Using a calendar spread is a creative way to adjust your long or short options trades that can reduce your exposure and maximize your profit potential. They are a great strategy to learn if you want to profit from time decay and take advantage of directional options trades in the same position. Let’s take a look at how they work and what makes them so powerful.

Summary

- A calendar spread is a long or short position in the stock with the same strike price and different expiration dates

- They allow you to take advantage of time decay as well as picking the direction of the stock

- They can provide downside protection while having unlimited profit potential to the upside

- Calendar spreads can be neutral to bullish long-term or bearish long-term

- They benefit from passage of time and an increase in implied volatility

What is Calendar Spread?

A calendar spread is an options trading strategy in which you enter a long or short position in the stock with the same strike price but different expiration dates. This can be either two call options or two put options.

With a standard calendar spread, an investor would buy an options contract with a longer expiration date and sell an options contract with a shorter expiration date with the same strike price. Calendar spreads are also commonly referred to as “horizontal spreads” or “time spreads“. It benefits from the passage of time and an increase in implied volatility.

The main goal of a calendar spread depends on the type of sentiment you have regarding the stock. There are different types of calendar spreads that are suited to different types of trading environments.

It’s worth noting that there is a modified version of a calendar spread known as a “diagonal spread”. If the options strategy uses two different strike prices for each month it’s referred to as a diagonal spread.

Important Note: The key difference between calendar spreads and regular vertical spreads is that the strike price of a calendar spread is the same on both sides while having a different expiration date.

Different Types of Calendar Spreads

As a trader and an investor, you can get pretty creative with calendar spreads. You can use a spread to capture time decay and also pick the direction of the stock in the same trade. Below are some of the different types of calendar spreads you can enter.

- Neutral Calendar Spread: If a trader is neutral on the price of the stock in the short term they will SELL a near-term call option and BUY a longer-term call option with the intent to capture profit from time decay.

- Bull Calendar Spread: If an options trader is bullish on the price of the stock in the long term, they will SELL a near-term call and BUY a longer-term call option. The goal is to have the premium earned from selling the call option finance some of the cost of buying the longer-term option.

- Bear Calendar Spread: If an options trader is bearish on the price of a stock in the long term, they will SELL a near-term put option, and BUY a longer-term put option. The premium earned from the selling the put option is used to finances the longer-term put option.

There are more ways in which you can structure calendar spreads. These include legging into a spread or even legging out of a spread. More advanced strategies that can further amplify your profitability, but they do require careful execution and constantly monitoring the price of the stock.

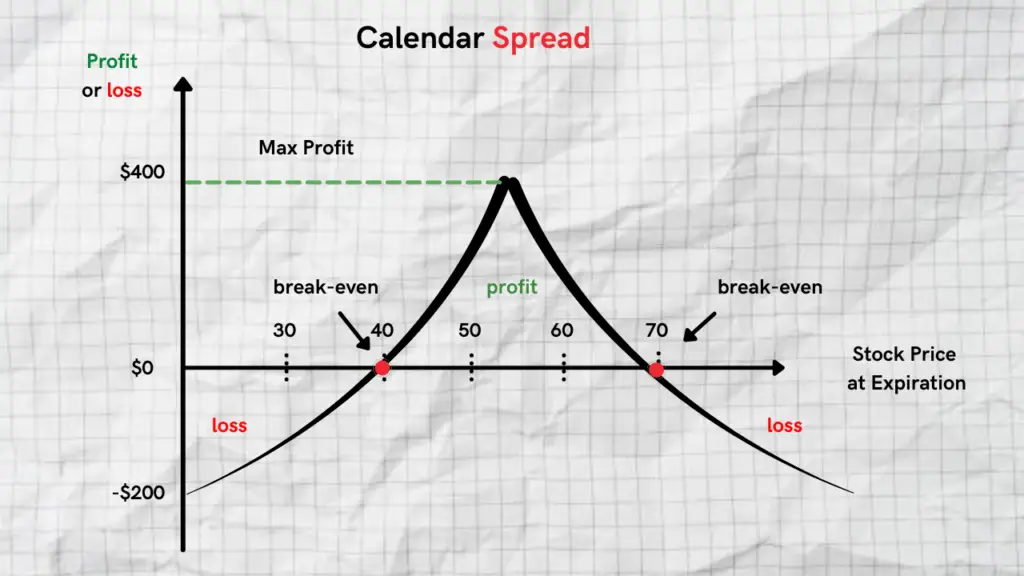

Calendar Spread Payoff Diagram

Example Calendar Spread ( Bull Call Spread )

The risk profile of a calendar spread will vary based on the type of spread you decide to enter into. For example, a bull call calendar spread will have the following risk profile below.

