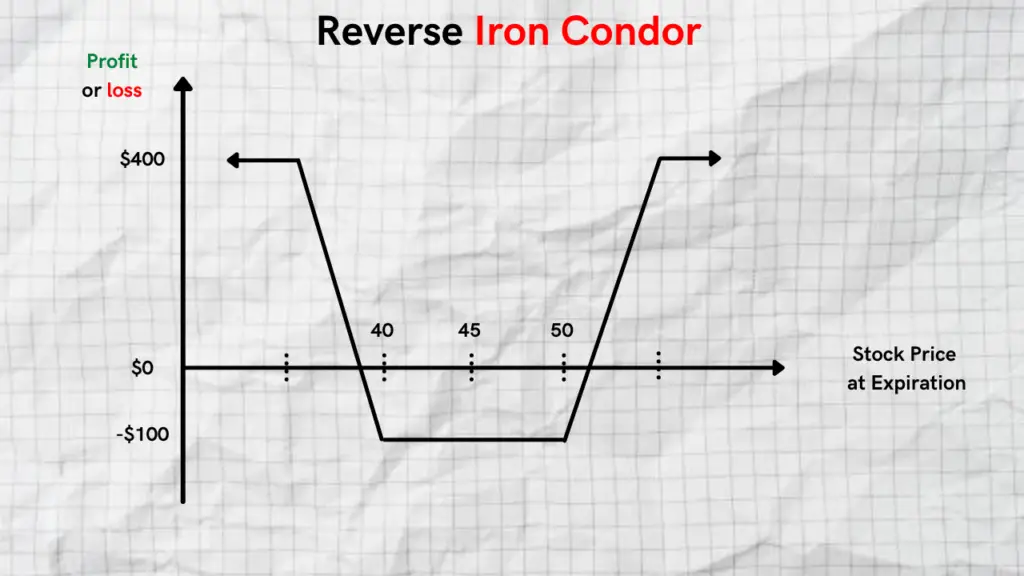

The reverse iron condor (RIC) is a unique options trading strategy that is the opposite of a standard iron condor. It targets sharp volatility in either direction in order to capture a profit. Many traders love trading iron condors to collect premium in a low volatility environment with defined risk. However, there are traders that look to target volatility with a reverse iron condor. Let’s take a look at how a reverse iron condor works and how to set one up.

What Is A Reverse Iron Condor?

A regular iron condor consists of selling 1 out-of-the-money call spread and selling 1 out-of-the-money put spread for a net credit. The trader keeps all the premium if the price of the stock stays below the call spread at expiration and above the put spread at expiration.

A reverse iron condor is simply the opposite.

With a RIC, you buy 1 out-of-the-money call spread and buy 1 out-of-the-money put spread for a net debit.

Regular Iron Condor Construction

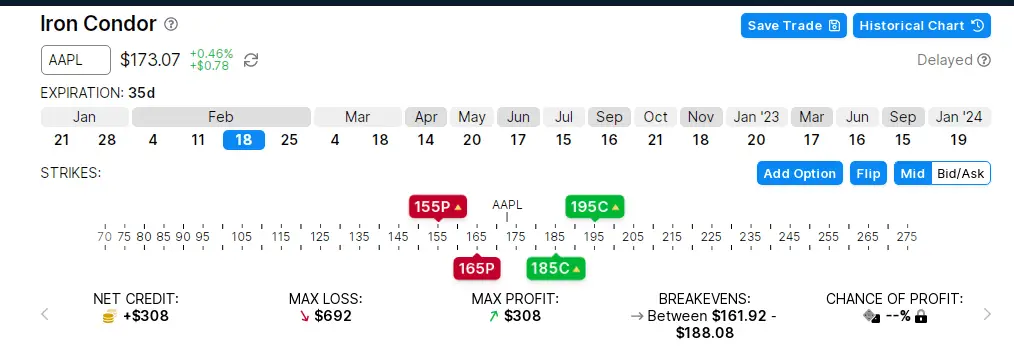

Before we explain how a reverse iron condor works, it’s important to fully understand how a regular iron condor works.

