A vertical spread is an options trading strategy that involves simultaneously buying and selling calls or puts to create an options spread. Vertical spreads allow options traders to take limited risk with their trades and capture profit from small to mid-sized movements in the underlying stock.

There are different types of vertical spreads that can be used by traders to take advantage of and profit from different market conditions. Let’s take a look at how they work and what types of market conditions are best suited for each spread.

Summary

- A vertical call spread involves simultaneously buying and selling calls or puts on the same expiration date with different strike prices

- With this type of options trading strategy traders have fixed risk and limited profit potential that can help preserve capital and make modest gains

- The four main types of vertical spreads are long call spreads, short call spreads, long put spreads, and short put spreads

What is a Vertical Spread?

A vertical spread is an options trading strategy in which traders simultaneously buy and sell calls or puts with the same expiration date, but with different strike prices. The distance between the strike prices constitutes the size of the “spread”. The term “vertical” is used as a reference to how the strike prices are positioned, one being higher and the other being lower.

Vertical spreads allow options traders to take directional risk while having fixed risk and defined profit potential. With vertical spreads, one leg of the trade offsets the cost basis of the other resulting in either a credit or debit spread.

There are essentially four different types of vertical spreads that options traders can construct. Each vertical spread can vary with regard to its risk profile and profit potential. Below are the four major vertical spreads options traders should familiarize themselves with.

- Vertical Long Call Spread (Bullish)

- Vertical Short Call Spread (Bearish)

- Vertical Long Put Spread (Bearish)

- Vertical Short Put Spread (Bullish)

Let’s take a look into each type of vertical spread into further detail to gain a better understanding of how they’re constructed, their directional bias, and profit potential.

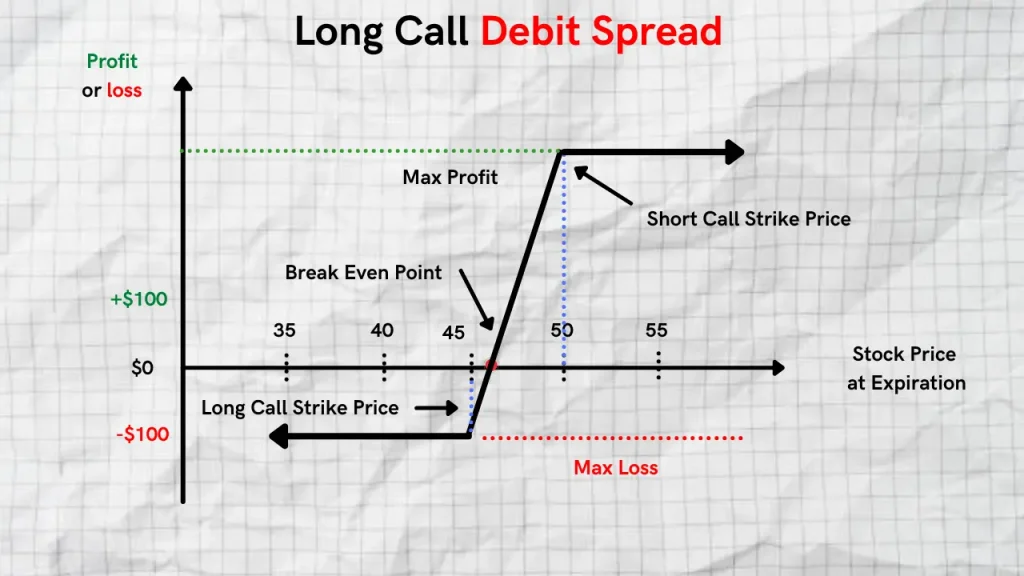

What is a Vertical Long Call Spread?

A vertical call spread is also known long call debit spread. This is considered a bullish strategy consisting of one long call and one short call on the same stock, with the same expiration date but with different strike prices. The short call is positioned above the long call and results in a net debit. The short call limits the profit potential of the trade while the long call reduces the cost of the overall spread position.

