If you’re thinking about retirement, you’re most likely thinking to yourself, do I have enough saved up? This is a question many people have at one point or another and it’s completely normal. The truth is that over 64% of Americans don’t think they have enough saved up for retirement or aren’t sure if they have enough. According to the Federal Reserve, [1]the median household retirement savings are approximately $65,000 from the most recent data published in 2020.

This data is for individuals who have retirement accounts set up. It’s estimated that about 25% of working Americans don’t have any sort of retirement in place and are relying mainly on social security when they retire. Of the people who do have retirement accounts, 55% have them through an employer-sponsored account such as 401(k) or Roth-IRA. The other percentages are sprinkled into pensions and personal brokerage accounts.

Summary

- The median household retirement savings is approximately $65,000

- Roughly 25% of working Americans don’t have a retirement plan in place

- People’s retirement savings after age 60 no longer grow at the same pace due to taking distributions

What is the Average Retirement Savings By Age?

Firstly, it’s important to note that a high percentage of people are failing to save for retirement at all. If you want to have a comfortable retirement it’s important to establish a retirement account early on and put away as much as you can. The earlier you start the better.

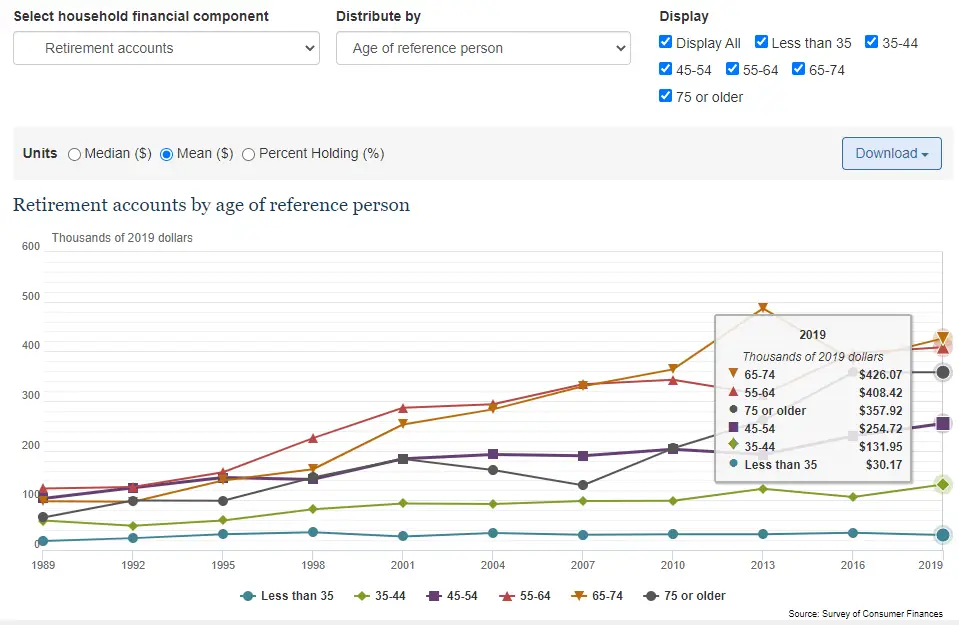

This table comes from 2019 data according to the Federal Reserve SCF data.[2]

Average Retirement Savings By Age Since 1989

You can see that on average after age 60, retirement savings no longer continue growing at the pace they did when people were younger. This is due to people starting to take distributions from their 401(k)’s, retirement accounts, and pensions after age 60. 401(k) plans allow you to take distributions starting at age 59.5.

One thing to keep in mind is that these are average figures with people who have a retirement plan in place. If you don’t have a retirement plan in place or you don’t have one offered through your employer, it’s highly recommended that you talk to a financial advisor and explore your options.

Knowing where you stand in comparison to other people with your retirement savings is important because it can help you benchmark if you are on the right track.

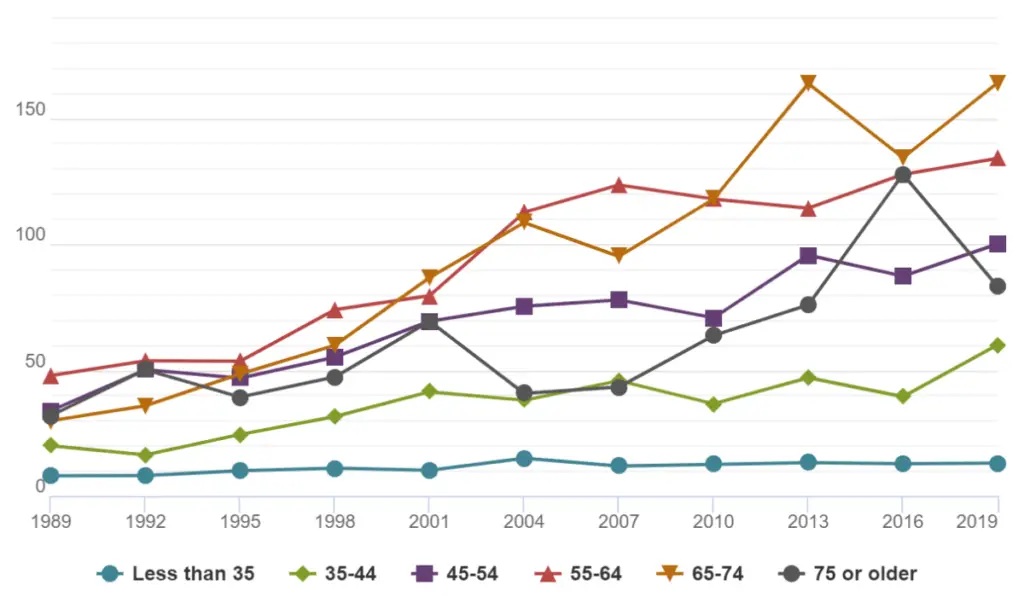

What is the Median Retirement Savings By Age?

