Vega is an important Greek in options trading that measures an option’s price sensitivity to changes in the volatility levels of derivatives. It can provide traders with relevant information about how an options price will change if implied volatility changes. As an options trader, you want to know the impact of implied volatility on your trades. If certain changes in implied volatility shift your probability of profit you be prepared to make changes in order to protect profitability and limit your downside risk. Let’s take a look at how Vega works, how to use it effectively to manage options risk, and its relationship to implied volatility.

Summary

- Vega is a measure of an option’s price (premium) relative to underlying changes in implied volatility of a derivative

- Short options have positive Vega and long options have positive Vega

What is Vega?

Vega is a metric that measures the level of increase or decrease in the options premium based on a 1% change in implied volatility. It’s used as a gauge to get insight into how sensitive a stock options premium is relative to changes in the implied volatility. The driving force behind Vega is changes in implied volatility and time to expiration.

Vega values can be both positive and negative.

Options with long-term expirations have positive Vega values which reduce as the time to expiration approaches. Options contracts that are due to expire immediately have negative Vega values. Vega is often used by options traders to hedge against unexpected changes in implied volatility.

To gain a better understanding of the dynamics behind Vega it’s important to understand its relationship with time to expiration, the moneyness of options, and implied volatility.

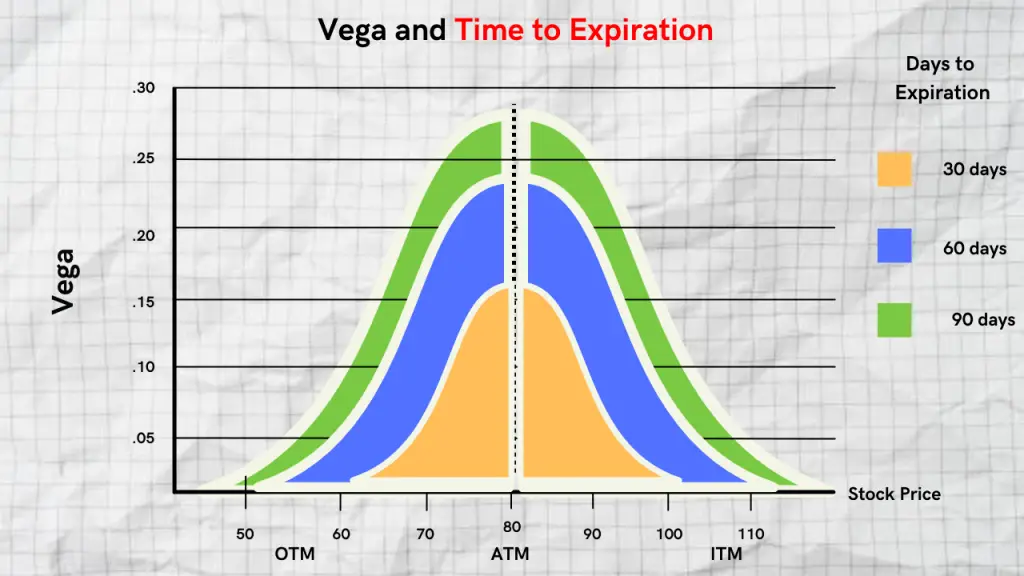

Vega and Time to Expiration

The longer an options contract has until expiration, the higher the impact of volatility on its premium. This depicts the impact on Vega with time to expiration. It’s more sensitive to longer-dated options because there is a higher probability of changes in implied volatility for longer-term expirations.

The value of Vega decreases the closer an option gets to expiration. On the flip side, the value of Vega goes up as the price of the stock approaches the strike price along with a longer time to expiration. This is because options holders pay higher premiums for options contracts expiring further in the future than shorter-term expirations.

Important Note: Vega only impacts the extrinsic value of an option’s premium, it bears no weight on the intrinsic value.

Vega and Options Moneyness

Vega is highest for at-the-money options and goes down as the stock price moves deeper out-of-the-money or deeper in-the-money. Understanding this relationship is important because it allows you to know how the value of Vega will change if the price of the stock moves towards or away from the strike price.