Vertical Long Call Spread Setup

- Buy ITM Call

- Sell OTM Call

Vertical Long Call Profit Potential and Loss

With a long call spread, the maximum profit would be realized if the stock price is at or above the short call strike price at expiration. The maximum loss with this spread is limited to the net debit paid to enter the trade. This would occur if the stock price is at or below the long call strike price at expiration.

Vertical Long Call Spread Example

Let’s assume that you’re bullish on the future price of a stock. As a result, you decide to enter into the following bull call spread below.

- Current Stock Price: $100.00

- Buy $95 call for $5.50, sell the $102 call for $3.50

- Net Debit = $5.50 – $3.50 = $2.00

- Max Profit Potential = ($7.00 spread width – $2.00 net premium paid) x $100.00 = $500.00

- Max Loss Potential = $2.00 premium paid x $100.00 = $200.00

If the price of the stock expires above the short call strike price of $102, you will make $500. If the stock price expires below the long call strike price at expiration you will lose $200.

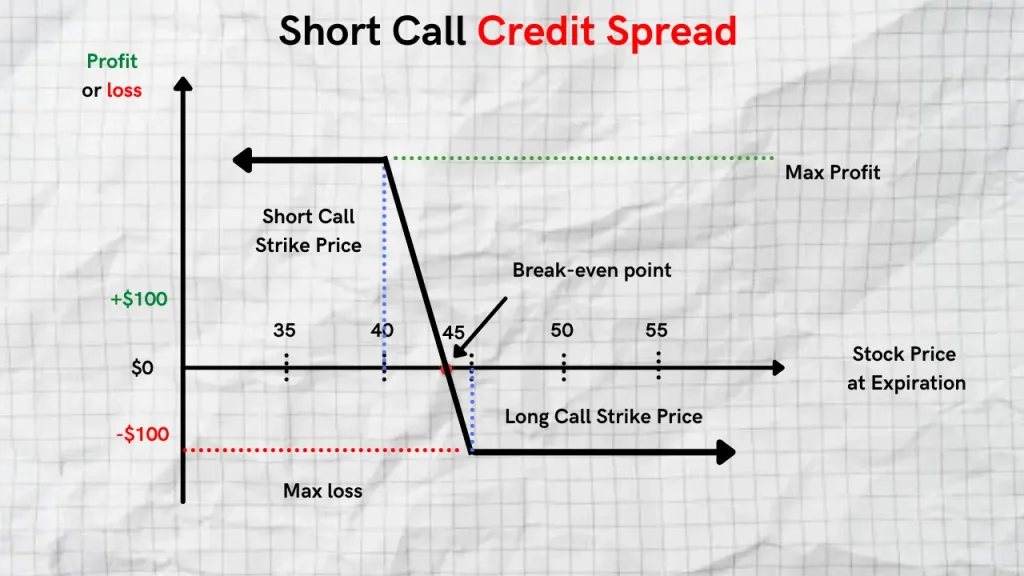

What is a Vertical Short Call Spread?

A vertical short-call spread is also commonly referred to as a credit spread. This is a bearish strategy consisting of one long call option and one short call option on the same stock, with the same expiration date, but with different strike prices. With a short call credit spread, both of the calls are out-of-the-money, however, the short call strike price is sold closer to the current stock price than the long call option. This results in a net credit for options traders, hence why it is called a credit spread.

Vertical Short Call Spread Setup

- Buy OTM Call

- Sell OTM Call

Vertical Short Call Profit Potential and Loss

With a short call spread, the max profit potential is the credit received as a result of creating the spread. This will be realized if the option expires OTM at expiration. This occurs if the stock price is at or below the short call strike price at expiration. On the flip side, the maximum loss realized would be if the price of the stock expires at or above the long call strike price and would be limited to the difference between the call spread strike price less the credit received.

Vertical Short Call Spread Example

Let’s assume that you’re bearish on the future price of a stock. As a result, you decide to enter into the following short call credit spread below.

- Current Stock Price: $100.00

- Sells $105 call for $6.50, Buys $107 call for $5.00

- Net Credit = $6.50 – $5.50 = $1.0

- Max Profit Potential = $1

- Max Loss Potential = ($2.00 spread width – $1.0 in net premium received) x $100 = $100.00

If the price of the stock stays below the short call strike price of $105, you will keep the full amount of the premium you received as a result of writing the credit spread. However, if the price of the stock rallies above the long call strike price of $107 you will incur the max loss of $100.

