If you have experience trading covered calls, you have more than likely run into the situation in which the stock price has gone past your short call strike price. As the days to expiration count down, and the stock price continues to stay above your short call strike, the probability of assignment is imminent. This brings us to the topic of rolling covered call options. We have put together an extensive guide for you to fully understand the mechanics and different ways to roll your covered calls. Let’s dive in!

Summary

- Rolling a covered call involves buying back the short call you sold from your original covered call

- The main reason to roll a covered call is when you have the opportunity to make more money than just holding onto your position until the expiration date

- There are different ways in which you can roll a covered call including rolling up, rolling down, rolling out, rolling up and out, rolling down and out

The Covered Call Rolling Strategy Explained

A regular covered call involves buying 100 shares of the underlying stock and selling an out-of-the-money call option to collect a premium. A covered call accomplishes some of the following below:

- Can create income from the stock without adding additional risk

- Reduces the loss potential on shares of stock by the premium amount

- Increases the probability on making a profit while holding shares of stock

Rolling a covered call option is a strategy in which you buy back the call option you originally sold and sell a new call option – with a different expiration date and strike price. It’s important to understand the costs and trade-offs associated with rolling covered calls to effectively execute them.

Why Roll a Covered Call?

The main reason to roll a covered call is when you have the chance to make more money than simply holding onto your original covered call and waiting for expiration. Let’s take the following covered call example below.

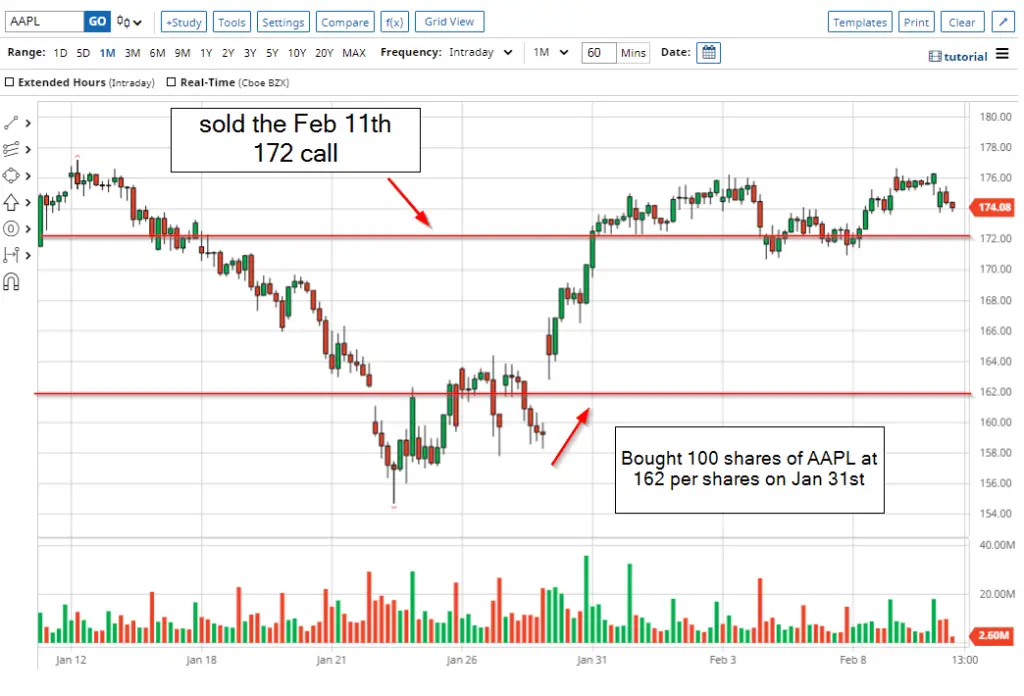

We purchased 100 shares of AAPL stock on January 31st at $162 per share and sold a 172 Feb 11th call option for $1.35 in premium. Below is the chart.

As you can see the price of AAPL has gone above our $172 short call strike and currently stands at $174.08 per share on February 9th.

The total stock appreciation we have in this trade is $12.08 per share or $1,208 and we also took in a premium of $1.35 or $135 when we sold our call. However, our stock appreciation is capped to $10 per share since we purchased the stock at $162 per share and our short strike is at $172 per share.

Two things can happen with our covered call trade by the time of expiration.

