Gamma scalping is a complex options trading strategy that is used to manage options trades. It’s mainly used by institutions and hedge funds to manage portfolio risk and large positions in equities and futures. In the past, gamma scalping has been a very commission heavy strategy due to the constant trading involved with it. However, with recent change in retail trading and reduced commissions across the industry, it’s become more accessible for retail traders to participate in.

In this article, we will first define gamma and dive into how gamma scalping works along with some examples of the strategy in action. Before we go any further, we want to emphasize that this strategy can by very complex and requires you to have a solid understanding of options trading if you decide to try it.

Summary

- Gamma scalping is a complex options strategy that is used to offset theta decay on a long options trade

- Gamma represents the rate of change of an options delta based on a single dollar move in the stock

- The gamma is highest for at-the-money options

Gamma Explained

To effectively understand gamma scalping, it’s important to first have a solid understanding of the option Greeks and gamma in general. Gamma is the rate of change of an options delta, while delta is the rate of change of the options premium for every dollar move in the underlying stock.

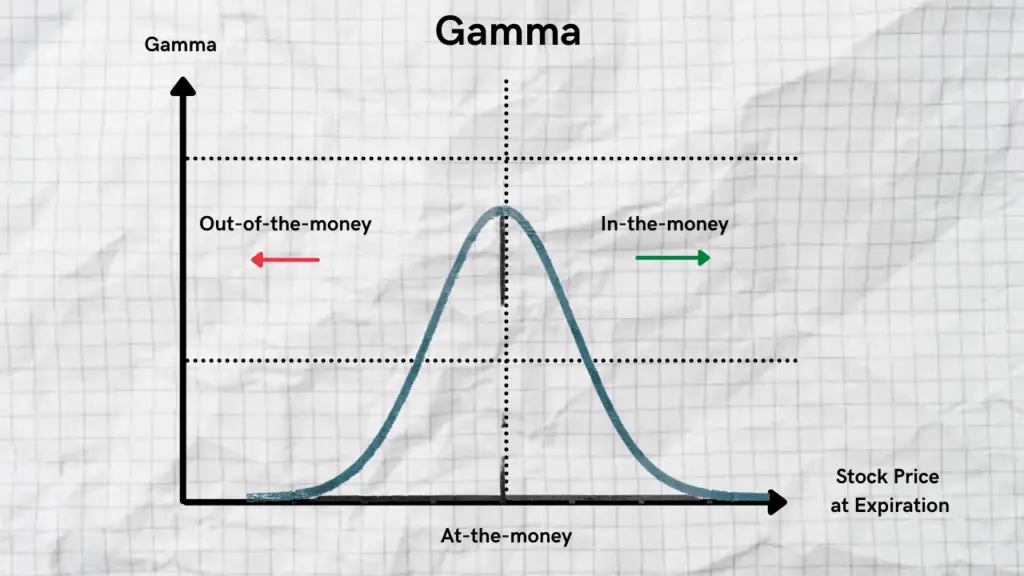

The graph above illustrates at what points gamma is the highest and at what points gamma is the lowest. As you can see from the graph:

- The gamma is highest for at-the-money options

- Gamma approaches zero the further out-of-the-money an option is

- Higher gamma indicates that the options delta could change significantly with a very small change in the stock price

- Lower gamma indicates that the options delta won’t change much with a change in the price of the stock

For options contracts that are near-the-money, the gamma will increase as the expiration date approaches. This happens because the time value of the option is reducing and the option begins to lose its extrinsic value and retains its intrinsic value.

As you can see, gamma and delta have a relationship to one another that is essentially tied back to the options premium. Whenever the delta of an option changes, so does gamma. Understanding this relationship is important because it will help you make sense of changes in gamma when the price of the stock moves.

Understanding Positive and Negative Gamma

Positive Gamma

When buying options, either calls or puts, the gamma of your options position will be positive. As the price of the stock goes up, positive gamma means that the delta of your call options will become more positive and move closer towards +1.0. When the price of the stock falls, the delta of your call option gets less positive and moves closer to 0.

Negative Gamma

When selling options, the gamma of your options will be negative. A short call option with a negative gamma will have a delta that becomes more negative if the price of the stock rises. If the price of the stock drops, the short gamma options position will have a higher delta.

It’s important to understand this relationship because it will help you become more efficient when scalping gamma. Another important relationship to understand about gamma is how it changes with time. This is vital to understand because it will help you decide the time frame that is most suitable for you to scalp gamma.