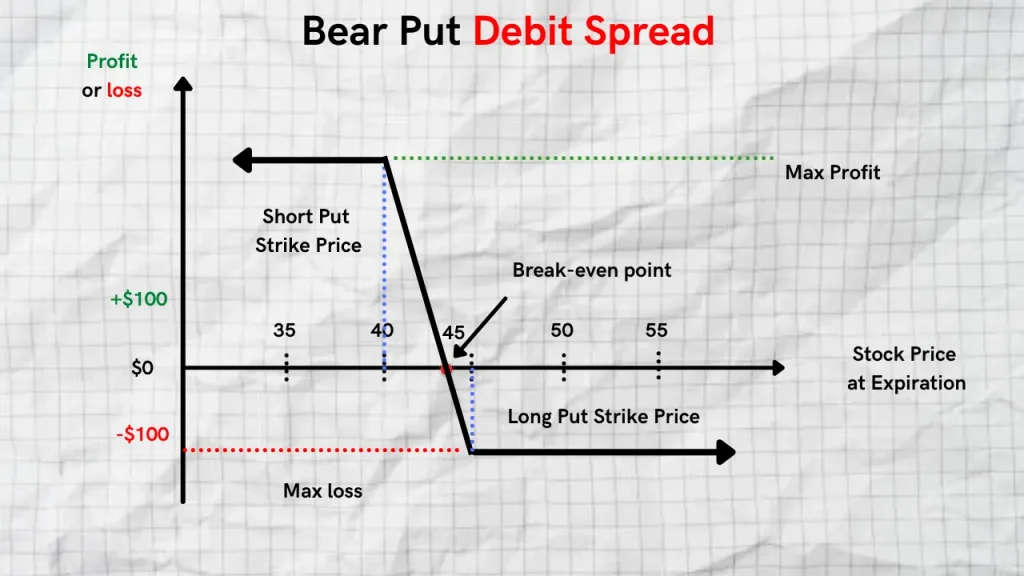

What is a Vertical Long Put Spread?

A vertical long put spread is also commonly referred to as a bear put debit spread. This trade consists of one long ITM put option and one short OTM put option on the same expiration cycle with different strike prices. The strike price of the long put option is higher than the short put strike. The value of the long put option will go up if the price of the underlying drops.

Vertical Long Put Spread Setup

- Buy ITM Put

- Sell OTM Put

Vertical Long Put Spread Profit Potential and Loss

With a vertical long put spread, your max profit potential would be realized if the price of the stock is at or below the short put strike price at expiration. The max profit potential is limited to the difference between the width of the two put strikes, minus the net premium paid for the traded. You would incur the largest loss if the price of the stock is above the long put’s strike price at expiration. Your max loss is capped to the net debit paid to enter the trade.

Vertical Long Put Spread Example

Let’s assume that you’re bearish on the future price of a stock. As a result, you decide to enter into the following bear put debit spread below.

- Current Stock Price: $100.00

- Buy $105 put for $7.50, Sell a put for $102 for $5.50

- Net Debit = ($7.50 – $5.50 ) = $2.00

- Max Profit Potential = ($3.0 spread width – $2.00 net premium paid) x $100.00 = $100.00

- Max Loss Potential = ($2.00 premium paid x $100) = $200

If the price of the stock rallies above the long put strike price of $105 you would incur the highest loss at $2.00. However, if the price of the stock stayed at or below the short put strike price of $102, you would make a maximum of $100.