- The price of Apple ends above our short call strike price at expiration. Expiration is only 2 days away and the probability of assignment is high. The price of Apple stock can continue rising more after expiration and we stand to lose out on additional stock appreciation. We will keep our full premium and our underlying shares will be sold at $172. Our total profit would come out to $1,135 ( $1,000 in stock appreciation + $135 premium from selling the call)

- The price of Apple ends below our short call strike price at expiration. If the price of Apple dips below our short call strike, we will get to keep our full premium and still hold onto our underlying shares. We can chose to sell another call option and continue earning more premium as the price of the stock price moves.

Now that you know the two different possible outcomes with a covered call if you let it ride out until expiration, let’s take a look at how to roll a covered call.

How to Roll a Covered Call

It’s important to note that there are different ways you can roll a covered call. You can roll any time before or on the stock options expiration date. The idea of “rolling” is that the covered call you initially sold gets closed out with a buy order. After that, another covered call immediately gets sold.

This is done to open up the trade to more stock appreciation potential while continuing to earn options premium. Let’s take a look at some of the different ways in which investors can roll out their covered calls.

Different Ways to Roll a Covered Call

There are essentially five main ways in which you can roll your covered call trade. There are different variations of it, but the following five are considered the most popular ones.

It’s important to fully understand why they are used and in which specific scenarios in order to improve your profitability with covered calls.

Rolling Up

One of the most popular ways to roll a covered call is by “rolling up”. Rolling a covered call up is done by simultaneously:

- Buying to close your existing covered call

- Selling a call with a higher strike price on the same expiration date

The primary reason traders roll up covered calls to a higher strike price, but keep the same expiration date is if the price of the stock moves sharply to the upside early on in the trade. This can happen around earnings releases, news announcements, or any other unexpected news announcements that can have positive impact on the price of the stock.

Another reason traders roll up their covered calls is because the price of the stock has gone above their short call strike price and they don’t want to sell their stock position yet. In this scenario, there will be a net cost of rolling up your call, but you will open up your trade for a higher profit potential.

Rolling Up a Covered Call Example

Let’s take a look at how rolling up a covered call might occur.

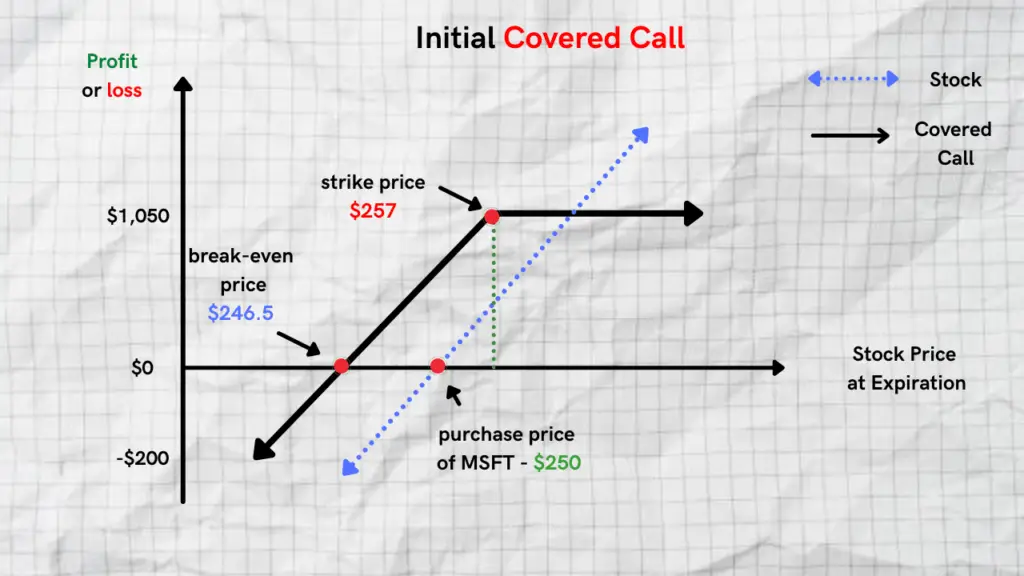

Let’s assume that the price of MSFT (Microsoft) stock is currently trading at $250 per share and you believe it will slowly trend up for the next 30 days. As result, you decide to enter into a covered call and purchase 100 shares of MSFT at $250 and sell 1 MSFT June $257 call.

| Example Scenario | MSFT is trading at $250 per share 30 days to June expiration |

| Initial Trade #1 | Buy 100 shares of MSFT @ $250 per share Sell 1 MSFT June $257 call @$3.50 |

