An iron condor is one of the most popular and widely talked about options trading strategies. It’s a directionally neutral options strategy that is used when you are anticipating a small movement in the price of the stock during a specific time frame. On top of that, an iron condor is a limited-risk trading strategy that takes advantage of low-volatility environments to earn a premium.

Summary

- An iron condor consists of two vertical credit spreads – one credit spread on the put side and one credit spread on the call side

- It has limited risk as well as limited profit potential

- An iron condor consists of 4 different strike prices all with the same expiration date

- The trade profits the most if the price of the underlying stays within a narrow price range

What Is an Iron Condor?

An iron condor (IC) is a combination of two vertical spreads on opposite ends of the market consisting of 4 separate options contracts. It’s made up of one credit spread on the put side and one credit spread on the call side with the same expiration date. The two credit spreads are oftentimes referred to as the “wings” of the condor which have identical widths on each side that hold symmetrical risk.

The goal of an iron condor is to have the underlying stock price “expire” in between the two strike prices. As such, iron condors are best used in a low volatility environment in which the price of the stock trades within a tight range.

Iron Condor Payoff Graph and Construction

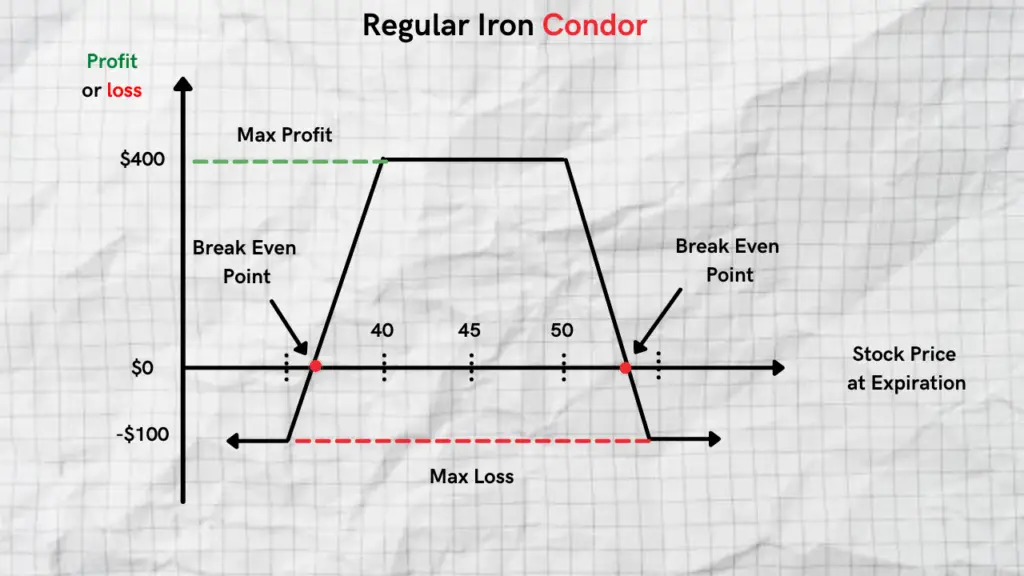

The iron condor has limited downside risk as well as limited upside profit potential. The wings of an iron condor protect against significant stock moves in either direction. For an IC to be profitable at expiration, the price of the stock needs to remain between the two wings. You will receive a net credit as a result of creating the trade.

Below are the four separate contracts involved in creating an IC trade.

Wing 1 ( Put Side )

- Sell 1 OTM put ( closer to the price of the stock )

- Buy 1 OTM put ( further away from the price of the stock)

Wing 2 ( Call Side )

- Sell 1 OTM call ( closer to the price of the stock)

- Buy 1 OTM call ( further away from the price of the stock )

The put and call options that are further out-of-the-money have lower premiums than the put and call options that are close to the stock price. As such, when you write an IC you will receive a net credit.

If you end up altering the strike price on the put or call side, you can make it so that you have a slight directional bias with the iron condor while remaining neutral. This is considered a broken wing iron condor that has an altered risk profile and usually ends up receiving more premium than a regular iron condor.

Iron Condor Risk Profile

Before trading an iron condor, it’s important to be aware of all the risks involved. There are advantages and disadvantages to trading iron condors. As such, it’s important to be aware of the different risk elements associated with iron condors.

Limited Profit Potential

Although an IC is a great strategy to use to collect premium, it has limited profit potential. The max profit potential is limited to the credit amount received as a result of writing it minus brokerage commissions.

Max profit = Premium Received – Broker Commissions

The max profit will be achieved when the price of the stock is between the strike price of the short put and the short call at expiration.

Important Note: Since an iron condor includes 4 separate options contracts, commissions tend to be higher when compared to single vertical spreads or other options trading strategies.

