Understanding how different strike prices work in options trading is instrumental to becoming a better trader. In this article, we will take a look at what the options strike price is along with some important examples.

What is an Options Strike Price?

Commonly referred to as the “exercise price”, the stock options strike price is the price at which an options contract can be bought or sold once the option is exercised.

For call options, the strike price is the price at which a stock can be purchased. And for put options, the strike price is the price at which a stock can be sold.

Understanding an Options Strike Price

The strike price is a key element for options traders to use when setting up their options trades. It is instrumental in determining the value of options contracts.

It shows investors the distance the price of the stock must go to to be in-the-money or out-of-the-money. It’s important to note that strike prices will vary based on the price of the individual stock. They will not always be the same fixed dollar intervals for each stock. This brings us to the topic of strike price widths.

Strike Price Widths Explained

The distance between two individual strike prices is referred to as the “strike price width”. The width of strike prices will depend on a few different factors such as:

- Liquidity of the underlying stock

- The current price of the stock

- The expiration date ( how far out you go )

- Distance away from the current stock price

If a stock is very liquid then the width of its strikes will be between $.50 to $1 or up to $2.50. If a stock is considered illiquid and has lower trading volumes it can have wider strikes because it’s harder for market makers to create a smaller range of strike prices on lower volume stocks.

In instances like TSLA, which has a very high price, the widths of the strikes will naturally be wider than stocks that have a lower price. Tesla usually has strike prices that are $10 in width. It’s also worth noting that the further you go out in expiration, the higher likelihood that the intervals of the strike price will be larger.

Strike Price Example

We will take a look at two different examples of strike prices which will illustrate how they can vary across different stocks.

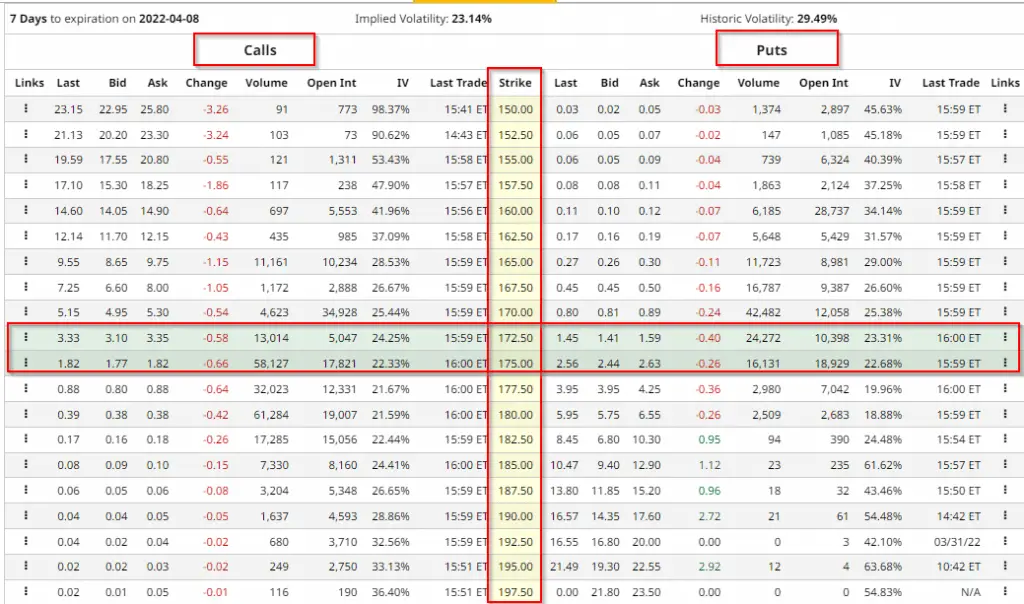

Example 1) AAPL

Below are different strike prices for Apple Stock (AAPL).

The different strike prices are listed in the middle. The left-hand column are the call options and the right-hand column are the put options. The middle column represents at-the-money strike prices. We can see from this example that the width of each strike price is $2.50. Now let’s take a look at Tesla’s strike price.

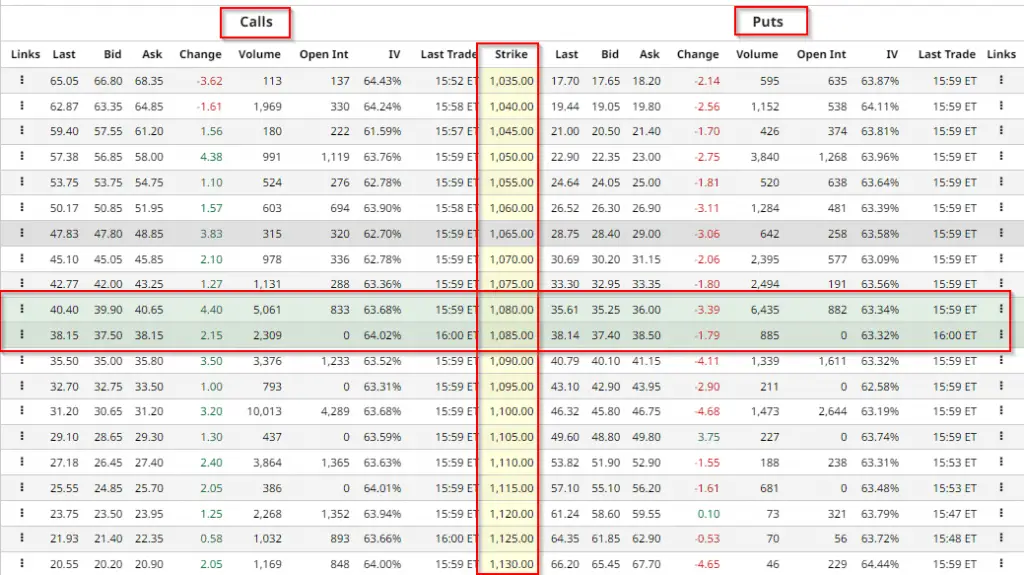

Example 2) TSLA

Below are different strike prices for Tesla (TSLA).

From the screenshot, you can see that the width of Tesla’s strike prices is $5. They are wider than Apple’s and that is due to the fact that Tesla is a much higher priced stock.

Options Premium and Strike Prices

Understanding the relationship between the strike price and the options premium is extremely important when reading an options chain. The options premium is higher for options with strike prices that are in- the-money.

The deeper in the money an options contract is, the higher the premium amount. That is because there is more intrinsic value. Subsequently, the further out-of-the-money your strike price is the lower the premium amount because that option only consists of time value.

Expiration and Strike Prices

Another important relationship to understand when it comes to the options strike price is the expiration date. The further you go out in expiration, the larger the width of the strikes tend to be. There is also reduced liquidity when you go further out in expiration.

Strike prices that are deep out of the money will also have wider strikes. This is important to know when you decide how far out in expiration you want to place your options trades as it will impact the premium you pay.

Conclusion

Making sense of the different relationships associated with options strike prices is important because it relates directly to how you structure options risk. As a trader, you want to be fully aware of where the price of the stock is in relation to your options strike prices at all times. This impacts your risk and reward levels as an options trader.