Trade Breakdown: The initial covered call we put on has a max profit potential of $10.50 per share. This is calculated by taking the short call strike price ($257) subtracting the purchase price of the stock ($250) and adding the premium received ($3.50) as a result of writing the call. The break-even price is calculated by taking the purchase price of the stock and subtracting the premium received as result of writing the call

Max profit = (short call strike price – purchase price of the stock) + premium

Max profit = ($257 – $250) + $3.50 = $10.5

Break-even stock price = purchase price of the stock – premium received

Break-even stock price = $250 – $3.50 = $246.5

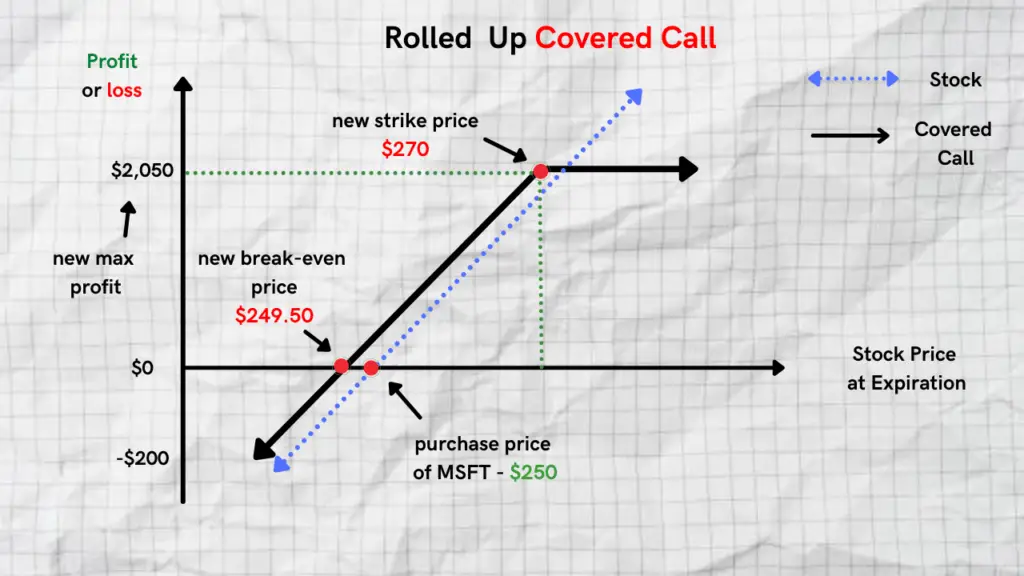

After 15 days have gone by, the price of MSFT goes up to $260 per share. You decide that you don’t want to sell your stock position at $257 and decide to “roll-up” the trade. As a result, you end up buying back your initial short call option and roll up a new call to the $270 strike price with the same expiration date.

| Example Scenario 15 days later | MSFT is now trading at $260 per share 15 days remaining to June expiration |

| New Trade (rolled-up) | Buy back the $257 call @$6.00 Sell 1 MSFT June $270 call @$3.00 Net debit cost of $3.00 per share |

Trade Breakdown: After rolling up the original short call from $257 to $270, you have moved out your profit target further out and can sell your shares at $270. The difference in strike prices between your last call option and your new short call is $13. This allows you to collect more stock appreciation but it comes at a cost of $3.0 share.

This new trade increases your max profit potential to $20.50 per share and changes your new break-even price to $249.50

New max profit = ( original max profit + difference in strike prices) – net debit cost of rolling up

New max profit = ($10.50 +13.0) – $3.0 = $20.50

New break-even stock price = ( original break-even price + net cost of rolling up)

New break-even stock price = $246.50 + 3.0 = $249.50

Below is how it would shift out our covered call payoff graph.

As you can see in the graph, making this trade adjustment costs us $3 per share, but it brings our break-even price higher to $249.50 which is much closer to our purchase price of $250. It also significantly increases our max profit potential to $20.50 per share.

Rolling Down

A lesser-known method for rolling covered calls is done by “rolling down”. Rolling down a covered call is done by simultaneously:

- Buying to close your existing covered call

- Selling a call with a lower strike price on the same expiration date

One of the reasons traders roll down their covered calls to a lower strike price is if they are no longer bullish on the price of the stock and want to reduce their break-even price. When you roll down a covered call, you will end up receiving a net credit and subsequently reduce your max profit potential.

Rolling Down a Covered Call Example

Let’s take a look at how rolling down a covered call might occur.