Sample Trade:

- Sell 1 June APPL 180 call ( +$4.0 )

- Buy 1 July AAPL 180 call (-$5.0)

- Net debit paid ( $1.0 )

Limited Downside Risk

The great component to a bull call calendar spread is having limited downside risk. The maximum amount you can lose is limited to the debit paid to get into the spread.

The max loss will be reached once the price of the stock goes down below the lower strike price and stays there until the expiration date of the longer-term call option. The max possible loss in this example is $1.0.

Unlimited Profit Potential

Once the near-term options contract expires worthless ( Sell 1 June APPL 180 call ) you collect the full premium (+4.0). Then trade turns into a full long call option with unlimited profit potential.

The premium earned from selling the near-term options contract acts as partial financing for the long call option ( Buy 1 July AAPL 180 call).

Risks Associated with Calendar Spreads

It’s important to note that there are risks associated with trading calendar spreads. You should be well aware of how they work before you decide to trade them.

- Early Assignment Risk: It’s important to be conscious of the expiration date associated with the short options contract. As the date approaches and the price of the stock happens to get closer and closer to your short strike you may have to make some adjustments.

If the short options contract expires out of the money, the contract expires worthless and your long options contract remains. However, if your short options contract is in the money you should consider buying it back before the expiration date or rolling it to a further expiration date. If you fail to do that, you will be assigned 100 shares short of the stock.

- Limited Profit Potential Early On: The calendar spread has limited profit potential when the sold contract is still in play. Once the short option expires, it opens up unlimited profit potential for the long options contract. Before the short options contract expires it’s considered a neutral strategy.

- Timing Your Entry: This strategy can be very sensitive to unexpected moves in the stock early on in the trade. Sharp movements in either direction in a short period of time have an impact on gamma. As such, it’s recommended that you carefully time your entries. Be conscious of earnings announcements, ex-dividends dates, and news announcements which can cause short-term volatility in the price of the stock.

Benefits Associated with Calendar Spreads

Although calendar spreads carry some level of risk, they offer some advantageous benefits.

- Unlimited Profit Potential: A great attribute associated with calendar spreads is that they offer unlimited profit potential after the near-term option contract expires. This can allow you to profit from a sharp move in the stock after the initial contract expires.

- Financing For a Long Call Option or Put Option: One way to think of a calendar spread is in terms of financing for a long call option or long put option. The credit earned from the shorter-term options reduces the debit cost for the longer-term contract.

- Flexible Way to Manage Position: A great advantage to trading calendar spreads is that they offer different ways to manage your options position if the trade goes against you. You can roll one leg of the trade to a different contract month, close one leg of the trade and keep the other open to take on additional risk.

Managing a Calendar Spread ( Adjusting)

There are several different ways you can manage calendar spreads. It will all depend on what happens to the price of the stock and what kind of calendar spread you entered into (bullish or bearish). Below are the three most popular methods for managing calendar spreads.

Rolling a Calendar Spread

If you have a long call calendar spread, the short call option can be rolled lower if the price of the goes down. You would close the short call by buying it back and resell it at a lower strike price. This is done in order to collect more premium and improve your profit potential.

The goal with the adjustment is to have the price of the stock expire below your short strike as you collect more premium than you paid for the long call option. It’s worth noting that if you roll 1 leg of your calendar spread to a different strike price, this will convert your calendar spread to a vertical spread.

Hedging a Calendar Spread

Another way to make an adjustment to your calendar spread is to hedge it with another calendar spread. This would require you to enter into another spread on the opposite side of the market. Hedging calendar spreads is not very common and is done in very unique situations.

Converting to Butterfly or Condor

An advanced method to make adjustments to your spread is to convert it to an iron condor or a butterfly. This is referred to as a calendar spread conversion and it can get very complicated for novice traders and investors.

FAQ’s

When Should I Buy a Calendar Spread?

Calendar spreads are considered neutral, but can also be bullish or bearish. They are great for both stable markets or in instances in which implied volatility goes up.

Related Reading:

Covered Call Options Trading Strategy Explained

Risk Free Iron Condor – Setting Up an Iron Condor With No Potential For Loss

What is a Reverse Iron Condor and How Does it Work?

Iron Condor vs Iron Butterfly