In finance, curb trading was an old practice in which people participated to purchase stock when exchange weren’t properly set up and regulated. Although a bit ancient and no longer exists, it serves as important historical footstep to the evolution of our financial system.

Summary

- Curb trading is an old trading term that refers to orders that were executed off of standard exchanges and after the market has closed

- The term “curb trading” traces back to brokers and traders who gathered outside the curb of street corners to buy stock and sell stock

- Curb trading led to the formation of the American Stock Exchange (AMEX)

What is Curb Trading?

Curb trading is an old-school method of executing stock orders after exchanges have closed trading for the day. It traces back to a period before stock trading took place on licensed exchanges.

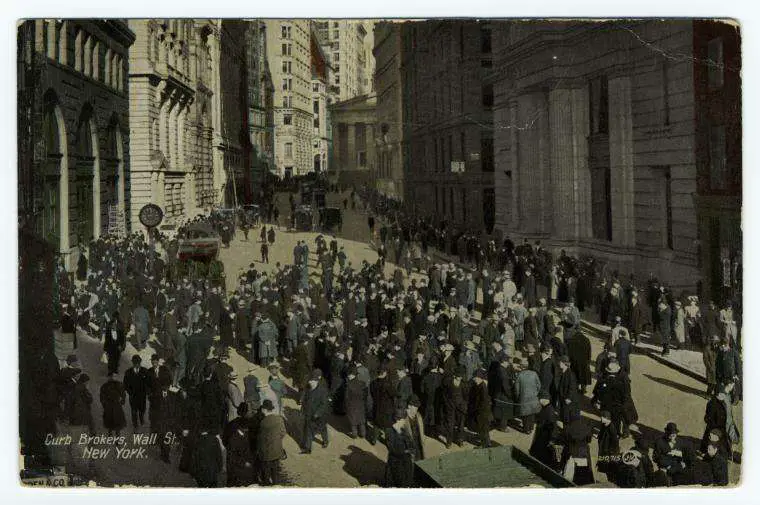

Prior to the establishment of licensed exchanges in the early 1800s, brokers and traders would gather outside the “curb” of street corners in Manhattan in an open outcry. Curb trading is the equivalent to modern-day extended hours trading but in a regulated trading environment through licensed exchanges.

How Curb Trading Started

In the old days, securities that were considered unsafe to trade on standard stock exchanges like the New York Stock Exchange (NYSE) and the NASDAQ were bought and sold on the corner of street curbs. The brokers that offered curb trading were common in the 1800s and early 1900s.

Curb brokers were known for offering dealing into high-risk small-cap stocks which were mainly in the industrial sector. Historically, the most famous curb was on Broad Street in the financial district of Manhattan. It was chaotic, unorganized and fights oftentimes broke out.

The Establishment of Exchanges

Curb trading led to the formation of the American Stock Exchange (AMEX) which was previously known as the Curb Exchange until 1921 when it was registered and operated as a legitimate stock exchange. Today the AMEX is known as the NYSE American after it was acquired by NYSE Euronext in 2008. Curb trading pushed exchanges to start offering extended hours trading to better help investors manage their capital and risk

Today, curb trading is mainly a folktale phrase that references trading activity that takes place away from an organized exchange. The rise of technology and expansion of the financial system has rendered this type of trading obsolete. It’s worthwhile to know about curb trading since it was instrumental in helping the overall stock market evolve and grow to a more regulated and organized system.

Was Curb Trading Legal?

In present times in the US, curb trading is considered an illegal practice under the rules and regulations of the Commodity Futures Trading Commission and Commodity Exchange Act. [1]

Back in the day, there wasn’t any sort of regulation around curb trading, and it wasn’t deemed illegal. Although it wasn’t illegal, investors who participated in it often times lost money and didn’t receive official proof of ownership of the stocks they bought.

References

[1] Commodity Futures Trading Commission and Commodity Exchange Act