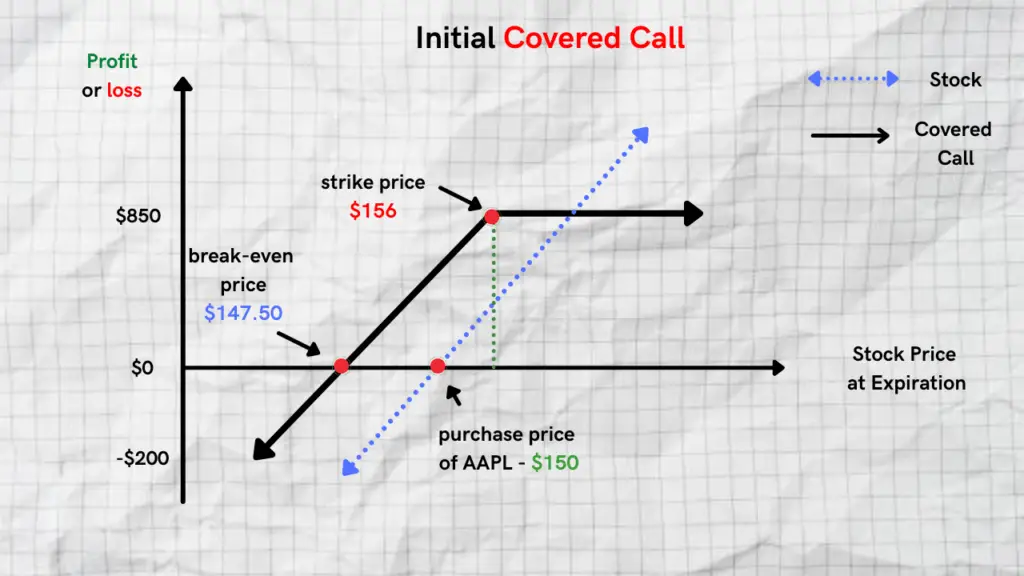

Let’s assume that the price of AAPL (Apple) stock is currently trading at $150 per share and you believe it will trade in a tight range in the next 30 days. As result, you decide to enter into a covered call and purchase 100 shares of AAPL at $150 and sell 1 AAPL July $156 call.

| Example Scenario | AAPL is trading at $150 per share 30 days to July expiration |

| Initial Trade #1 | Buy 100 shares of AAPL @ $150 per share Sell 1 AAPL July $156 call @$2.50 |

Trade Breakdown: The initial covered call we put on has a max profit potential of $8.50 per share. This is calculated by taking the short call strike price ($156) subtracting the purchase price of the stock ($150) and adding the premium received ($2.50) as a result of writing the call. The break-even price is calculated by taking the purchase price of the stock and subtracting the premium received as result of writing the call

Max profit = (short call strike price – purchase price of the stock) + premium

Max profit = ($156 – $150) + $2.50 = $8.5

Break-even stock price = purchase price of the stock – premium received

Break-even stock price = $150 – $2.50 = $147.50

After 20 days have gone by, the price of AAPL drops to $147 per share. You decide that you want to “roll down” your trade and reduce your break-even price since stock dropped in price. As a result, you end up buying back your initial short call option and sell a new call at the $145 strike price with the same expiration date.

| Example Scenario 20 days later | AAPL is now trading at $147 per share 10 days remaining to July expiration |

| New Trade (rolled-down) | Buy back the $156 call @$0.50 Sell 1 AAPL July $145 call @$3.50 Net credit of $3.00 per share |

Trade Breakdown: After rolling down your original short call from $156 to $145, you have moved down your profit target and reduce your profit potential. This is a decrease of $11 per share from your original short call but you do receive a net credit of $3.00 per share and subsequently reduce your break-even price.

This new trade does reduce your max profit potential to just $0.50. Knowing how much rolling down your covered call impacts your max profit potential is important because you can decide where to place the new short call strike. Your new break-even stock price is $144.50.

