To get a better understanding of the mechanics behind options trading, it’s important to have a solid understanding of what open interest is and its impact on price. It’s an often misunderstood concept in options trading but can provide immense value if you know what to look for.

What is Open Interest In Options?

Open interest (OI) represents the number of active options contracts for a particular stock at a particular strike price. The open interest number is the amount of options contracts that have been traded (bought or sold) but have not yet been offset through exercise or assignment.

When you purchase or sell an options contract, it is recorded as either an opening or closing trade. For example, if you bought 20 call options on AAPL stock, you are purchasing call options to “open” your trade. Buying the 20 call options would add 20 contracts to the open interest amount.

If you wanted to exit your call options, you would have to sell them to “close” your trade. Once you sold your call options, the open interest would go down by 20 the next day.

It’s important to note that if you sell call options at a particular strike price, the open interest will also increase. Since the open interest represents the amount of options contracts bought or sold at a particular strike price, the same concept applies if you were buying or selling puts. Remember the following rule below about open interest in options.

Opening an Options Transaction = Open Interest Increases

Closing an Options Transaction = Open Interest Decreases

Important Note: The open interest amount varies at different strike prices and IS NOT updated throughout the trading session.

It’s worth noting that traders often get open interest and options volume confused. They are not the same thing and it’s important to make the distinction between the two.

What is Volume in Options Trading?

The volume represents the number of contracts bought or sold on a given trading day on a particular strike price. For options, the volume figure is the number of contracts bought and sold. Unlike open interest, the options volume updates throughout the trading period and constantly changes throughout the day.

It helps traders understand the level of trading activity for a particular stock at a specific strike price. Making sense of options volume can help you understand the price level a stock might be trending towards.

If you happen to notice heavy trading volume around a particular strike price, it might indicate that the price of the stock is likely to move towards it. Open interest and volume should be used alongside each other to get a more accurate picture of how perception is shifting for a stock’s price.

Why Open Interest Important

When looking at an options chain, it’s very difficult to determine whether options contracts were bought or sold over a specific strike price. However, you can still gather important information by noticing how open interest is distributed across different strike prices along with the volume.

If the volume of an options contract is significantly higher than the total open interest at a particular strike price, it indicates a high level of interest. This could mean many different things, but at a basic level, it can at least show demand for contracts at a given strike price.

Another reason open interest is important is that it can provide you with information about the liquidity levels of an option.

If a stock’s option chain has low OI it indicates:

- Low level of interest on a stock

- Thin liquidity

- Higher options spreads

- Few buyers and sellers

On the flip side, if a stock has high OI it indicates the following:

- Highly liquid stocks

- Many buyers and sellers

- Better options fill

- Lower spreads

It’s also worth noting that the open interest will vary significantly the further in-the-money or out-of-the-money you go. If you notice that there is very high open interest at strike prices that are very far away, it could indicate that the price of the stock could rise or fall to that level. Notice the emphasis on could.

Important Note: Open interest should not be used as a sole indicator for your options trading strategies.

How Frequently is the Open Interest Updated

The open interest of stock options is updated once per day, usually at the end of the trading session. There may be times in which you notice a very high open interest for particular stock options. However, it’s important to take a few things into account:

- The OI can change drastically between days

- It changes faster as the stock options expiration date approaches

- It can be misread if you don’t understand the relationship between volume and open interest

When looking at an option’s open interest, you must look at it across different strike prices as well as different expiration dates. It’s also important that you pay attention to the options volume. Not only that, but you should also pay attention to the open interest on both the put side and the call side. Looking at all of these together will provide a more holistic view of the behavior of the option in a specific stock.

Open Interest Example

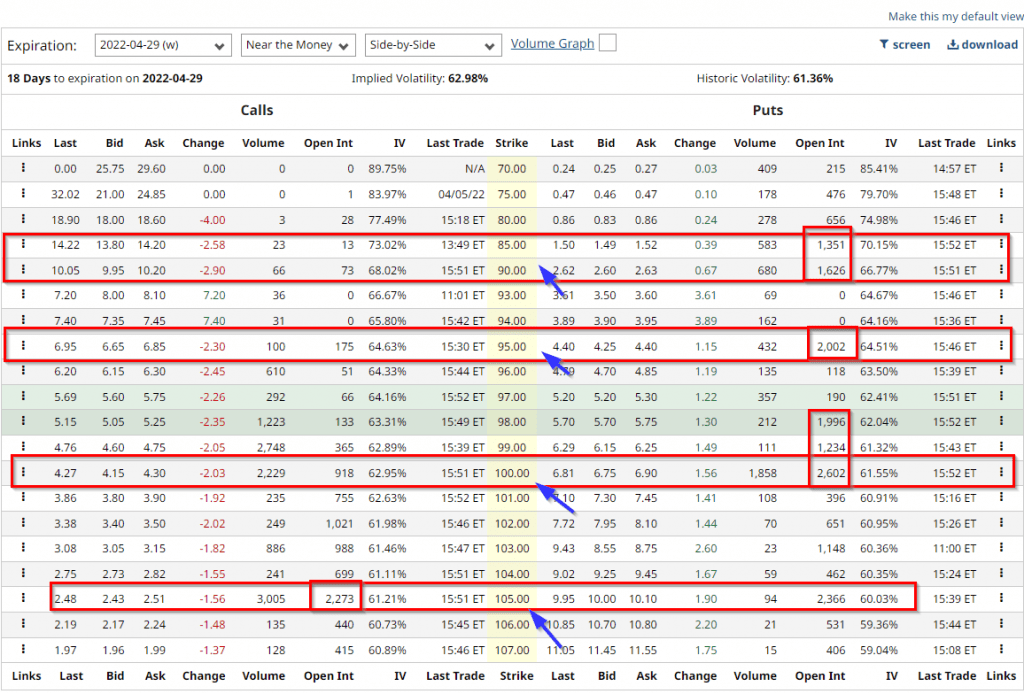

Below we have AMD’s options chain.

As you can see above, we have pointed out a few different strike prices along with their open interest levels. Starting with the put side of our image:

- We can see that there is significant OI at strike prices 85/90/95/100/105

- This can indicate that traders are purchasing puts as downside protection if the stock price drops significantly

- Or this can indicate large buy orders if the price of AMD drops below those prices

Moving on to the call side of the options chain we can see the following:

- We can see that the OI at the 105 strike price is high as well as the options volume.

- This can indicate that traders want to push the price of AMD higher while having protection on the downside with the put options.

This is the correct way to start looking at open interest in order to gain a better understanding of where the stock price has the potential to move.

Conclusion

As you can see, the open interest can give you additional insight into the future price behavior of a stock. However, it should not be used as a sole metric to put on options trades. When used in combination with the options volume, the OI can help you make better trading decisions and understand change’s in a stock options chain.