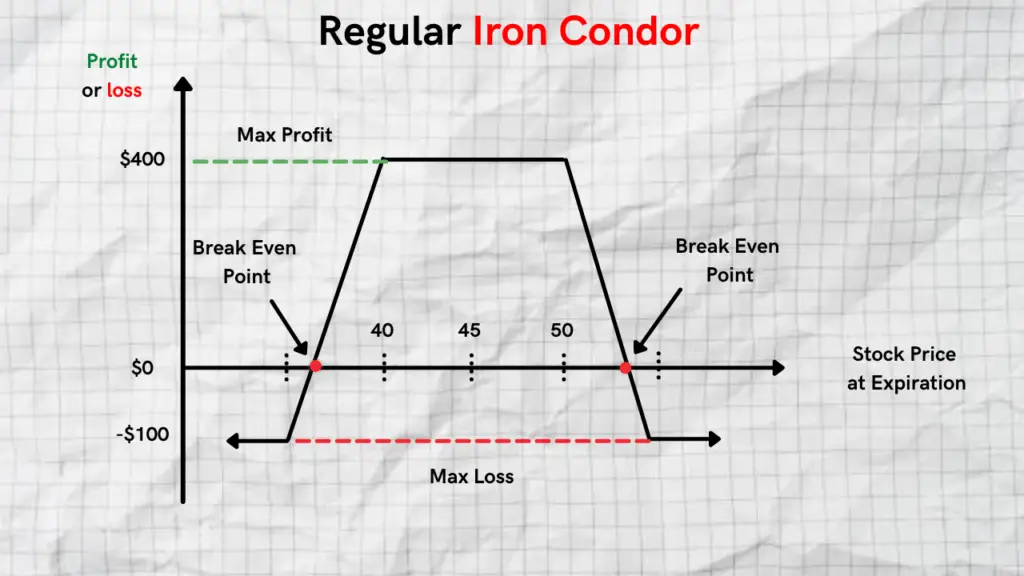

Let’s use the following example with Apple (AAPL) trading at $173.07 per share.

A regular iron condor would be constructed in the following way below for a net credit.

As you can see, an iron condor consists of two wings. One on the put side and one on the call side.

Wing 1 ( Put side )

- Sell February 18th 165 put

- Buy February 18th 155 put

Wing 2 ( Call side )

- Sell February 18th 185 Call

- Buy February 18th 195 Call

It’s important to note that the wings of a regular iron condor are equidistant on each side. The put side is $10 wide and the call side is $10 wide. If the wings were not equidistant, it would be considered a broken iron condor. Another variation of an iron condor is the chicken iron condor.

Reverse Iron Condor Construction

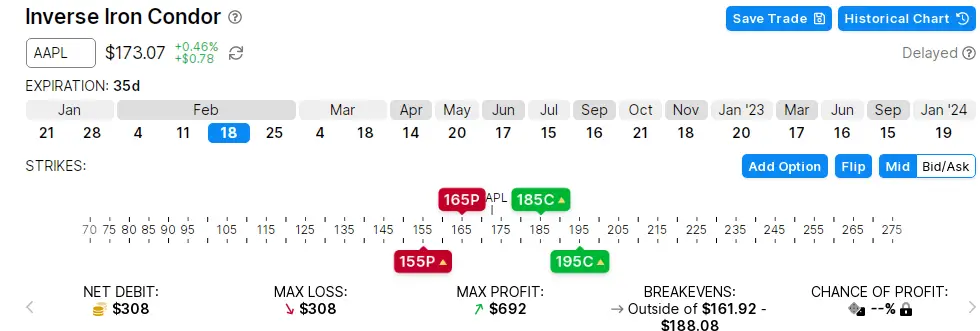

Let’s use the following example with Apple (AAPL) trading at $173.07 per share.

A RIC would be constructed in the following way below for a net debit.

Wing 1 ( Put side )

- Buy February 18th 165 put

- Sell February 18th 155 put

Wing 2 ( Call side )

- Buy February 18th 185 Call

- Sell February 18th 195 Call

As you can see, this is simply constructed in the opposite way of a regular iron condor. The distances in strikes between the wings remains at $10.

