An implied volatility crush is an important options trading concept to understand so traders can minimize their downside risk. There is an overwhelming amount of options traders who don’t have an understanding of implied volatility and how it impacts options pricing. As such, in this post, we will discuss the important factors associated with implied volatility along with the working dynamics of an IV crush.

Summary

- Implied volatility is a theoretical projection about a future price movement in the price of a stock

- The IV crush is a term used by options traders to describe a sudden decline in IV and the value of an option

- An IV crush occurs most commonly around news events, earnings releases, and new product launches

Understanding Implied Volatility

Implied volatility, commonly denoted as “IV” is an often misunderstood concept and statistic in options trading. It’s important to make the clear point that implied volatility is a theoretical projection of the market’s perception within a given time frame of a likely movement in the price of the stock, in either direction.

It’s a metric that is used by options traders to estimate the future price volatility of a stock. Below are some important factors to remember about implied volatility. Understanding these concepts will help you make sense of the IV crush.

- High implied volatility indicates a higher likelihood the stock will experience a sharp move in either direction

- Implied volatility DOES NOT have a directional bias

- Low implied volatility indicates a lower likelihood that the price of the stock will experience sharp moves in either direction

- Higher implied volatility results in higher options prices, while lower IV results in lower options prices

- It is expressed as a percentage and varies over different time horizons

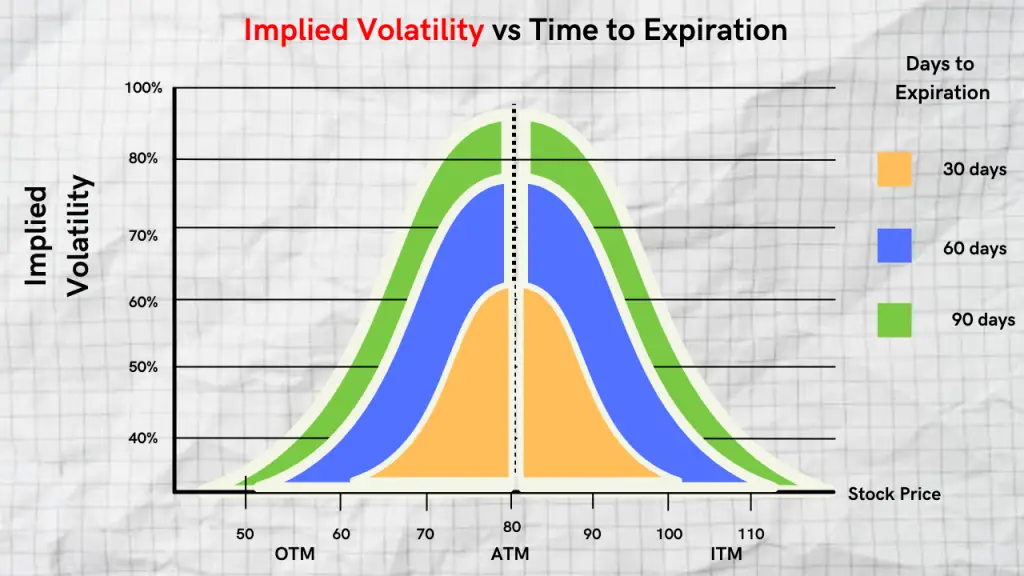

It can be thought of as a gauge for future price volatility. Implied volatility is different depending on the time to expiration.

As you can see from the graph, implied volatility tends to decrease as the time to expiration approaches. This is because as the uncertainty of volatility is priced out of the options premium the closer an option gets to expiration. There is more price uncertainty with longer time to expiration. Understanding implied volatility is extremely important in order to make sense of the IV crush.

What is the IV Crush?

The “IV crush” is a term used by options traders to express a sudden sharp decline in implied volatility. This sharp decline in implied volatility results in a sharp decline in the value of an option. The “crush” component of the term refers to the rapid decay in the value of a call or put option.

During an IV crush the price of the stock tends to move sharply in a very short period of time. The expectation of a large move in the stock was priced in through the implied volatility. After the large move in the underlying, the “pending uncertainty” in the premium is “crushed” out of the options price.

When does the IV Crush Occur?

An IV crush occurs most often when there is a ramp-up in implied volatility and around certain events. An IV crush can most often be observed around events such as:

- Quarterly earnings

- Regulatory decision rulings

- News events

- FDA drug approval

- New product launches

- Lawsuit announcements

As an example, before an IV crush occurs the implied volatility can go up as high as 100%, 150%, or even over 200%. After an IV crush occurs, the implied volatility can drop down half more than what it was before the IV crush occurred.

Why Does the IV Crush Occur?

The IV crush is essentially a bursting of a bubble of uncertainty via the options premium. You can think of implied volatility as a ballooning level of uncertain volatility. As the implied volatility increases so do the options premium. Once that bubble pops and the price of the stock moves sharply in either direction, the premium is crushed out of the price of the option, and implied volatility decreases.

After a news event occurs or earnings are released, the new information is priced into the stock. The risk of an IV crush means that options buyers should keep a close eye on changes in implied volatility before buying options.

Risks of an IV Crush

Let’s assume that AAPL is getting ready to release earnings. You decide to purchase a long call option because you believe that they will have a stronger than expected quarter and the price of the stock will go up.

After earnings are released, your prediction was spot on. The price of the stock goes up 10%, but your long call option is break-even for the day. Congratulations, you have just experienced your first IV crush. But, how can the option be flat if the stock is up by 10%?

If the move in the underlying is less than the implied volatility that is priced into the options trade, the decrease in implied volatility after the news release may be bigger than your gain. Even if you were right in your prediction, the impact on your options premium from the IV crush can be just as big as your price move or in certain cases even bigger than your price move. So, in certain scenarios, you could be directionally correct but even lose money if the IV crush is larger than your stock move.

How to Profit From an IV Crush

As an options trader, it’s important to be aware of a stock’s normal IV levels. This is because IV has a mean-reverting nature. An IV spike tends to return to its normal levels a few days after a news or earnings announcement has happened.

As we previously noted, when implied volatility goes up, so does the price of the options. It’s important to keep a close eye on implied volatility changes. Buyers of options benefit from an increase in implied volatility while options sellers benefit from a decrease in IV. As such it’s important to pay close attention to how implied volatility is changing.

If you are an options seller, a high implied volatility environment can hurt you if the market turns against you. However, you can receive more premiums for selling options in a high implied volatility environment. Options sellers can benefit from an IV crush because the theta decay experienced from an IV crush is significant and quick.

If you buy options, you will benefit from an increase in implied volatility because an increase in implied volatility increases the value of the options you buy. However, if you have a directional bias, an IV crush can quickly evaporate the value of the options you hold. As such, it’s important to be aware of events that can invoke an IV crush.

IV Crush Example

Final Thoughts

As an options trader, it’s important to be aware of the impact that an IV crush can have on the price of an option’s premium. If you plan to trade strategies that focus on earnings releases, it’s critical to pay attention to changes in implied volatility. If there are sharp changes in implied volatility in a short amount of time or leading up to an event, be ready for the potential IV crush and adjust your trades accordingly.

FAQ’s

How do you stop an IV Crush?

As an options trader, there isn’t a way to stop an IV crush. However, if you have a directional bias and want to reduce your risk you can hedge your options trade to protect yourself from a total directional loss.