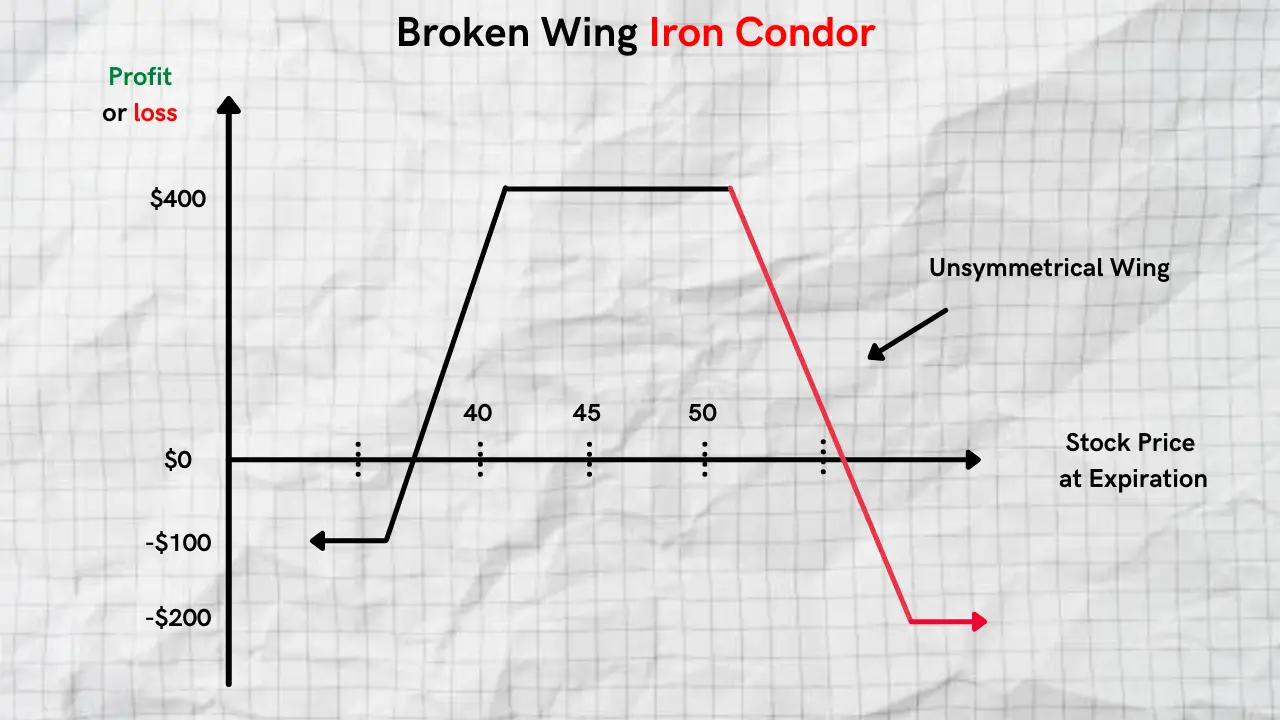

The broken wing iron condor is a modified iron condor strategy that can provide you with an alternative risk profile for your options trade. Instead of having equal risk on each end of the iron condor wings, the risk for a broken iron condor leans more to one side of the trade.

What Is a Broken Wing Iron Condor?

The broken wing iron condor, also commonly referred to as a “risk-adjusted condor”, is a varied form of a standard iron condor that holds more exposure to one side of the trade. Unlike a standard iron condor, the distance between the long and short strike prices is wider on one end of the trade than the other.

Although a broken wing iron condor is still considered a non-directional trade, it will hold a slight directional bias. This will be reflected in the risk and reward of the trade. In most cases, one of the wings of a broken iron condor will collect more premium than the other.

Broken Wing Iron Condor Construction

Just like a traditional iron condor, A broken iron condor consists of 4 separate option contracts. The key difference is that a broken iron condor will have varied widths of strike prices on one side of the trade. See the following example below.

Wing 1 – Put Side

- Sell 1 AAPL OTM 165 put

- Buy 1 AAPL OTM 162 put

Total Width = $3 (165 – 162)

Wing 2 – Call Side

- Sell 1 AAPL OTM 170 call

- Buy 1 AAPL OTM 171 call

Total Width = $1 (171-170)

In this example, wing 1 on the put side has a $3 width while wing 2 on the call side has a $1 width. Since the width on wing 1 of this sample trade is wider than the call spread, it collects a larger credit, but it also holds more risk.