New Max profit potential = (original max profit – difference in strike price ) + net credit received

New max profit potential = ($8.50 – $11) + $3.00 = $0.50

New break-even stock price = (original break-even stock price – net credit received )

New break-even stock price = ($147.50 – 3.0) = $144.50

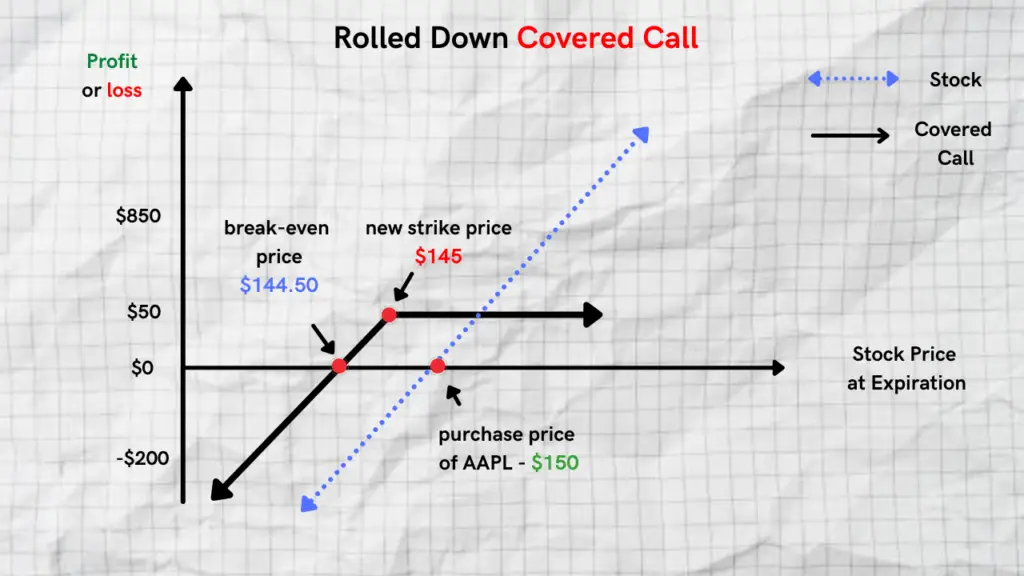

Below is how rolling down this trade would shift our payoff graph.

Rolling Out

Another method for rolling covered calls is done by “rolling out”. Rolling out is done by simultaneously:

- Buying to close your existing covered call

- Selling the same strike price with a further expiration date

Investors who just roll out the current covered call to a further expiration date but keep the same strike price, do so in order to take a longer term approach on their trade and collect more premium.

Rolling Up and Out

Rolling a covered call-up and out is done by investors who have gotten more bullish on the price of the stock and want to move their targets out further while still collecting some premium. Rolling up and out is done by simultaneously:

- Buying to close your existing covered call

- Selling another covered call with a higher strike price and a further expiration

In most cases, rolling your covered call-up and out can result in either a net debit or net credit depending on where the price of the stock is relative to your original short call.

Rolling Down and Out

Rolling down and out is usually done if an investor wants to receive more options premium and lower their break-even point on a trade. It’s usually done if the price of the stock has moved well below their initial break-even point. Rolling down and out involves:

- Buying to close your existing covered call

- Selling another covered call with a lower strike price and a further expiration

As a result doing this trade you end up extending your expiration date further out while also receiving more premium. This extra premium helps to reduce your break-even price but will also limit your max profit potential.

Rolling Covered Calls Cheat Sheet

| Rolling Method | How It’s Done |

| Rolling Up | Buy to close existing covered call Sell another covered call, same expiration date with a higher strike price |

| Rolling Down | Buy to close existing covered call Sell another covered call, same expiration date with a lower strike price |

| Rolling Out | Buy to close existing covered call Sell another covered call, further out expiration date with the same strike price |

| Rolling Up and Out | Buy to close existing covered call Sell another covered call, further out expiration date with a higher strike price |

| Rolling Down and Out | Buy to close existing covered call Sell another covered call, further out expiration date with a lower strike price |

The Risks and Benefits of Rolling Covered Calls

As with any options trading strategy, there are risk and benefits involved. Understanding the underlying risks and trade-offs associated with rolling covered calls is important in order to reduce your risk and keep your profits on target.

Risks of Rolling Covered Calls

- There are additional trading costs associated with closing your existing covered call and opening a new one

- Traders can often times roll their covered calls prematurely due to the price of the stock moving sharply early on in the trade

- Investors can roll the trade out to the wrong strike price if they don’t understand the proper procedure for rolling their trade

Benefits of Rolling Covered Calls

- Rolling covered calls can enhance the amount you earn from your underlying stock position

- Allows you to collect more options premium

- Can help you to reduce your break-even price when the trade moves against you

Summary

If you’ve made it all the way through this guide, congratulations! You know more about rolling covered calls than 90% of traders.

Related Reading

Covered Call Options Trading Strategy Explained

Poor Man’s Covered Call Explained