Max Loss For Reverse Iron Condor

The max loss potential for a RIC is the net debit paid for the trade. From our example, this comes out to $308, not including broker commissions and fees.

Max loss = net debit paid

Max Profit for a Reverse Iron Condor

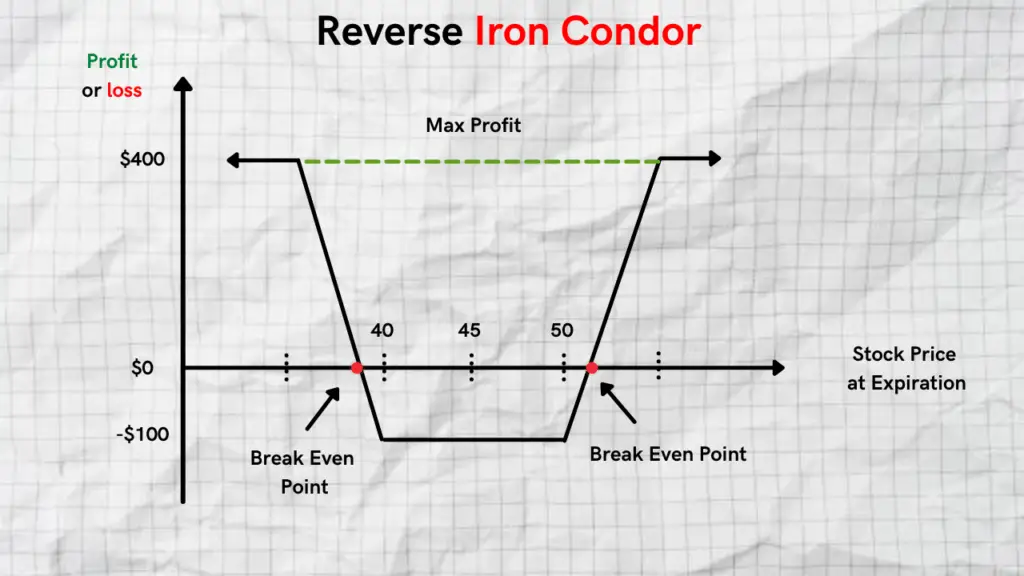

The max profit potential for a RIC is limited. The max profit potential occurs when the price of the stock drops below the strike price of the short put or goes above the higher strike of the short call option.

Max Profit = Strike Price of Short Call (or Long Put) – Strike Price of Long Call (or Short Put) – Net Premium Paid

When To Use A Reverse Iron Condor

As we can see from our example above, we need AAPL to move sharply in either direction by expiration when putting on a reverse iron condor.

Therefore, the main use of the RIC strategy is if you’re expecting volatility in the stock in either direction. Once the trade is on you want the stock to move sharply in either direction. They are best used during news and earnings releases.

Benefits of Using a Reverse Iron Condor

The benefits of using a RIC is that you can take advantage of high volatility environments. You can also use them if you are unsure on the direction that the stock is going to move but you are confident that the stock will experience a sharp move in the near future.

Risks of Using a Reverse Iron Condor

One of the main risk of using a RIC is the stock not moving enough in either direction to break even. It’s important to find a high volatility stock or event to use the strategy in order to make a profit. Therefore, they are recommended to be used during earnings releases and news events.

Another small risk that people often overlook with a RIC is the fact that it involves 4 separate options contracts. This means that you will pay commissions on each of the 4 legs which can quickly add up in commissions costs. Make sure your are fully aware of the costs before you place them.

Bottom Line

Before you decide to use a RIC in your options trading strategy, make sure you fully understand the following factors about them.

- How to properly put on the contracts on each side

- Where the break-even points are

- The maximum loss potential on the trade

- The maximum profit potential on the trade

- The commission costs you will incur

Related Readings

The Chicken Iron Condor Strategy Explained

The History of Options Trading

Benefits of Trading In the Money Call Options

Iron Condor vs Iron Butterfly