The draw period in a home equity line of credit (HELOC) is an important element to understand if you are planning on applying for a HELOC or already have one. A home equity line of credit is a great financing option that is available for qualifying borrowers.

It can be used to help borrowers fund home improvements, renovations, or use the money to consolidate debt. Before you apply for a HELOC it’s important to understand how the draw period works so you can manage your payments effectively.

What is a HELOC Draw Period?

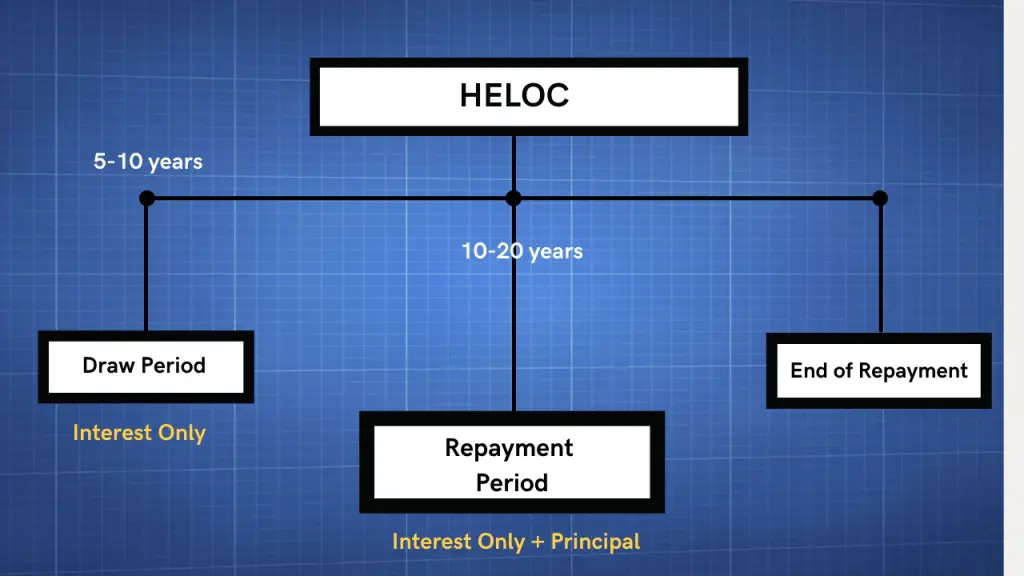

The draw period is the period of time in which you can draw funds from your HELOC up to your approved credit limit. This draw period will vary based on the available options given to you by your lender. In most cases, this period is anywhere from 5 to 10 years. However, some lenders may go out to 15 years.

It’s important to note that a HELOC is not a loan, it’s a line of credit. Therefore, you don’t have to start using the money immediately. You can “draw” the funds anytime during the draw period. The credit limit you get approved for in your HELOC will depend on how much equity you have in your home.

HELOC Draw Period Example

For example, let’s assume you owe $200,000 on your house, but your home is valued at $300,000. This means that you have $100,000 in equity. A HELOC permits you to borrow up to a certain percentage of that equity – usually 60%-85%. The credit limit you end up getting approved for will depend on your credit score, debt-to-income, and other financial-related factors.

Let’s assume you take out an $80,000 HELOC with a 5-year draw period. This means that you will have 5 years to borrow the funds from your approved credit limit.

How do HELOC Draw Periods Work?

HELOCs can be a great option for homeowners who want to tap into their equity. The great part about HELOCs is that you will only pay interest on the amount you end up borrowing throughout the draw period.

During the draw period, you are only required to make interest payments on the amount you borrow, so the payments will usually end up being pretty low. Depending on your lender, they may require you to have pay monthly minimums on the amounts you end up borrowing.

For example, let’s assume you take out an $80,000 HELOC with a 5-year draw period. This means that you will have 5 years to borrow the funds from your approved credit limit. Once your draw period is over, you can’t use the credit that was previously extended to you unless you refinance or get another HELOC.

