If you have ever traded stocks in the past, you have more than likely come across the market phenomenon of a short squeeze. It’s a unique market condition that causes the price of a stock to shoot up in a short period of time by forcing short-sellers out of their positions. Knowing the mechanics behind a short squeeze will help you understand why they occur, how you can spot them, and the common risks associated with them.

Summary

- A short squeeze occurs when short sellers are forced to close out their stock positions due to a rapid rise in the price of the stock

- Short squeezes are often triggered by short-sellers hitting margin calls

- For a short squeeze to happen, there has to be a significant level of short interest

Short Squeeze Explained

A short squeeze is a market trading condition that occurs when “short sellers” are forced to close out their stock positions due to rising stock prices. A short squeeze begins when the price of a stock goes up quickly in a short period of time.

This rise in price can trigger margin calls for short-sellers, forcing them to close their short positions and buy back shares of the stock. The term “short squeeze” indicates that short-sellers or “bears” are being “squeezed” or forced to get out of their positions.

For a short squeeze to occur, there has to be a significant short interest in the stock along with a catalyst that pushes the price of the stock up in a short period of time. It’s worth noting that a short squeeze is often times a very short-lived event.

How Long Does a Short Squeeze Last?

Many factors impact how long a short squeeze will last. However, for the most part, short squeezes are very temporary and last up to an average of 2 weeks. There are also exceptions to this, depending on the public interest of the stock that can make them last much longer.

For example, the Volkswagen short squeeze of 2008 lasted approximately 31 trading days from the time it started and is considered one of the most famous short squeezes of all time. For a brief period of time, the short squeeze made Volkswagen one of the most valuable companies by market cap during that time.

There were a few different factors that led to this short squeeze including like:

- Low stock float

- Volkswagen’s high debt load

- The economic hit taken by the 2008 recession

- High short interest relative to float

All these factors were suitable catalysts to trigger a short squeeze and send the stock to highs it had never seen before. In addition to these factors, there were takeover rumors that Porsche was planning to increase their stake in VW which kicked off the short squeeze.

Important Note: Short squeezes are not based fundamental factors of a company. They are usually driven by a change in investor and trader sentiment along with a heavy reliance on technical and speculative factors.

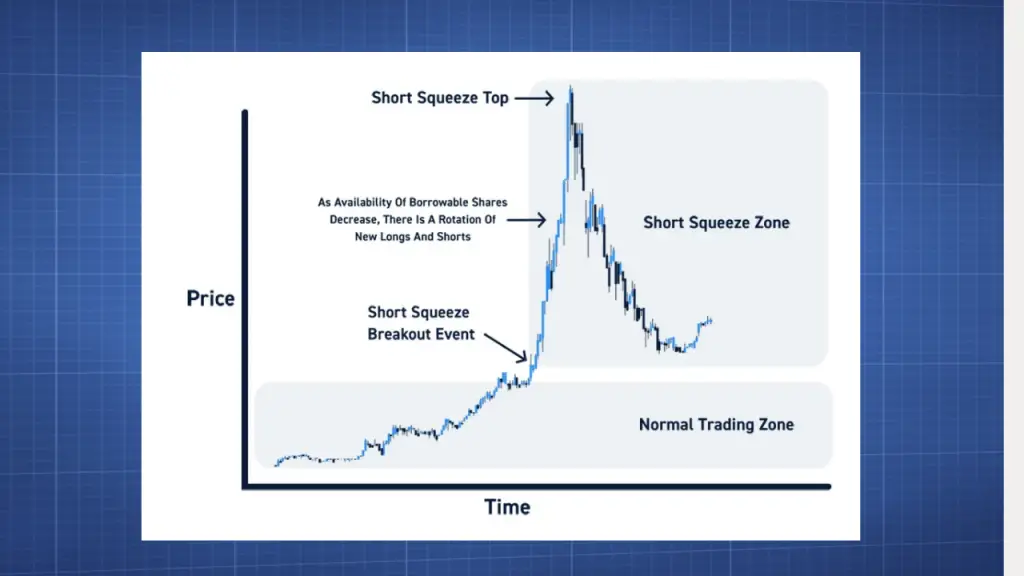

What Does a Short Squeeze Look Like?

Before a short squeeze kicks off, the price behavior of the stock tends to be bearish. In addition to this, the average daily trading volume is very normal. A short squeeze usually kicks off due to some sort of catalysts such as unexpected earnings, takeover plans, or an altered public sentiment.

This catalyst will lead to an increase in the average daily trading volume and slowly begin to push the price up. As this begins to happen, more retail traders tend to take interest and they start to go long the stock. This increased interest pushes the stock price higher which then forces short sellers to cover their positions and buy back the stock.

What Happens After a Short Squeeze?

As previously mentioned, a short squeeze doesn’t last long. Following the initial price surge experienced during this event, a stock will reach an exhaustion point. Once this happens, the price of the stock can exhibit an exhaustion gap before reversing aggressively to the downside.

This signals that the buying frenzy is over and people who were long the stock have begun taking profits and exiting their positions. It’s important to know that when a reversal occurs following a short squeeze they are fast and significant. On average, you can see 30-50% drops in price in a single day following short squeeze exhaustion. Identifying technical areas for exhaustion is important to help you protect your profits and avoid getting in a trade too late.

The Impact of Options on Short Squeezes

A stock that has a liquid options market can experience higher levels of volatility if a short squeeze does occur. This has to do with the effects of a gamma squeeze on the underlying share price and the mechanism that occurs when market makers are forced to cover their positions.

Therefore a stock with a much more active options market tends to have much more explosive short squeezes. This is because both retail short sellers are forced to cover their positions as well as the market makers. Once both parties are participating in covering their trades the volatility and price surge are significantly higher.

How to Find a Short Squeeze?

The most useful method for finding a short squeeze is by using a stock scanner. Using a stock scanner will help you filter for stocks that are ripe for a short squeeze. We recommend using Scanz to look for potential short squeezes. Below is some of the most useful criteria to look for:

- The amount of share short should be greater than average daily volume

- The shares short as a percentage of float should be greater than 10%

- Increasing shares short percentage

This criteria is a good starting basis to ensure a squeeze occurs if there is the right catalyst in place to push the stock price up.

Are Short Squeezes Illegal?

Although many investors will argue that short squeezes are unethical, they are 100% legal and are a direct function of normal market behavior. However, a coordinated effort to induce a short squeeze is considered illegal stock manipulation.

Many investors and market analysts have made the argument that the GameStop short squeeze was a coordinated manipulation effort by retail investors in the wallstreetbets subreddit. However, others have argued that this type of short squeeze would not have occurred if market makers didn’t allow the short float to reach such a high level.

Risks Associated with a Short Squeeze

As a short seller, the risks of being caught in a short squeeze can cause significant losses. As such, it’s important to have proper risk management and control if you do ever happen to get caught on the wrong end of one. In addition, it’s important to be aware of how sensitive the stock you are trading is.

This will require you to have a solid understanding of its float and how it’s changing over time. If you notice a significant shift in the short interest or an increase in the trading volume, it’s important to stay alert and change your risk management parameters as necessary.

As the volatility of the stock shifts, it can impact the liquidity and execution of your orders. Being conscious of changing factors in the underlying stock will help you shift your strategy.