Iron condors and iron butterflies are two very similar options trading strategies. They’re used in low implied volatility environments to collect options premium. The less the price of a stock moves, the more premium you will end up bringing in. The more the price of a stock moves, the higher your probability of experiencing a loss. Let’s first break down how an iron condors works and then the differences in iron butterflies.

Summary

- Iron condors and iron butterflies are used in low implied volatility environments.

- They both include 4 separate options contracts .

- An iron condor includes a spread on the put side and a spread on the call side.

- An iron butterfly also includes a spread on the put side and a spread on the call side with the short strikes being at the same price.

Iron Condors Explained

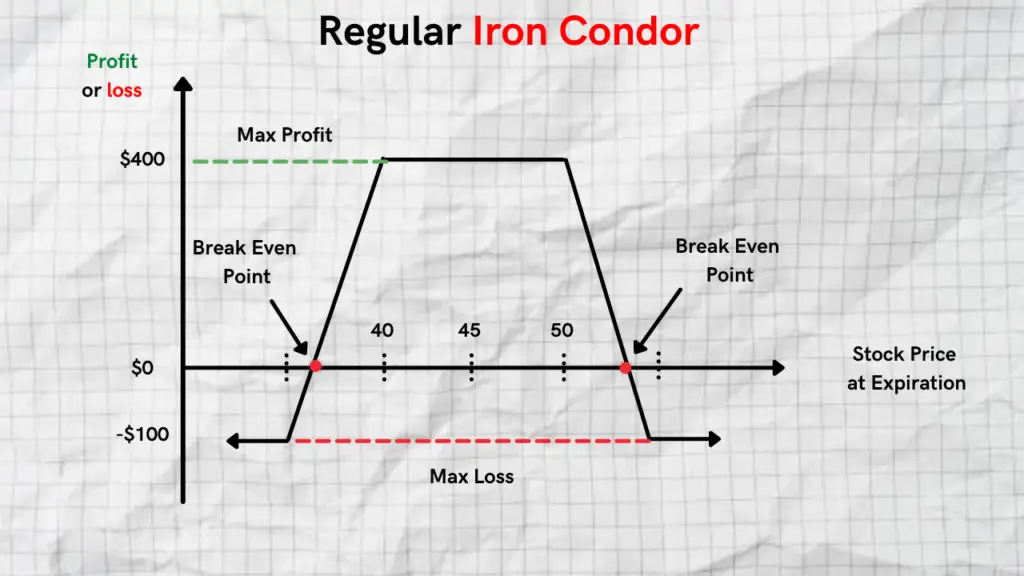

An iron condor consists of two put contracts (one long and one short) and two call contracts (one long and one short), along with four different strike prices with identical expiration dates.

It’s a delta-neutral options trading strategy that profits the most when the price of a stock does not move much. It has limited upside and limited downside risk because the “wings” of the condor protect against significant moves in either direction.

The goal with an iron condor is for all of the options contracts to expire worthless. This occurs if the price of the stock closes between the two strike prices at expiration.

How to Structure an Iron Condor

A standard iron condor will feature a spread on the put side and a spread on the call side. There will be a total of 4 contracts involved. Think of it as building two separate wings.

The Put Side ( wing 1 )

- Buy 1 OTM put with a strike price below the current price of the stock (used as downside protection).

- Sell 1 OTM put with a strike price below the current market price, but closer to the stock price.

The Call Side ( wing 2 )

- Sell 1 OTM call with a strike price above the current market price (used as upside protection)

- Buy 1 OTM call with a strike price further above the price of the stock price.

You will receive a net credit as a result of writing the iron condor. The closer the wings are to the price of the stock, the higher premium you will receive for writing the iron condor. Subsequently, this will result in a lower probability of profit.

Recommended Reading: The Chicken Iron Condor Strategy Explained

Important Note: The two wings should be equidistant from the price of the stock, otherwise it would be considered a broken wing butterfly.

Iron Butterfly Explained

An iron butterfly, just like an iron condor consists of four contracts, spread across three different strike prices. This also uses a spread on the put side and a spread on the call side. The major difference is that the short strikes share the same strike price.

How to Structure an Iron Butterfly

The Put Side ( wing 1 )

- Buy 1 OTM put with a strike price below the current market price of the stock (used as downside protection)

- Sell 1 ATM put (same strike price as the short- call)

The Call Side ( wing 2 )

- Buy 1 OTM call with a strike price above the current market price of the stock (used as upside protection)

- Sell 1 ATM call (same strike price as the short- put)

Important Note: It’s recommended that you close out your trade prior to expiration to avoid assignment risk. If you get assigned you will have to put up the cash to purchase shares.

Difference Between an Iron Condor and Iron Butterfly

The main difference between an iron condor and an iron butterfly is where you position the short strike prices, along with the premium received from your short contracts.

With an iron condor, your short positions have a larger distance from the stock’s current price.

With an iron butterfly, your short position strikes are closer to the stock’s current price than they are with an iron condor.

Related Reading

Chicken Iron Condor Strategy Explained

What is a Reverse Iron Condor and How Does it Work?

How to Improve Your Fills When Trading Iron Condors

What is a Reverse Iron Condor and How Does it Work?