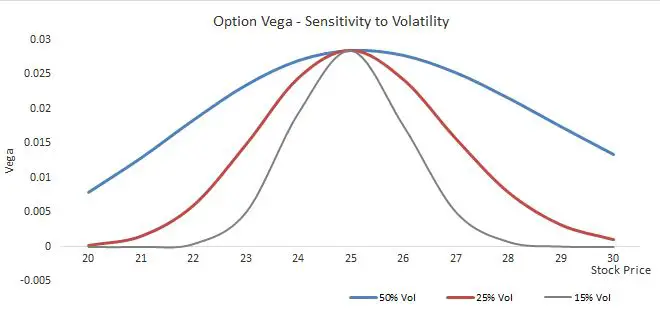

The value of Vega changes when there are big changes in the price of a stock as well as large swings in implied volatility. This is often directly related to news announcements made by a company which can signal higher or lower levels of future certainty.

Understanding Implied Volatility

To get a better grasp on Vega it’s important to have a basic understanding of implied volatility. Vega should also be used with a grain of salt because it’s theoretical. This is because implied volatility itself is a projection and is subject to change in the future.

Implied volatility is a theoretical projection of the market’s perception of a likely movement in the price of a stock. It’s an important options metric used by options traders to estimate the future price volatility of a stock. The higher the implied volatility of a stock, the higher likelihood that the price of the stock will move experience a sharp move to the upside or downside. Implied volatility does not predict a directional bias.

It’s expressed as a percentage and as it goes up and down it will impact Vega. It’s important to make the point that Vega isn’t simply volatility. Many options traders tend to confuse Vega with implied volatility which isn’t accurate. It measures the sensitivity skew of an option’s premium relative to changes in implied volatility.

Vega and Implied Volatility Relationship

The relationship between Vega and implied volatility is important to understand for options traders because it directly impacts the options premium. As previously mentioned, implied volatility is a theoretical projection of the underlying market’s perception of a likely movement in the price of a stock.

Therefore it shouldn’t be the sole determining factor for taking options trades. It is best used in conjunction with Vega to get a more accurate depiction of the sensitivity level of the premium relative to changes in implied volatility. This may be a lot to unpack, but our examples will illustrate this relationship.

It’s worth noting that implied volatility and Vega can shift without a change in the price of the stock. This can simply happen as options contracts expire due to changes in open interest along with other changes in options pricing.

Measuring Vega

If you have long options positions they will have a positive Vega value and short options positions will have a negative Vega value.

- Options buyers want the premium to go up and benefit from an increase in implied volatility

- Options sellers want the premium to decrease and will benefit from a decrease in implied volatility

As such it’s important to know how you stand to benefit from an increase or decrease in Vega depending on the type of options trading strategy you plan to use.

What Does it Mean to be Vega Neutral?

Being Vega neutral is a way to hedge against implied volatility risk in a specific stock. In essence, you need to establish a hedge position that makes your net Vega exposure 0 or “neutral”.

Net Long Vega Example

For example, let’s assume you took the following trade below.

- Long 1 AAPL 150 call option with 90 days to expiration at +.50 Vega (Long Vol)

- Short 1 AAPL 150 call option with 60 days to expiration at -.20 Vega (Short Vol)

- Net Vega: +.30

- This trade is considered net long Vega

Vega Neutral Example

Let’s take the following example below to illustrate a Vega neutral trade.

- Long 1 AAPL 140 call option with 60 days to expiration at +.40 Vega (Long Vol)

- Short 1 AAPL 140 call option with 60 days to expiration at -.40 Vega (Short Vol)

- Net Vega: 0

- This trade is considered delta neutral

In this example, we have completely hedged against implied volatility risk by making Vega neutral on both ends of the trade. Being Vega neutral removes us from sensitivity risk associated with changes in implied volatility.

Vega and Options Spreads

Vega can be a useful measure to help you measure implied volatility exposure in fixed risk strategies like vertical spreads. With options spreads, Vega allows you to measure your implied volatility exposure and gain an idea of how your premium can change with changes in the implied volatility.

If you notice that your net long or net short Vega exposure is shifting against you, you can cut your losses quickly and protect your downside. Using Vega as a metric for managing complex multi-leg trades like iron condors and vertical spreads can be extremely useful.

FAQ’s

How Does Time Value Impact Vega?

The time value has a direct impact on the value of Vega. The more time remaining until expiration, the higher the Vega will be. Leap options will have very high Vega values due and will be much more expensive. Consequently, a 1% move in implied volatility will have a higher impact on longer-term options because they hold more time value.

How Does Vega Change As Earnings Approach?

As an earnings release approaches, implied volatility increases due to a higher probability of changes in the price of the stock. The increase in implied volatility will naturally cause Vega to also increase.