Reverse mortgage programs have increased in popularity with seniors who have a decent amount of equity in their homes who may want a second stream of income for their retirement. This brings us to the topic of home equity conversion mortgages (HECM).

Let’s check it out.

Summary

- A borrower has to be at least 62 years or older

- The borrower must occupy the house as their primary residence

- HECM allows a borrower to convert the equity in their home into cash

- A HECM is a type of reverse mortgage that is insured by the Federal Housing Administration (FHA)

- To qualify a borrower must meet property and financial requirements outlined by HUD

What is a HECM Mortgage?

A home equity conversion mortgage (HECM) allows seniors to convert the equity of their home into cash. It’s a type of mortgage program that is insured and managed by the Federal Housing Administration (FHA). A HECM is a great option for seniors who want to tap into their home’s equity and use it as a supplement to their retirement income.

The amount that can be lent out depends on the appraised value of the home and will be subject to FHA underwriting guidelines. For borrowers to qualify for a HECM, they need to be at least 62 years of age. The money is lent out based on the value of the equity in the house.

The interest accrues on the loan balance, and no payment is required until the borrower dies or the home is sold. If these two conditions occur the loan must be rapid in full.

How Does a HECM Mortgage Work?

A HECM is one of the most popular types of reverse mortgages. The terms associated with reverse mortgages can vary widely based on the different types of reverse mortgage products that are available to borrowers. Proprietary reverse mortgages allow higher borrowing limits and usually tend to have lower costs than standard HECM’s.

The terms and fees associated with a HECM versus a proprietary reverse mortgage will depend on the borrower’s age and how long they expect to stay in the home. Some reverse mortgages focus on borrowers that are at least 62 years of age with zero requirements for loan repayment until the borrower dies or sells the home.

HECM and Home Equity Loans

Oftentimes, a HECM is closely compared to a home equity loan. With a home equity loan, borrowers receive a cash advance based on the equity in the home. The difference is that with a home equity loan, the funds have to be paid back monthly after they are disbursed.

With a HECM, borrowers don’t have to make monthly payments. They only pay if the house is sold or the borrower passes away. Another big difference between a home equity loan and a HECM is that with a HECM you have to pay mortgage insurance premiums while with a home equity loan you do not.

Home Equity Conversion Mortgage (HECM) Eligibility Requirements

Reverse mortgages have special eligibility requirements that borrowers have to meet to be able to qualify. Not every senior will qualify and there are financial as well as property level requirements that have to be met for borrowers to qualify.

Recommended Reading: Conventional Loan vs. FHA – What are the Differences and Features?

If you meet the following eligibility requirements below, you can take a reverse mortgage application by getting in touch with an FHA-approved lender. Let’s take a look at the requirements below.

Borrower Requirements

As a borrower you have the following requirements:

- Must occupy the property as your primary residence

- Be 62 years of age or older

- Own the property fully or pay down a significant amount

- No delinquencies on any federal debt

- Participate in a consumer information session given by a HUD-approved counselor (done to ensure borrowers understand how the reverse mortgage works)

- Must have the necessary financial resources to continue making payments on property taxes, insurances and HOA fees, etc.

Property Requirements

On top of the borrower requirements, the property itself must meet the following requirements below:

- If the property is a condo, it must be a HUD-approved condo project

- Must be a single-family home or 2-4 home with one unit occupied by the borrower

- If the property is a manufactured home it must meet FHA requirements

- Individual condo units must meet FHA single unit requirements

Financial Requirements

Lastly, for the borrower to qualify they have to meet the following financial requirements:

- Payment of real estate taxes, property taxes, and flood insurance must be verified

- Credit, income, assets, and monthly living expenses will need to be verified

If a borrower meets the necessary requirements they will be able to obtain a HECM. It’s important to closely review all your needs and requirements to determine if you need a reverse mortgage in the first place.

What’s the Difference Between HECM Mortgage and a Reverse Mortgage?

A HECM is the most common type of reverse mortgage, so there isn’t a difference between it and a reverse mortgage. It’s simply a type of reverse mortgage that is available to borrowers.