Gamma vs Time to Expiration

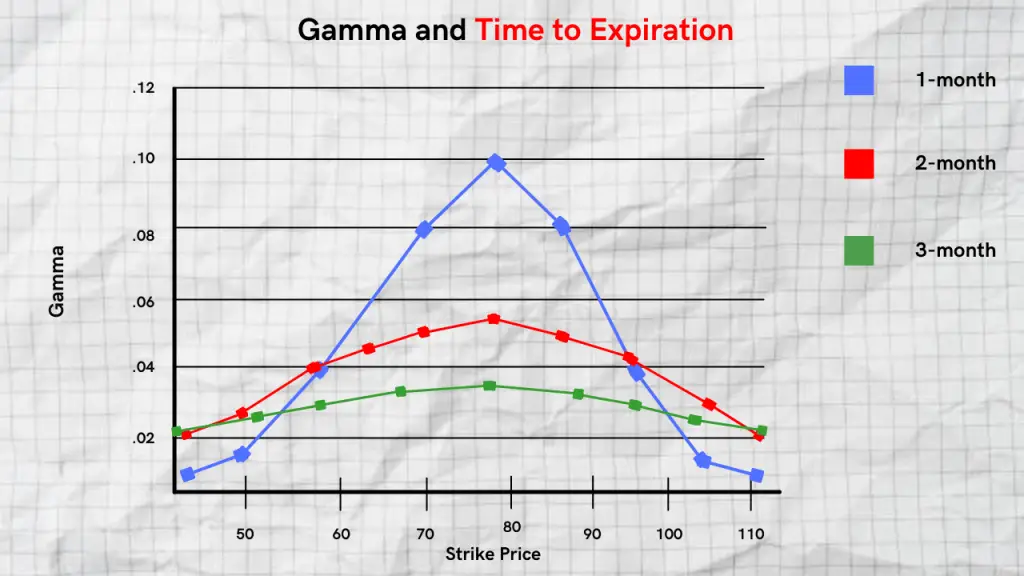

Another important component to making sense of gamma is its relationship with time to expiration. As the time to expiration approaches, the gamma of at-the-money options will increase. At the same time, the gamma of the in-the-money and out-of-the-money options will decrease. Gamma increases near expiry because there is a greater visible change in delta in shorter-term options than longer-term options.

The chart above shows the different behaviors of gamma with options at different expiration dates, in 1 months, 2 months, and 3 months. As you can see, the gamma of longer-term expirations is lower, As the time to expiration approaches, gamma increases for at-the-money options.

Gamma and Implied Volatility

Before getting involved with gamma scalping, it’s important to understand the relationship between gamma and implied volatility. Understanding this relationship will help you determine the optimal points at which to hedge your exposure when gamma scalping.

If Volatility is High

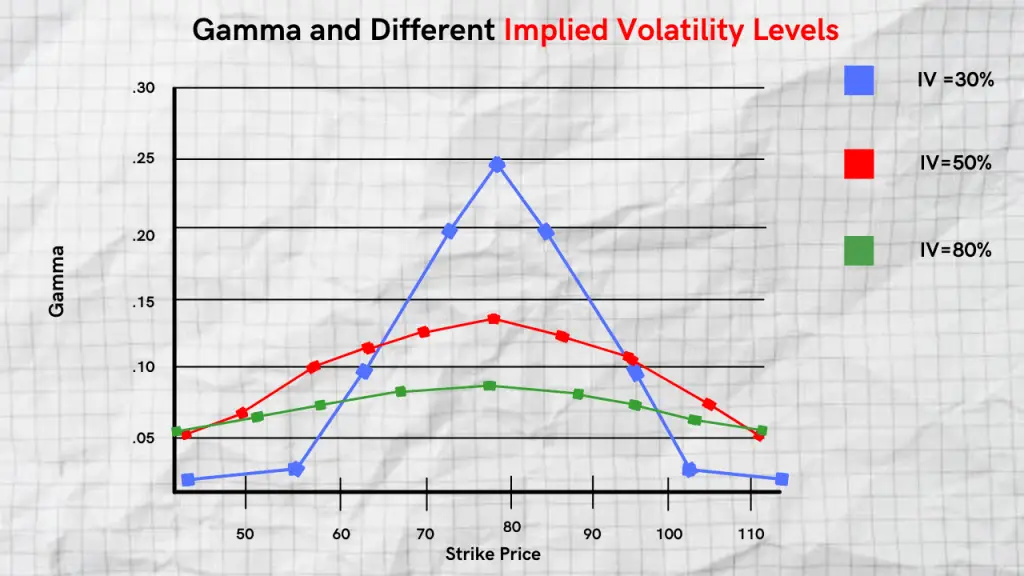

If volatility is high, gamma will usually be more stable across all options strike prices. The reason is that when volatility is high, the time value component of deep in-the-money and deep out-of-the-money options is already very high.

High Vol = More Stable and Less Sensitive Gamma

As such, when there is an increase in the time value of the options as they get closer to the money, gamma is less sensitive and will remain more stable.

If Volatility is Low

On the contrary, when volatility is low, gamma will be more sensitive across strike prices. Gamma will be the highest for at-the-money options and approach 0 for deep-in-the-money and deep-out-of-the-money options.

