There are many instances in which a buyer can’t qualify for a traditional mortgage. This can make a real estate transaction problematic for sellers and real estate agents. There are alternative financing options that may be able to help buyers to get a house.

This is where a wrap-around mortgage comes into play. A wrap-around mortgage is an alternative financing option that can help a buyer get the necessary funding to purchase a home. In some cases, this transaction can help the seller of the home turn a modest profit. However, it’s important to note that there are risks involved with a wrap-around mortgage. If you are thinking about exploring this option as a borrower, it’s important to be fully aware of how they work and the risks involved.

Summary

- A wrap around mortgage is an alternative financing option to help borrowers get a home

- It allows a buyer to purchase a home if they can’t qualify for traditional financing

- With a wrap-around mortgage, the seller offers the buyer-seller financing to get the property

- The buyer is responsible for making mortgage payments to the seller and the seller has to continue making payments on their original mortgage

What is a Wrap-Around Mortgage?

A wrap around mortgage is an alternative funding method to help buyers acquire a home. It works by allowing the seller to maintain and continue their existing mortgage while the buyer “wraps” around the amount required to purchase the property.

It’s considered a secondary mortgage financing option and instead of paying a mortgage company for the loan, the buyer will make monthly payments directly to the seller of the home. Due to the fact that this type of transaction carries risk for the seller, it is often done at higher interest rate than the original mortgage.

How Does a Wrap Around Mortgage Work?

Also commonly known as an “overriding” or “all inclusive mortgage”, a wrap-around mortgage is a form of seller financing. Its typically used as a method to refinance or purchase another property when the existing mortgage on a property can’t be paid off.

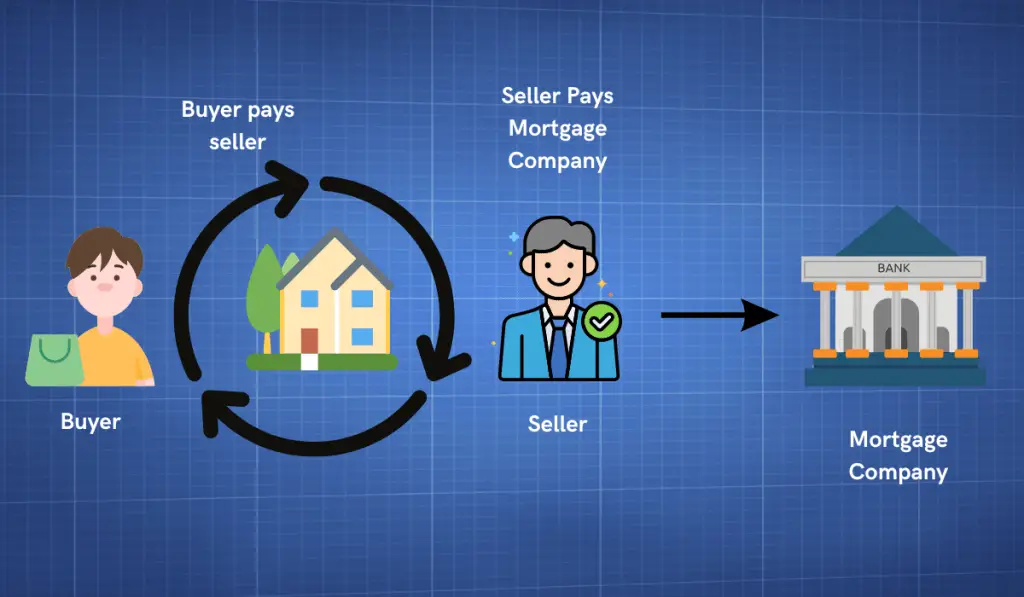

With a standard real estate transaction, a buyer purchases a home with a mortgage that they qualify for through a lender. The title company transfers the funds to the seller and then the seller uses the funds to pay off their existing mortgage on the home and keep the difference.

With a wrap-around mortgage, the seller of a home retains their mortgage on their home and offers the buyer “seller financing” to the buyer and “wraps” the buyer’s loan onto the existing mortgage. In short, the seller of the property becomes a lender. The buyer is then obligated to make monthly payments to the seller.

The buyer and seller agree to the terms of the contract and sign a promissory note. The promissory note lays out the terms of the mortgage such as:

- Down payment amount

- Interest rate

- Length of the loan

From there, the title company passes the deed over to the buyer. The seller will continue to make payments on their existing mortgage, however, they technically no longer own the house.

