As most options traders know, the value of a call option goes up when the price of the stock rises. Some traders chose to trade call options that are out-of-the-money and some chose to trade call options that are in the money. In this post, we will break down the benefits of buying in-the-money call options and why people buy them in the first place.

Summary

- A long call option is considered in the money when the price of the stock is above the strike price

- Deep in the money call options have deltas very close to 1.0

- Buying in the money call options is more cost-effective than buying shares of the stock

- In the money call options can help reduce your downside risk

When is a Call Option Considered In-the-Money (ITM)

A call option is considered in the money when the price of the stock is above the options strike price. When the stock price is above the strike price the option holds intrinsic value and gives the buyer the right to purchase the stock below the current market price.

Recommended Reading: Stock Options Expiration Date Explained – How do They Work?

If the strike price of the call options is at $10, but the price of the stock is trading at $12 the option is considered in the money. In this scenario, the options contract has $2 in intrinsic value. If the stock continues to go higher, the option moves deeper in the money and holds more intrinsic value. The key benefit to trading in the money call options is the fact that they have intrinsic value and high deltas.

In-the-Money Call Option Example (AAPL)

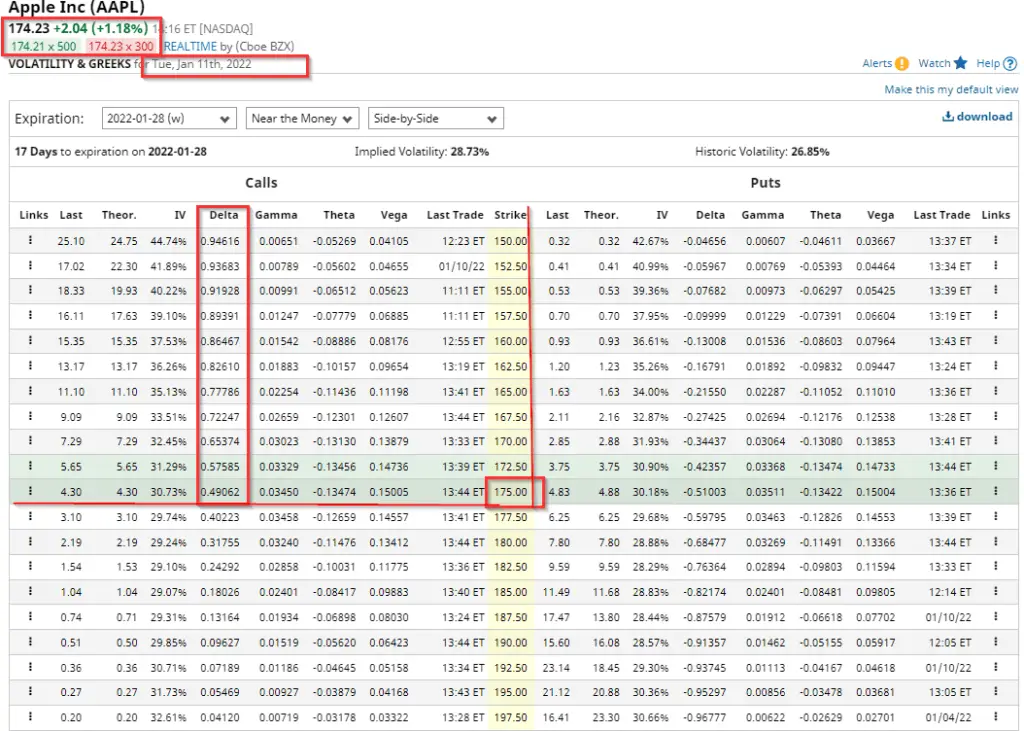

Below we have an options chain for AAPL. The expiration is for January 28th with the current trade date of 1/11/2022.

From our screenshot above we can see that the current price for Apple is at $174.24 per share.

Anything below the strike price of $175 would be considered in the money. Anything below that has intrinsic value. You can also see that as the option strike price goes lower, the delta increases. This is because the further ITM the call option goes, the more intrinsic value it has.

When is a Call Option Considered Deep-In-The-Money (DITM)

A call option is considered deep in the money if it has a strike price that is significantly below the current market price of the underlying stock. Deep in the money call options will consist mainly of intrinsic value and very little time value.

Deep in the money call options tend to have deltas between 0.90 to 1.0. A call option with a delta of close to 1 means that the price of the option will decrease or increase almost identical to the change in the price of the stock.

Deep in the Money Example (MSFT)

Let’s assume an investor purchased a June call options contract for MSFT with a strike price of $200 on February 1, 2021. On April 1st, the price of the stock is trading at $265 with a delta of .98. The options contract has $65 dollars of intrinsic value and would be considered deep in the money.

When is a Call Option Considered At-The-Money (ATM)

An at-the-money call option is an option that has a strike price equivalent to the current market price. At the money call options don’t have any intrinsic value, but are at the point in which option will begin to have intrinsic value. At the money call options have deltas around 0.50.

If the options strike price is at $10 and the current stock price is at $10, the option is considered at the money. At the money call options have high amounts of trading activity because they are very close to having intrinsic value.

Advantages of Trading In The Money Call Options

In the money call options are advantageous because they have immediate intrinsic value. Compared to out-of-the-money call options, ITM call options tend to have higher liquidity. Once a call option is in the money you can exercise the option and purchase the underlying stock for less than what it’s trading.

Another advantage of trading ITM call options is higher deltas. This can be advantageous to traders who want to trade the stock with a delta that correlates closely to the movement in the underlying. It helps you get exposure that moves closely in sync with the price of the underlying security.

Main Reasons Why People Buy In the Money Call Options

- Trading ITM call options costs less than buying the underlying stock at the current market price. For example, If MSFT stock costs $200 per share, I can buy a call options contract with a $190 strike price for much less depending on the expiration in order to control 100 shares of stock.

- ITM call options can help reduce your downside risk. The maximum amount you can lose with a call options contract is capped, whereas owning the stock outright poses more downside risk.

- They can reduce the impact of time decay (theta). In the money call options carry both intrinsic value and time value and have a higher probability of expiring in the money.

Disadvantages of Trading In the Money Call Options

It’s important to note that there are also disadvantages to buying ITM call options instead of buying the underlying stock:

- Your options will typically lose value every day if the stock doesn’t change in price. The closer your call options contract gets to the expiration date, the less value the downside risk has. That is the premium you paid for and the value you will lose over time from decay.

- They are more expensive to enter compared to out-of-the-money options. Although the payoff on an ITM call option can be high, you could potentially suffer a large loss if the stock moves sharply against your position.

Bottom Line

As you can see there are some benefits of trading in the money call options. They provide immediate intrinsic value and can help you control 100 shares of stock with much less capital. Although they provide flexibility its important to be aware of their risks if you decide to trade them.