After you feel comfortable about how a reverse mortgage works it’s important to get in touch with an FHA-approved lender and discuss the options which you may be eligible for. The lender will give you further information on the HECM program they carry and other important information such as:

- Maximum first-year payment limits

- Different types of payment options

- Repayment terms

- Loan approval process

Payment Options for a HECM

There are a few different payment options available for borrowers who are looking to get a HECM. They all work differently and they are important to review based on your financial situation is.

Let’s take a look at each one:

- Term Payment: This is an option for borrowers to receive fixed monthly payments for a specified period of time. For example, if the borrower is 63 and they wish to defer getting their Social Security benefits until age 70 (to get the maximum benefits), they can establish HECM term payments for 7 years. They will receive the same fixed payments every month regardless of whether the property of the value drops. This is a great option for borrowers who want a steady stream of payments coming in every month.

- Line of Credit: A line of credit can be established with a reverse mortgage where borrowers access funds only when they need them. Borrowers will need to send in a written request to the company that services the loan to get funds. A unique feature of a HECM line of credit is that it comes with a guaranteed growth rate. Every month, the unused portion of your line of credit grows at the same rate as the interest rate that is applied to your loan balance

HECM line of credit example:

Let’s assume you borrowed $10,000 against an available $50,000 line of credit. The servicer will charge you interest on the $10,000 but will increase your remaining $40,000 line of credit by the same rate.

If your current interest rate is 5% you will see growth on your $40,000 line of credit the next month at $166/month.

$40,000 X 5% = $2,000

$2,000 / 12 = $166.67

- Single Lump Sum Disbursement: With this option, all the proceeds of the loan are disbursed in a lump sum, usually after the closing takes place. This is a great option for people who needs a large sum of cash for a specific reason.

- Tenure Payment: The tenure payment option provides borrowers with fixed monthly payments for as long as the borrower lives in the home as a primary residence. Even if the loan balance ends up exceeding the value of the home, the borrower will continue to receive the same monthly payment. The payment stops only if the borrower leaves the house or dies.

- Modified Term/Line of Credit: This is a hybrid option that combines the term payment along with a line of credit. The borrower establishes a line of credit and ends up receiving fixed monthly payments for a specific period of time.

- Modified Tenure/Line of Credit: With this option, the borrower establishes a credit line and receives fixed monthly payments as long as they continue to live in the house or as long as they live.