Low Vol = More Sensitive Gamma

The reason this occurs is that when volatility is low, the time value component of options is low, but will rise significantly as the stock price gets closer to the strike price. As supported by our graph, you can see the spike in gamma towards at-the-money strike prices and how it approaches 0 the deeper you go out-of-the-money and deeper you go in the money.

What is Gamma Scalping?

Now that we have a better understanding of gamma and how it behaves, let’s explore how gamma scalping works.

Gamma scalping is an options trading strategy that is used to offset the theta decay on a delta-neutral long options trade. The process behind gamma scalping involves buying and selling shares of the underlying stock in an attempt to make up for some of the effects of theta decay.

Theta is the cost to carry a long options position which decays daily. When reading an options chain, theta will always be displayed as a negative number and represents the amount the value of an option erodes every day. When you purchase an option, theta is working against you and when you sell an option theta works in your favor.

Gamma Scalping Trade Example and Setup

Gamma Scalp Setup

The gamma scalping strategy starts with a long straddle and gets adjusted as the price of the stock goes up or down. Let’s take a look at the basic construction and the right way to start it off.

Initial Setup

- Long straddle ( Long Call + Long Put ) – same strike price

- The position should be delta neutral

- At least 45-90 days until expiration

- There is a net debit paid to enter this position

The initial setup starts with a long straddle on the same strike price. The trade should be delta neutral and it’s recommended that you go out a minimum of at least 45 days until expiration with 90 days till expiration being the ideal expiration length. When you initially put the trade on you will have a fixed level of risk.

Adjustments

- Stock Price Falls – Add long stock position

- Stock Price Rises – Sell short stock position

If the price of the stock falls, you purchase x amount of shares in the underlying depending on how much the price of the stock moves. If the price of the stock rises, you sell shares short. Depending on the volatility of the stock you’re trading, it is recommended that you begin to purchase or sell shares in the underlying when you have a minimum of $1 in intrinsic value on your options.

This is just a recommended minimum, you can widen it out more than that. When your options contract has at least a minimum of $1 in intrinsic value, you can use the underlying shares as a way to lock in that intrinsic value.

Let’s take a look at how an example trade would pan out. For this trade, we will use AMD as an example.

Gamma Scalp Example

The price of AMD on 11/1/2021 is $122 per share. We decide to enter into a long straddle for the next 60 days and buy the Jan 1st, 2022 $122 put and buy the Jan 1st, 2022 $122 call option.

Initial Trade

| Example Scenario | AMD is trading at $122 on 11/11/2021 |

| Initial Trade ( long straddle) | Buy 1 ATM Jan 1st 2022 $122 put – $7.50 Buy 1 ATM Jan 1st 2022 $122 call – $7.00 60 days until expiration |

| Total Debit | $14.50 ( $7.50 + $7.00) |

After the Trade ( Adjustment and Trade Management)

After 9 days we can see that the price of AMD has rallied from $122 per share to $154 per share. This means that our $122 call option has $32 in intrinsic value, while our $122 put has been slowly decaying. We still have 51 days until expiration.

Remember, when gamma scalping, when the price of the stock goes up, you sell shares short at certain price points depending on the volatility of the stock.

An effective way to gamma scalp AMD in this example is to sell 25 shares every $10 move up in the stock stock. The amount of shares you decide to sell will depend on how volatile the stock is and one way to get an idea is by the expected move in the stock by the options market. With this in mind, below is how we would have sold the shares short.

Trade Management

Below are the different price points we would have sold shares short of AMD as the price went up.

- $132 – 25 shares

- $142 – 25 shares

- $152 – 25 shares

Now after 11/9/2021, we can see that the price of AMD sharply falls down to about $138 per share in about a single day. As the price reverse and goes down, your short positions would now be profitable and you can begin to sell them off. This is where you scalp gamma. You made profit on your short positions, and your $122 call option still has $16 in intrinsic value with the stock price at $138.

With our example above you would have had a weighted average price per share of $142. So, your short positions would have become profitable after AMD dropped below $142 per share. Since you would have closed out your short positions at $138 per share you would have “scalped” approximately $300 in profit ( $142 – $138 ) x 75 shares.

You would continue to repeat this process throughout the expiration of the trade. The idea of gamma scalping is that you make up the theta decay that naturally occurs with options as the time to expiration approaches.

The Risks and Benefits of Gamma Scalping

Risks

- Can get pretty cost-intensive with trading commissions

- Requires careful monitoring and understanding of the Greeks to manage effectively

- Placing the wrong hedge trade can cause significant losses

Benefits

- It can be an effective way to combat the effects of theta decay on a long straddle position

- Can help you effectively hedge and manage portfolio risk in volatile products

- It can be a great way to hedge directional exposure

FAQ’s

Is Gamma Scalping Profitable?

Although gamma scalping is complicated, it can be profitable if the ideal market conditions align along with correct trade management. As a trader, you need to pay close attention to how changes in the stock price impact delta and gamma throughout the life cycle of the trade.