings release on 11/2/2021. They also had a positive earnings release and great guidance for the future, but their stock price ended up sliding down.

As you can see, as a result of the stock buyback announcement the price of AIZ has been on a steady decline since 11/2/2021. Market participants have interpreted the stock buyback as negative and have begun to sell off shares. It’s worth noting that this will most likely be a temporary pullback in price until the official stock buyback starts on 1/12/2021.

Reason 4) Higher Than Expected Levels of Debt

If a company beats earnings, but investors notice that the company took on a significant amount of debt compared to the previous quarter, this can cause the price of the stock to drop despite a positive earnings announcement. Investors can perceive additional debt as being risky for the company which can reflect negatively in the stock price.

It’s worth noting that not all debt is considered negative. But if the debt the company took on is significant compared to their previous quarter it might cause investors to dump their shares.

Reason 5) Institutional Buying and Selling

When there are higher levels of liquidity, big hedge funds and institutions will look to liquidate part of their larger positions. Days leading up to an earnings release, trading volume tends to pick up and options volatility tends to rise.

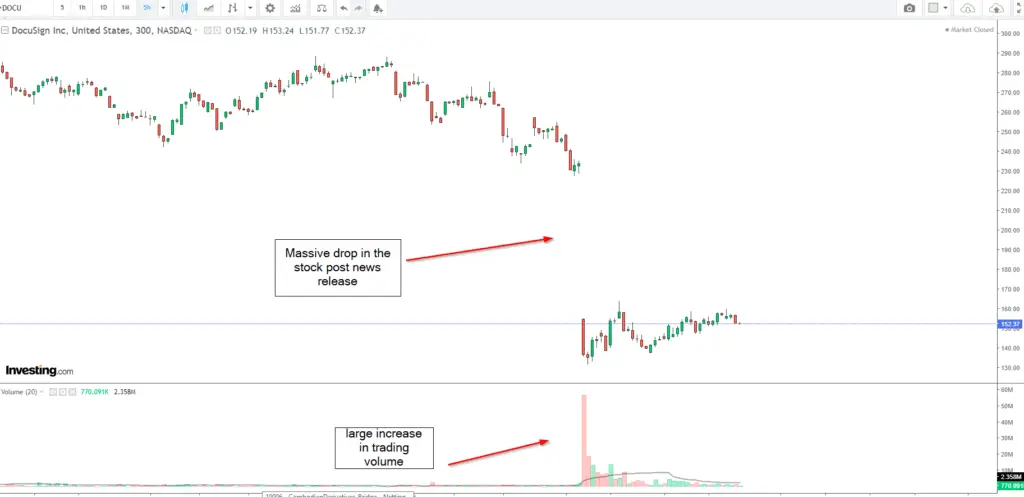

As a result, this provides higher levels of liquidity for hedge funds and larger investors to rebalance their portfolios. One obvious way to spot institutional buying and selling is by a large increase in volume during an earnings release. See the example below of Docusign (DOCU).

Larger than usual institutional buying and selling around these periods can have a larger impact on the price of a stock. This can cause the price of the stock to drop during earnings releases because it provides optimal liquidity for hedge funds to dump their shares.

Reason 6) The Sector Has Become Competitive

A commonly overlooked factor that can impact the price of a stock during news releases is the competition level in the sector. If there have been new companies in the past couple of quarters that have managed to gain market share or push out competitive products, it can have an impact on the price of the stock.

Recommended Reading: Why Do Companies Split Stock? – Stock Splits Explained

For example, if a sector is very easy to penetrate and gain market share, pretty soon that market can become saturated with many different options. If a company has great earnings releases but reports that increased competition could have an impact on their future growth, investors could interpret that as a negative. This could cause the price of the stock to drop despite the positive news release.

Investors should be aware of how big of a market share a public company holds and how the market share is changing as new companies enter the space.

Reason 7) The Price of the Stock Has Overinflated in a Very Short Period of Time

If the price of a stock has overinflated in a very short period of time leading up to an earnings release, it can correct pretty aggressively. There are many instances in which stocks will run up aggressively in price leading up to an earnings release, only to have a massive pullback once earnings are released.

Two major reasons this can occur is due to:

- Irrational exuberance – This concept refers to strong investor enthusiasm that can drive up the price of stock much higher than what its fundamental factors reflect.

- Technical Rally – If a stock has recently hit a new high and earnings are around the corner, traders can push the price of the stock even further. One way to identify when this happens is by understanding how price exhaustion gaps work.

If you happen to notice a stock spiking up aggressively one or two weeks leading up to an earnings release, be cautious. The pullback in price can be just as aggressive as the rally.

Bottom Line

As you can see, there are many different reasons for a stock’s value declining despite a company reporting positive news. It’s important to be aware of the dates on which companies release their earnings. This can help you avoid buying a stock when the price is overinflated in a short period of time.

If you get caught in a scenario in which the price of the stock aggressively pulls back after you have bought around a news event, it’s important to remain calm. Individual stocks can have a lot of short-term volatility surrounding earnings release. As an investor, you should be well aware of it beforehand.