A covered call is a unique options trading strategy that uses shares as well as options to generate income from the options premium. It’s one of the most popular options trading strategies and is a favorite by long-term investors who wish to capture appreciation in the stock as well as collect options premium.

Summary

- The covered call is considered a neutral options trading strategy in which the investor believes the price of a stock will not move much in the near term

- With covered calls, investors sell options contracts and purchase an equivalent amount of shares of stock

- Covered calls tend to be used by investors who want to hold the underlying stock for a long period of time and generate income

What Is a Covered Call?

A covered call is an options trading strategy that uses both underlying shares and options contracts to create a trade. With a covered call, investors will sell options contracts and own an equivalent amount of shares of the underlying stock. This strategy is used by investors who want to hold a stock long-term and believe it will experience a minor increase or decrease in the near future.

A good way to think about covered calls is like owning a house and collecting rent from it. The house functions as the underlying shares of stock and the options contract function like a rental agreement that pays you money every month. The value of your house can increase over time and you can decide to eventually sell it.

Important Note: The terms “premium” and “credit” are used interchangeably to describe the amount received from writing a call option.

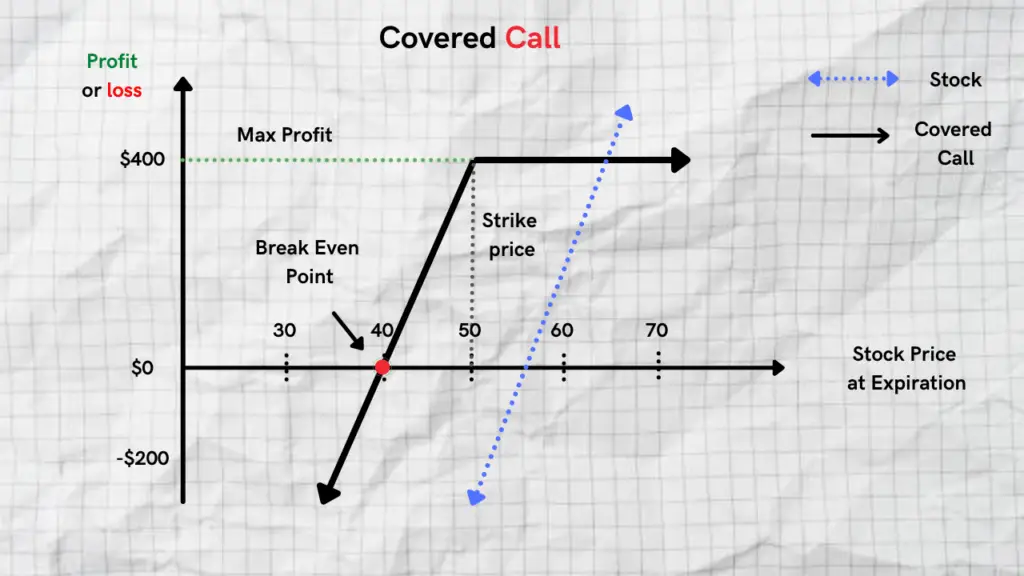

Covered Call Payoff Diagram

From the payoff diagram above, you can see that the covered call has virtually an unlimited loss potential and limited profit potential. This can help visualize the payoff so you know your risk and rewards.

Covered Call Construction

Creating a covered call includes purchasing 100 shares of stock and simultaneously selling an out-of-the-money call option. Investors who do covered calls tend to sell the contracts a minimum of at least one month out.

- Buy 100 Shares of Stock

- Sell 1 OTM call

By selling an OTM call you immediately receive a premium. The closer the strike price of the call option is to the actual price of the stock the more premium you stand to collect.

The further out-of-the-money you sell the call options contract the less premium you will receive. Most investors who sell covered calls tend to do it at least 5% away from the current price of the stock. If the stock is more volatile they tend to shift it out further out-of-the-money.

Why Are Covered Calls Used?

By using the covered call strategy, investors are able to earn a premium selling or “writing” call options while having the benefits of experiencing price appreciation in the stock. Another great benefit to doing a covered call is that you receive a credit as a result of writing the call and also dividends when paid out by the stock.

Doing a covered call essentially creates an additional income stream from your underlying stock position on top of the dividends. This of course only applies to stocks that actually pay out dividends.

Covered Calls Risk Profile

Before you decide to start trading covered calls, it’s important to be aware of the different potential risks elements.

Limited Profit

One caveat to trading covered calls is the fact that they have limited profit potential. In return for the premium received by investors as a result of writing a covered call, you give up the opportunity to fully profit from a significant increase in the price of the stock.

Max profit = Net credit received – Purchase price of the stock + strike price of the short call option – brokerage commissions

Unlimited Loss Potential

The potential loss for a covered call can be very heavy if the price of the stock falls significantly. This is a very common risk faced by most investors. The key difference with covered calls is the fact that they cushion the blow of a sharp decline by the premium from selling a call.

Max Loss = Virtually unlimited

A loss for a covered call occurs when the price of the stock goes below the purchase price minus the credit received. This is the point at which your position becomes unprofitable.

Breakeven Points

It’s important to know the breakeven points for a covered call in case you ever want to get out of the position altogether.

Breakeven price = Purchase price of the stock – net credit received

Now that you have a better understanding of how covered calls works, let’s take a look at an example.

Covered Call Example

You have reason to believe that the price of Apple stock (AAPL) will remain stable for the next month and make moderate gains. The current price of AAPL is $175 share in June. As a result, you decide to do a covered call. You buy 100 shares of stock and sell 1 OTM call option in July.

- Buy 100 shares of stock at $175 = $175.00 ( total cost of $17,500 )

- Sell 185 July call option ( +2.50 credit)

The total cost to purchase 100 shares of AAPL at $175 is $17,500. You also receive a $2.50 credit as a result of selling the call option.

At the end of the July expiration date, the stock price advances higher to $187. Let’s take a look at everything that happens as a result of the price increase.

Example Details

Original Purchase Price = $175/share

Stock Price at Expiration =$187/share

Total stock appreciation = $12/share

Total Premium Collected = $2.50

Short call strike = $185

In this example, since the price of the stock rallied past your short call strike price at expiration, your stock position of 100 shares would have gotten sold off at $185.

Total Profit on this trade = Credit Received – [Purchase price of the stock + strike price of the short call option]

Total Profit = $2.50 – $175+ $185

Total Profit $ = $1,250

Since the price of the stock rallied past your short call strike price to $187, you lost out on $2 in stock appreciation. But this was essentially made up from the $2.50 you received in credit as a result of selling the call option.

You can see there is an advantage to trading covered calls if the stock happens to advance to the upside. This example doesn’t take into account the brokerage commissions, but with this trade they are negligible.

Pros and Cons of Covered Calls

| Pros | Cons |

| Collect premium while enjoying the benefit of appreciation in the price of the stock | Limited profit potential if the price of the stock goes above your short strike |

| Benefits from time decay | Unlimited loss potential if the price of the stock moves down sharply |

| Can help offset downside risk | Gains on premium earned from covered calls is taxed as short term capital gains |

FAQ’s

What are the Covered Call Margin Requirements?

The margin requirement for covered calls is the amount you have to put up to purchase 100 shares of the underlying. If the current price of a stock is $100/share you will have to put up $10,000 to do a covered call.

Are Covered Calls Worth It?

Covered calls can be worth it if you pick the right stock. This strategy will not work well for volatile stocks. The best stocks for covered calls are ones that how low volatility, stable cash flows, and pay dividends.

Related Reading

Iron Condor vs Iron Butterfly

Poor Man’s Covered Call Explained

Rolling a Covered Call Option