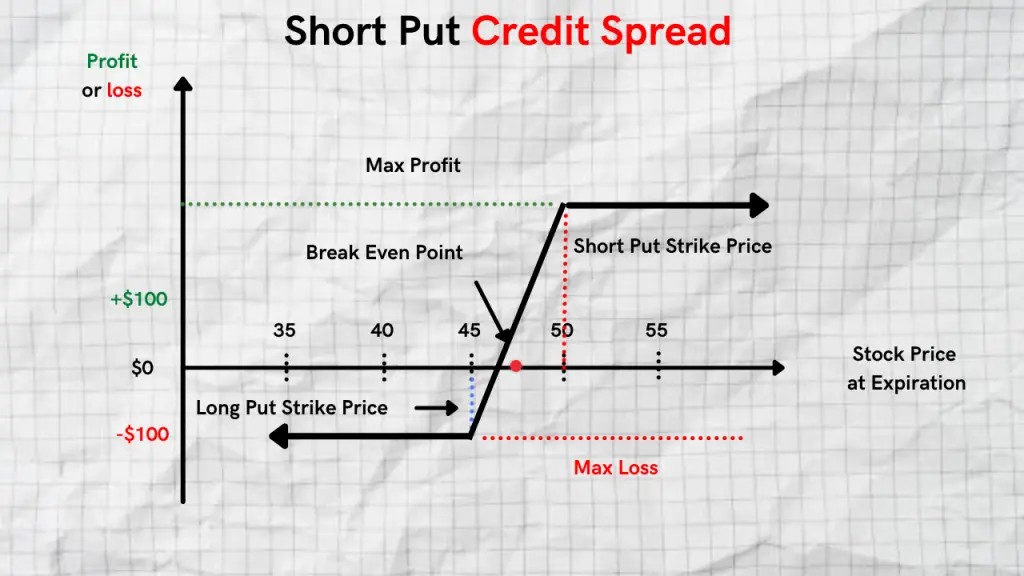

What is a Vertical Short Put Spread?

A vertical short put spread is a limited risk strategy consisting of one long OTM put and one short OTM put option on the same expiration date with different strikes. It is considered a bullish strategy and results in a net credit to the trader and is often referred to as a short put credit spread. The short put strike price is positioned higher than the long put strike price.

Vertical Short Put Spread Setup

- Buy OTM Put (further away from the current price of the stock)

- Sell OTM Put (closer to the current price of the stock)

Vertical Short Put Spread Profit Potential and Loss

The max profit on this credit spread is limited to the credit received as a result of writing the spread. Max profitability will be reached if the stock price is at or above the short put’s strike price at expiration. The max loss on this type of trade is limited to the difference between the width of the two strikes, less the premium received from writing the spread.

Vertical Short Put Spread Example

Let’s assume that you’re bullish on the future price of a stock. As a result, you decide to enter into the following short put credit spread below.

- Current Stock Price: $100.00

- Sell $98 put for $5.50, Buy $95 put for $3.50

- Net Credit = ($5.50 – $3.50) = $2.00

- Max Profit Potential = ($2.0 limited to the net credit received )

- Max Loss Potential = ($3.00 spread width – $2.00 net credit received) x $100 = $100.00

If the price of the stock stays at or above the short put strike price you will realize the max profit $2.00 which is the credit received as a result of writing the spread. On the flip side, you would incur the max loss amount if the price of the stock drops below the long put strike price of $95 and is limited to $100.

How to Manage Vertical Spreads

Now that you have a better idea of how vertical spreads work, it’s important to learn how to manage them if the market moves sharply against you or if you want to lock in profits prior to expiration. Below are some of the different options when it comes to managing your spreads.

- Roll it Forward

- Close it Out Prior to Expiration

Roll it Forward

Rolling out your spread to the next expiration schedule is done by paying the difference in premium in order to push it out to a further expiration. What technically happens is that your current spread gets closed out and a new one opens up for a further expiration date. This can be done very easily through your broker. They will let you know the amount you have to pay in order to make this happen.

How to Close a Vertical Spread

A good amount of options traders often get confused about the proper way of closing a vertical spread. Most options brokers will let you close the full spread out at once and let you know the cost. You can also choose to close out each leg individually. This is done by simply doing the reverse trade of the leg you are closing.

FAQ’s

Are Vertical Spreads Risky?

Options are risky products in general. However vertical spreads carry limited risk and the max loss potential is defined before you enter a trade. This makes vertical spreads less risky than other options trading strategies.