Important Note: The wings of a broken iron condor can be different on the side that the trader has a slight biased towards.

When To Trade Broken Wing Iron Condors

Due to the altered risk and payoff profile associated with broken wing iron condors, they should be traded when you have some sort of directional bias for the stock but still want to collect a premium on both sides of the trade.

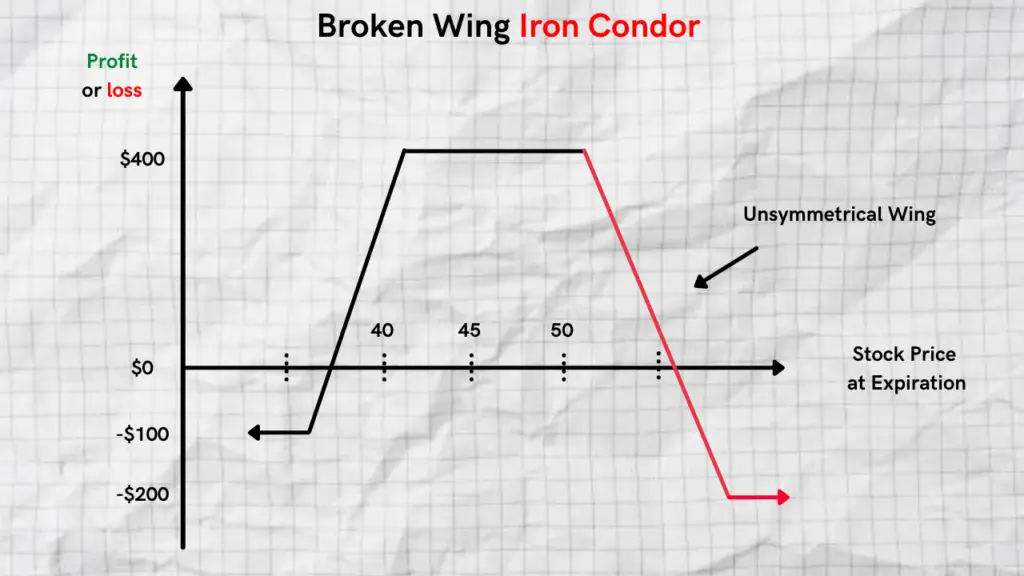

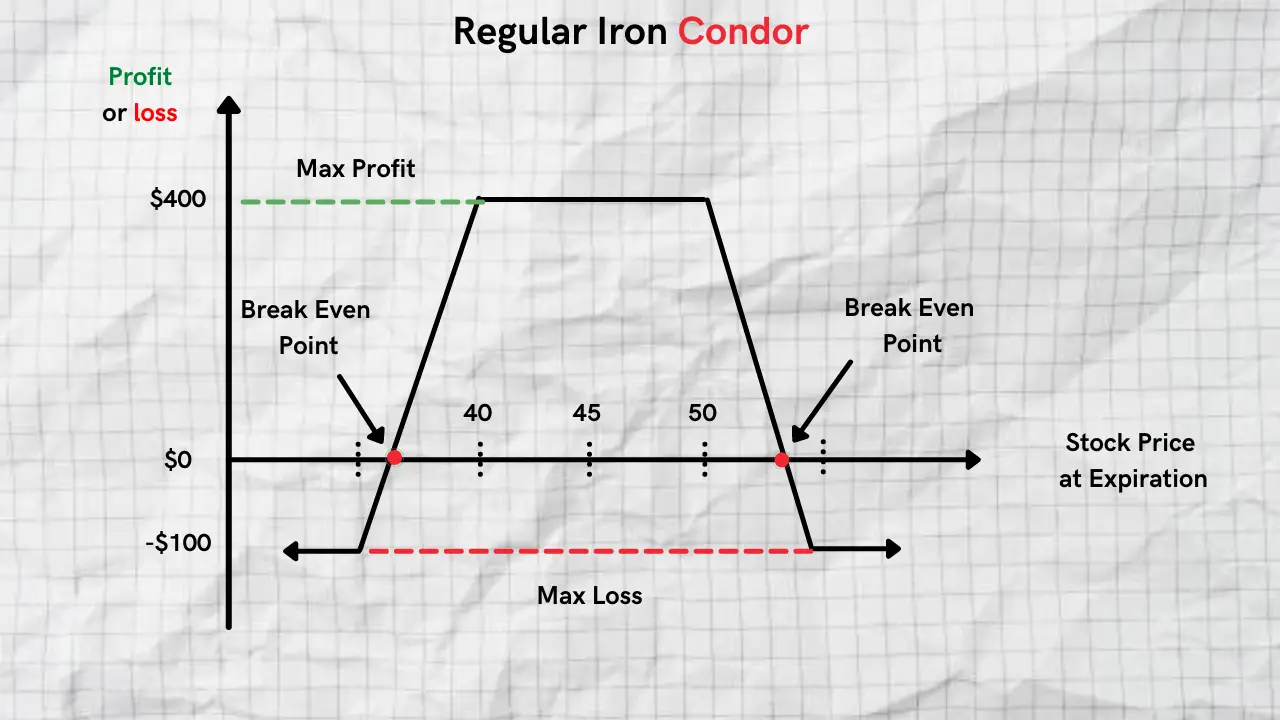

Drag to see the difference between a regular iron condor and a broken wing iron condor.

Traders who get into a broken wing iron condor still believe that a massive move in the stock is unlikely, but if it does happen they are still favoring one side slightly over the other. As such, they are willing to risk a bit more on one side of the trade than the other.

Broken Wing Iron Condor Risk Profile

Changing the risk profile of a broken iron condor can be accomplished in a few different ways.

- Adjusting the width of the wings (one side being wider than the other)

- Moving one side further out of the money than the other

Playing around with the width of the wings and the distance the strikes are from the price of the stock will shift the risk profile of your broken iron condor. Once you make these changes, it’s important to know your max loss, break-even point, and max profit potential.

Broken Wing Iron Condor Max Loss Point(s)

The max loss for a broken iron condor is limited but is usually greater than a standard iron condor. If the price of the stock falls at or below the lower strike of the long put or goes above the higher strike call, you will experience a loss.

A broken wing iron condor can have two different points for losing money.

Maximum Loss = Price of Stock > = Strike Price of Long Call

Maximum Loss = Price of Stock < = Strike Price of Long Put

Important Note: It’s worth noting that your max loss amount will vary based on which wing the price of the stock goes through. If the price of the stock blows through the wing on which your widths are wider, you will experience a larger loss.

Broken Wing Iron Condor Breakeven Point(s)

A broken wing iron condor will also have two different break-even points.