Limited Loss

An advantage to trading condors is the fact that they have limited and defined risk. You know the maximum amount you stand to lose before you enter the trade. There are two different ways in which you can lose money with this strategy.

- If the price of the stock falls AT or BELOW the lower strike price of the put purchased

- The price of the stock goes UP to or AT the higher call strike price

In either scenario, your max loss is limited to the difference in the strike price between the calls and puts MINUS the net credit received as a result of getting into the trade.

Max Loss Put Side = Strike Price of the Short Put – Strike Price of the Long Put – Net Credit Received

Max Loss Call Side = Strike Price of the Long Call – Strike Price of the Short Call – Net Credit Received

As you can see, if the stock price blows through your strike prices on your call or put side, one side of the trade will still make money. But the loss amount on either side will always be greater than the profit of the other.

Break-Even Point

An iron condor can also have two different break-even points.

- Put Side Breakeven Point = Strike Price of the Short Put – Net Credit Received

- Call Side Breakeven Point = Strike Price of the Short Call + Net Credit Received

It’s important to know how each side of the trade works so you can properly manage it as time passes. Let’s take a look at an example trade and examine the max profit, max loss and its break-even points.

Iron Condor Example Trade

Let’s assume that you think the price of Microsoft (MSFT) will remain in a tight trading range over the next two months. You decide to get into an iron condor with the current price of Microsoft trading at $225.50 per share.

Below are the 4 legs of your trade:

Put Side

- Sell a PUT with $210 strike (+$5.50 in premium)

- Buy a PUT with $205 strike (-3.85 in premium)

Total premium collected on the put side = $1.65 ($5.50 – $3.85 )

Call Side

- Sell a CALL with $240 strike (+4.50 in premium)

- Buy a CALL with $245 strike (-3.35 in premium)

Total premium collected on the call side = $1.15 ($4.50 – $3.35 )

Max Profit/Max Loss/Break Even Explained

As a result of doing this iron condor, you received a total of $2.80 in credit( $1.65 + $1.15). Knowing all this information let’s break down our max profit, max loss, and break-even points for the iron condor.

Max Profit ($2.80)

Our max profit is the total credit we collected as a result of writing the iron condor, $2.80.

Max Loss ( call side example )

The max loss occurs if the price of MSFT trades ABOVE $245 at expiration or below $210 at expiration. Let’s assume the stock price is at $250 at expiration.

This price is above the upper call strike price of $245. The short call option is losing $10 ($250 – $240) while the long call option is making money $5 ($250-$245). The trader loses $500 on the call side and the puts expire worthless keeping all the premium.

You lose $500 on the call side and keep all the initial premium as a result of writing iron condor for $280. In this example trade, your max loss is $220 ($500 – $280).

Break-Even Points

Remember that an iron condor has two break-even points.

Put Side Breakeven Point = $210 – $5.50 = $204.5

Call Side Breakeven Point = $240 + $4.50 = $244.5

Short Put Strike price $210

Short Call Strike price $240

Knowing these 3 risk profile points of an iron condor will help you make sense of it as the price of the stock changes and will help you manage the trade appropriately.

Managing and Closing an Iron Condor

When it comes to managing your iron condor, it’s very important to pay attention to the stock price in relation to how far away it is from your strike prices. If there’s a sharp move in the price of the stock early on in the trade, you can make adjustments to your iron condor to recoup some of the losses.

This is known as “rolling” and is a bit more advanced. It requires you to have a good working knowledge of iron condors and is not recommended to options newbies.

When to Close an Iron Condor?

It is generally recommended for investors to close out their iron condors at 50% profit.

What does this mean?

This means if you have taken in $500 net credit as a result of writing the iron condor, once it has earned $250 in profit from time decay you should close out all the legs. If the price of the stock continues to stay within a tight trading range, you can hold it out even further until 75% profit. Or if you are confident, you can let all the legs expire worthless without getting out earlier.

FAQ’s

Are Iron Condors Better Than Credit Spreads?

They can be better than standalone credit spreads because they allow traders to pull in more premium than a standalone credit spread. However, they can offer more than one way to lose a trade and can be riskier in the wrong trading environment.

Is an Iron Condor Safe?

Since they have a fixed level of risk, they are considered a safe options trading strategy. However, it’s worth noting that you can get assigned shares of stock with an iron condor if you don’t exit the trade before expiration.

Can an Iron Condor Be Assigned?

Yes, it can. It’s extremely important to pay attention to your trade as the expiration date approaches. If the price of the stock is below the short put strike price at expiration, you will be assigned 100 shares of the stock have to put up the necessary funds to make the purchase. If the price of the stock is above the short call strike price at expiration, you will be assigned 100 shares of stock short. As such, it’s recommended that you exit your trade before the expiration date or pay extremely close attention to the short strikes.