The Role of an Escrow Company In the Transaction

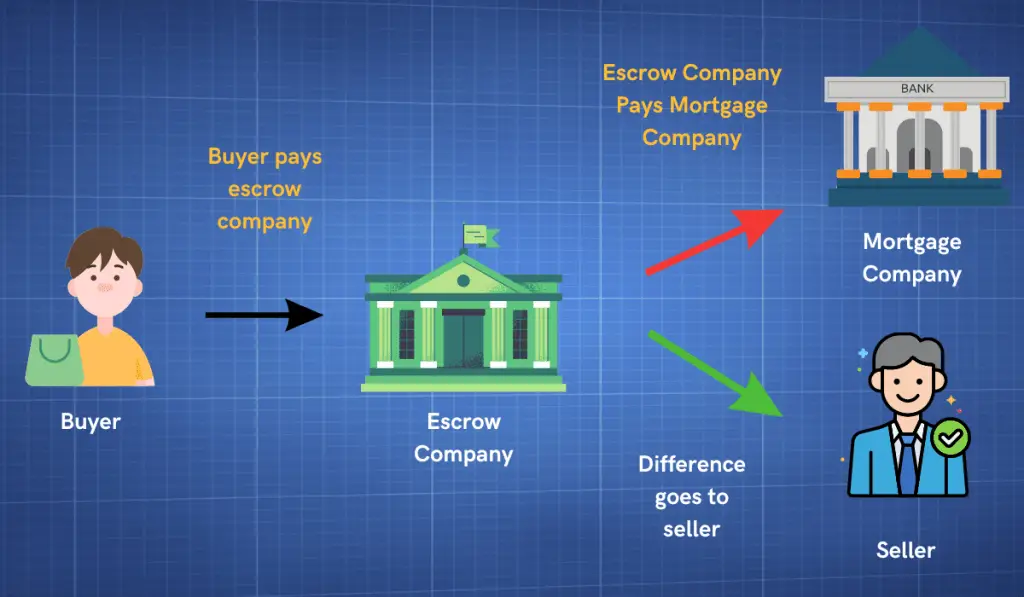

Just like a traditional mortgage, the buyer will make monthly mortgage payments to the seller and the seller will continue to honor their original mortgage payment. In certain cases, the buyer can make payments directly to an escrow company that handles the distribution of funds to the sellers’ mortgage company.

This can help facilitate the payment in a safer way and ensure the sellers’ mortgage stays current. In the majority of cases, the seller will make this loan to the buyer at a higher interest rate to compensate for the extra risk and make some profit.

Why Use a Wrap Around Mortgage?

A wrap-around mortgage is used by buyers that can’t qualify for traditional financing through a mortgage lender. A buyer may have a poor credit history, past bankruptcies, or low income that prevents them from qualifying for a conventional mortgage. If a seller is willing to provide seller financing for their property, a wrap-around mortgage can help a buyer purchase a home.

Although wrap-around mortgages aren’t very common, they are an available option to buyers who are willing to seek alternative financing methods to purchase a home. These types of transactions are more common in distressed real estate areas where investors are willing to work with buyers.

What is an All Inclusive Wrap-Around Mortgage?

This is commonly referred to as an all-inclusive trust deed (AITD). With a wrap-around mortgage, the buyer agrees to pay the promissory note negotiated with the seller. The AITD combines the original mortgage along with the promissory note into a single contract or security instrument.

If the buyer fails to uphold their obligations under the promissory note, the trust teed will put the lender in the first position to take the property. The AITD provides additional benefits to the overall transaction.

Wrap Around Mortgage Example

Let’s assume that John, a local investor, owns a home that currently has a $100,000 mortgage balance with a 3% interest rate. He knows of a local buyer named Steve that is looking to purchase a home but can’t qualify for traditional financing through a lender. John decides to provide seller financing to Steve and they agree to a loan of $110,000 with a 5% interest rate. They sign a promissory note and John hands him the keys to the house.

Steve will have to make monthly mortgage payments to John in exchange for getting alternative financing for the house. John will be collecting a 2% premium over his current interest rate and $10,000 extra over his current loan mortgage amount. Depending on the details inside the promissory note, home ownership may transfer over to Steve. If Steve fails to make his monthly payments, John is within his rights to start the process to reclaim his property.

Pros and Cons of a Wrap-Around Mortgage

Wrap-around mortgages can be a great option for buyers who can’t qualify for a traditional mortgage, however they do come with some risks that buyers and sellers should be aware of.

Pros

- Provide an alternative financing option for buyers who can’t qualify for a standard mortgage.

- They allow sellers to make a profit over their current mortgage obligation.

- These deals can open sellers up to new opportunities they may have never considered.

Cons

- The interest rate for buyers tends to be higher than what you might get with a traditional lender.

- The seller is relying on the buyer to make monthly mortgage payments which can open them up for risk if the buyer tops making monthly payments.

- As a buyer, you should be aware that senior claims on the mortgage take priority over them.

Wrap-Around Loan Alternatives

As a buyer, if you haven’t been able to qualify for a conventional loan, it’s recommended that you try and see if you can qualify for other types of loans. Below are some alternatives loans you may qualify for.

- FHA Loan – is a type of loan meant for first time homebuyers that has lower down payment requirements and allows borrowers with lower credit scores.

- VA Loan – In addition to an FHA loan, if you are an active military member you may be able to quality for down payment assistance through a VA loan.

- USDA Loan – A USDA loan can make purchasing a home in a qualified rural area easier by not requiring a down payment. Explore your options and see if any of the

Conclusion

As you can see, a wrap-around mortgage can be a way for borrowers to qualify for a home purchase outside of traditional financing. As a buyer looking to explore this option, it’s important that you fully understand the terms of the contract you negotiated with the seller. If you aren’t sure, it’s recommended that you have the contract reviewed by an attorney.

As the seller, it’s important that you try and do your best to vet your buyer and ensure that they will uphold their monthly payment obligations. Although there are risks on both sides, it’s a unique and alternative way to make a deal happen.