Can you Pay Off HELOC During Draw Period?

Yes, you can!

As previously mentioned, you are required to make interest-only payments on the amount you “draw” from your HELOC. However, you can also make principal payments to the HELOC during the draw period.

Recommended Reading: How Many Mortgages Can You Have

Your lender may also grant you the option to pay off your HELOC during the draw period. It’s recommended that you carefully read the terms and conditions associated with repayment of your HELOC. Some lenders may impose a pre-payment penalty if you pay off your loan during the draw period.

How Long Is the Draw Period on a HELOC?

The draw period for HELOCs will vary based on your lender and your needs. However, the two most standard draw periods are 5 to 10 years. Some lenders will offer longer draw periods if you happen to have a large amount of equity in your home.

Once your HELOC draw period ends, you will no longer be able to draw from it.

HELOC Draw Period vs. HELOC Repayment Period

It’s important to make the distinction between the HELOC draw period and the HELOC repayment period. As you already know the draw period is the period of time in which you can draw funds from your HELOC up to your approved credit limit.

The HELOC repayment period starts after the draw period is over. Once this happens, the loan goes into a traditional repayment schedule that will include the principal and interest that will be due each month. You will only be charged for the remaining loan balance at the end of your draw period.

How Long is the HELOC Repayment Period

The repayment period usually lasts anywhere between 10 to 20 years. There is usually no penalty for repaying your loan before the end of the repayment period. During this period you won’t be able to make any additional draws from your HELOC.

Will Applying for a HELOC Affect Your Credit Score?

Applying for a home equity line of credit requires the lender to perform a hard credit inquiry. As a result, your credit score may drop a few points during the application process. Most lenders will require you to have a minimum credit score of 700 to qualify for a home equity line of credit.

It’s worth noting that you need to make your HELOC payments once you begin to make draws. Failure to pay your minimum loan payments can negatively impact your credit score.

Can you Extend the Draw Period for a HELOC?

In certain cases, you may have the option to extend the draw period for a HELOC. This will depend on whether or not your lender will allow extensions for the draw period.

For example, if you have a shorter draw period for your HELOC like 5 years, your lender may permit you to simply extend it to 10 years. As previously mentioned, this will depend on whether or not your lender allows it. For this to happen, the lender will most likely require you to pay off your current HELOC and apply for a new one with a longer draw period.

Different HELOC Repayment Options

- Refinance to a lower interest HELOC. It’s worth noting that most HELOCs tend to have a variable interest rate. The rate can be much higher by the time your repayment period approaches. As such, refinancing to a lower interest rate or a fixed rate HELOC can help you reduce your payment.

- Do a Cash-Out Refinance. A popular option used by borrowers to pay off their home equity line of credit is to refinance their current mortgage. The amount you refinance your mortgage for will include the balance of your HELOC. You use the difference you receive in cash and pay off your HELOC.

- Refinance Into a Traditional Home Equity Loan. A home equity loan functions are very similar to a HELOC. You can use a home equity loan to pay off your HELOC. The home equity loan is different, however, because it doesn’t have a draw period and has fixed monthly payments over a specific term.

- Sell Your House. This may not be an ideal option for everyone, but it’s an option nonetheless. If you sell your house, the proceeds can be used to pay off your original mortgage balance along with the remaining balance on your HELOC.

It’s important to have a good understanding of your draw period, your repayment period, and repayment options when getting a home equity line of credit. Knowing how all these work can help you manage your debt obligations accordingly and so there are no surprises.

Repayment Preparation

Once your HELOC draw period ends, it’s important to review the total outstanding balance you have. Consult with your lender to see what your monthly payment will be once the repayment period begins. Your payment will be higher because you be responsible for paying both the principal and the interest portion of the loan during the repayment period.

We also recommend refinancing your HELOC to a lower interest rate that will reduce your monthly payments. Carefully consider all your options so you don’t pay more than you have to.

Article Sources

FTC Consumer Information. “Home Equity Loans and Home Equity Lines of Credit.”