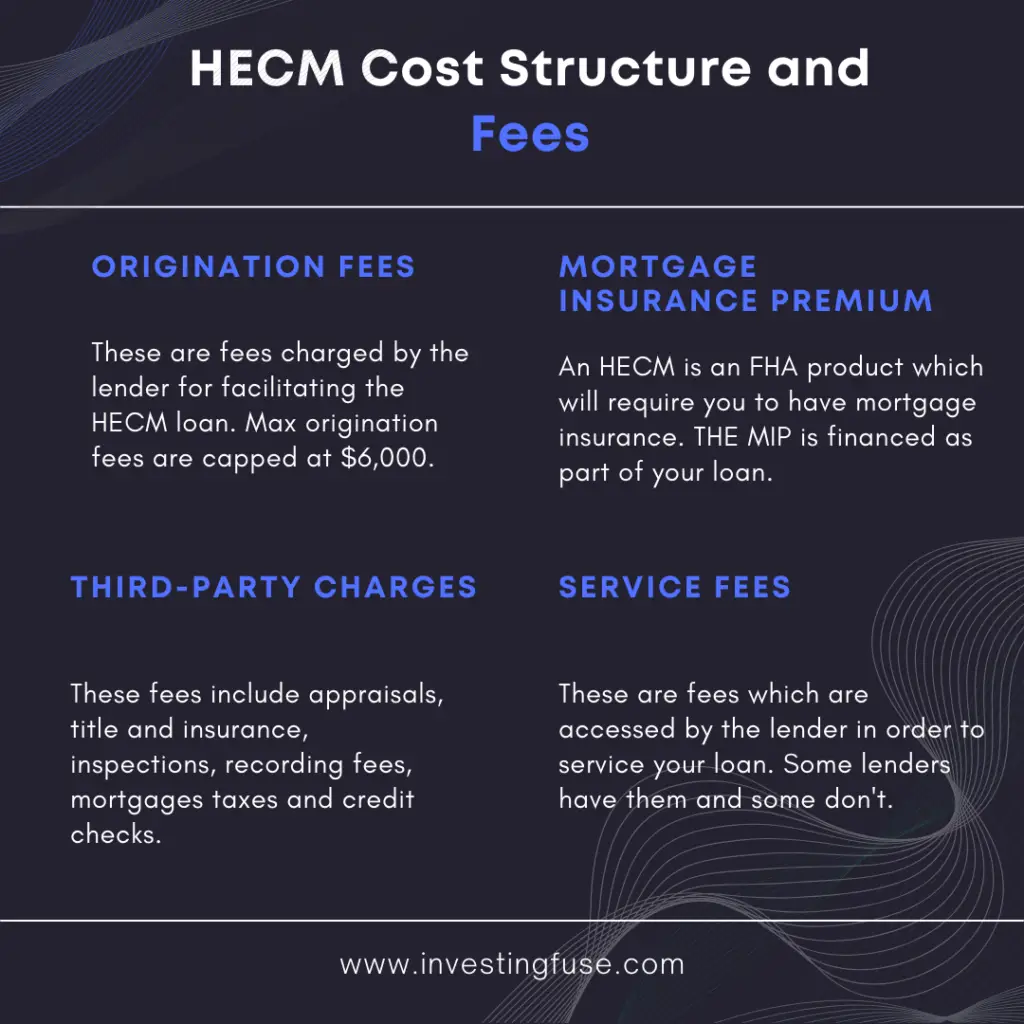

HECM Cost Structure and Fees

If you plan on getting a reverse mortgage it’s important to understand the cost structure and how fees are accessed. They vary from how standard mortgage fees work and as a result, it’s good to understand how.

Generally, most borrowers who get a HECM pay for the costs by financing them and getting them paid out from the proceeds of the loan. Since most people don’t want to pay out of pocket for the fees they end up rolling them into the loan amount.

The HECM loan has several different fees, which include: origination fees, mortgage insurance premiums, third party charges, prepaid interest, servicing fees. All of these fees will be disclosed to you by the lender. The HECM will be charged an initial mortgage insurance premium denoted as “MIP” at closing. It will range between 1.5% and 2%. Let’s take a look at a full breakdown of the fees associated with a HECM.

- Origination Fees

These fees are industry standard and are charged to compensate the lender for facilitating your HECM loan. According to HUD, a lender can charge the greater of $2,500 or 2% of the first $200,000 of your home’s value plus 1% of the amount over $200,000. The max origination fees are $6,000.

- Mortgage Insurance Premium

Since a HECM is an FHA product, they will require you to pay for mortgage insurance. The mortgage insurance serves as a protective measure that you will receive your loan payments. The mortgage insurance premium (MIP) is financed as part of your loan.

- Third-Party Charges

These are fees like appraisals, title and insurance, inspections, recording fees, mortgages taxes, and credit checks. These will usually be rolled into the loan.

- Servicing Fee

Most lenders have gotten rid of service fees, but there still might be FHA lenders who charge servicing fees to service the loan. These will be disclosed by your lender if they will be a part of your loan. If these are not disclosed on your home equity conversion mortgage, you should inquire about them with your lender.

FAQ’s

What are HECM Limits?

As of 2021 according to HUD, the HECM FHA mortgage limit is $822,375.

Can you lose your home with a reverse mortgage?

You can lose your home with a reverse mortgage. If you fail to meet the conditions stated in your home equity conversion mortgage you may lose your house. You should review the conditions within your loan requirements to ensure this doesn’t happen to you.

How many years does a reverse mortgage last?

It depends on the kind of payment term you have for your reverse mortgage. Generally, a reverse mortgage ends if you sell the house or die.

Can a family member take over a reverse mortgage?

With the current HECM programs available, you can’t add a family member to take over a reverse mortgage.

What is the difference Between a HELOC and a Home Equity Conversion Mortgage?

With a HECM the unused line of credit grows at the same rate the borrower is paying on the used credit, so the line of credit will grow if left unused. With a HELOC the line of credit does not grow, what you got for the credit line will remain the same.