As of 2019, according to Federal Reserve SCF data. the numbers below are the median retirement savings by age group.[3]

Median Retirement Savings By Age Since 1989 (in thousands of dollars)

This data is consistent with the fact that retirement savings start to decrease once people head into their 60’s and start taking distributions. It also stresses the importance of having enough retirement savings when you get older since your health care costs and needs also increase.

What is the Recommended Retirement Savings By Age?

The averages above may seem like quite a bit of money for some people. But with rising health care costs and living expenses, that money may not be enough for people depending on where they decide to retire. As a general rule of thumb, below are the recommended retirement savings from financial experts by age. [4]

How Much Money Will You Need to Retire?

The amount of money you will need for retirement depends on a multitude of different factors. Some of these include:

- State or country in which you retire

- Medical costs and expenses

- Monthly revolving living expenses

- Insurance costs

As a general rule of thumb, an easy way to determine how much money you will need for retirement is the rule of 4%. The rule of 4% recommends dividing your desired yearly retirement income by 4%.

So if you want $50,000 per year in retirement income you will need to have a nest egg of approximately $1,250,000 ($50,000/.04).

Important: The 4% rule assumes a 5% ROI per year (after taxes and inflation), with no additional income (such as Social Security).

Recommended Reading: The Average Retirement Age for Blue Collar Workers

Properly Planning For Retirement

There are 5 important steps you can take to properly plan for retirement.

- Understanding Your Time Horizon – Your time horizon is the difference between your current age and your planned or expected retirement age. This will allow you to get an idea of the timeline between now and the age at which you plan on retiring.

- Determine Your Spending Needs in Retirement – Knowing your spending habits and what kind of expenses you will have once you retire can help you define how much money you need for retirement. As a general rule of thumb, it’s recommended you save enough money to replace 60-70% of your pre-retirement monthly income.

As an example, if you would like to have $5,000 per month in retirement income, it’s recommended that you have $1,500,000 in a retirement nest egg using the 4% rule.

($5,000 X12 = $60,000/per year) ($60,000/.04 = $1,500,000)

- Understanding and Calculating Your Investment Return – Once you have decided on your time horizon and determined your spending needs it’s time to calculate your after-tax rate of return. This is done so you can access how feasible it is for your portfolio to produce the necessary retirement income. As you age you should slowly transition your investment into safer investments which will tend to have lower returns. Reasonable returns in retirement range from 5% to -8%.

- Developing Your Investment Goals – Your investment goals will depend on how much you make, how much you invest, and the kind of risk you are comfortable taking. You will experience a market crash at least once or twice in your lifetime. As a result it’s important to know how comfortable you are with taking risk. As always, it’s important to keep your investments diversified and know the kinds of risks you are willing to take.

- Estate and Will Planning – Estate planning and will planning are two retirement factors people often overlook. They are an integral part of retirement planning and everyone should review them. A good life insurance and disability plan will help ensure your family is left financially stable after you pass or are unable to work.

How Technology is Fueling Retirement

The rise of technology has made investing much more accessible to people than ever before. It has enabled people to learn about investing and start planning for retirement without going directly to a financial advisor. With online brokers slashing trading fees to zero, the power has been put back in the hands of the consumer. You can now to take charge of your financial future and educate yourself about investing and retirement.

Although technology is helping to make investing more accessible, financial advisors are still extremely valuable. They can help you discover investment plans you may not have known existed.

FAQ’s

How much do I need to retire on $100,000 per year?

Going by the rule of 4%, you would need $2,500,000 in a retirement nest egg to retire on $100,000 per year. This assumes a 5% per year minimum return on investment.

What is a good monthly retirement income?

A good monthly retirement income will vary by each person’s needs, desired retirement location, health, and more. Generally speaking, a good retirement income will be able to comfortably take care of your basic living expenses every month. Subsequently, a good retirement plan will also provide you with a variety of income sources to draw on. It’s recommended that you save enough to replace at least 70% of your pre-retirement monthly income.

What is the Average 40k balance for 65-year-olds?

According to a study performed by Vanguard on How America Saves, the average 65-year-old has approximately $216,720 in their 401k.

Article sources

[1] Report on the Economic Well-Being of U.S. Households in 2020 – May 2021 – https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm

[2]Survey of Consumer Finances, 1989 – 2019 -:Average Retirement Savings by Age – https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/#series:Retirement_Accounts;demographic:agecl;population:1,2,3,4,5,6;units:mean;range:1989,2019

[3] Survey of Consumer Finances, 1989 – 2019 -: Median Retirement Savings by Age – https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/#series:Retirement_Accounts;demographic:agecl;population:1,2,3,4,5,6;units:median;range:1989,2019

[4] Recommended Retirement Savings by Age: Fidelity Retirement Guidelines- 4 rules of thumb for retirement savings –https://www.fidelity.com/viewpoints/retirement/retirement-guidelines