Upper Break-Even Point = Strike Price of Short Call + Premium Received

Lower Break-Even Point = Strike Price of Short Put + Premium Received

Max Profit Potential for a Broken Wing Iron Condor

The max profit potential for a broken wing iron condor is the net credit amount received as a result of entering the trade. Max profit occurs when the price of the stock expires between the strikes of the put spread and the call spread.

Max Profit = Net Premium Received – Broker Commissions

Risk Associated with Trading Broken Wing Iron Condors

It’s worth noting that there is some risk associated with broken wing iron condors and it’s important to be aware of them before you get into a trade.

Unsymmetrical Maximum Loss

Since one of the widths of a broken iron condor is wider than the other, this creates unequal max loss potential on one side of the trade.

Assignment Risk

It’s important to note that if you don’t close your trade before the expiration date, there is assignment risk.

- If the price of the stock closes BELOW your short put strike price you will be assigned 100 shares of stock long.

- If the price of the stock closes ABOVE the short call strike price, you will be assigned 100 shares of stock short.

As such, it’s recommended that you close your iron condor out prior to the expiration date.

Wider Bid-Ask/Spreads

Since you will be placing trades with wider wings on one side, the spreads to get into the trade tend to be slightly higher. This increases the transaction costs associated with getting into the trade.

Benefits of Trading Broken Wing Iron Condors

Collecting More Premium

When you trade broken wing iron condors, you’re able to pull out more premium because one side of your trade has wider wings. While this changes your overall risk profile on the trade, it also increases your maximum profit on the trade.

Taking a Directional Bias

If the price of the stock has been trending in a particular direction a broken wing iron condor can provide you with the opportunity to take a neutral trade with a slight directional bias and earn a premium.

Related Reading:

Risk Free Iron Condor – How to Setup An Iron Condor With No Potential Loss

How to Improve Your Fills When Trading Iron Condors

Iron Condor Vs. Iron Butterfly