Trading comes with many different risks. One of those risks is execution slippage. Execution slippage in trading is highly misunderstood by traders and investors. If you plan to become a profitable trader, it’s important to have a solid understanding of order execution and the long-term impact of slippage on your returns.

Summary

- Slippage is the difference in execution between a trader’s expected fill price and the fill price they received

- Slippage occurs when the bid/ask spread changes from the time a market order is requested and the time it is filled

- Execution slippage can occur on different stocks, options, bonds, cryptos, futures, and commodity products

What is Slippage?

Slippage is the difference in execution between the expected price of an order and the actual fill price received. Traders should avoid trading financial instruments during periods of the day that are naturally prone to slippage. Execution slippage occurs most frequently during periods of high volatility, thin liquidity, and on financial instruments that have low trading volume.

In addition, market orders are most prone to execution slippage as well as large orders that are above the top of book volume. The truth is that if traders and investors experience slippage consistently they will naturally erode their returns. The good news is that if you understand different order types and liquid trading conditions, execution slippage can be reduced and even completely avoided.

It’s a trading expense that investors and traders should be conscious of and look to avoid. However, not all slippage is negative. It can sometimes work in favor of traders if they know how to structure their trades.

How Does Slippage Occur?

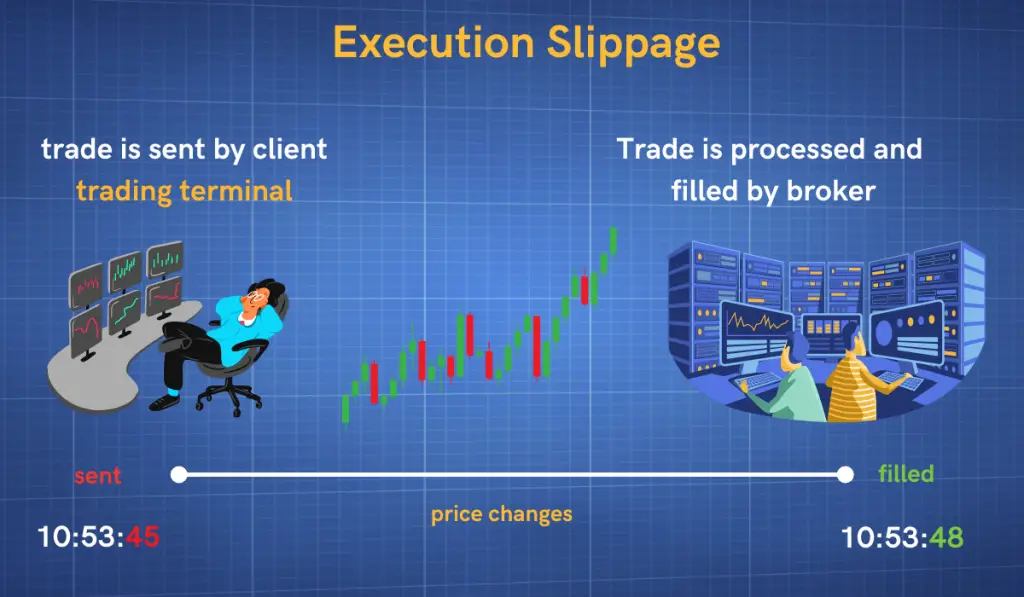

Slippage is experienced primarily with market orders and stop orders. When you place a market order with your broker to execute a trade, you send a trade request to the trader server.

After the broker receives your request it is sent for execution. Between the time you send your order request and when your trade receives a fill, the price of the stock can change. This creates the opportunity for your trade to get executed at a different price than you originally requested.

This is where “execution slippage” can occur and in most cases is worse than the original request. Over time, the small amounts of slippage on market orders can add up to hundreds of thousands of dollars in extra fees. However, traders and investors should be aware that there is both negative and positive slippage

Positive and Negative Slippage Explained

Something that most traders aren’t aware of is the fact that execution slippage can work in your favor. This brings up positive vs negative slippage.

Positive slippage

Positive slippage occurs when a trader receives a better fill than their original request. How does this happen? This depends highly on the broker you use as well as the kind of pricing schedule you’re on. In addition, this will also depend on the type of orders you use. Some brokers can choose to pass on “price improvements” back to their clients to help them get better fills.

This means that if the difference between your request price and your fill price is better, your broker can pass the “improvement” back to you. This is referred to as positive slippage and allows traders to receive a better fill than they originally requested. This means that for a market buy order your broker would fill your trade at a lower price than you originally requested. And for a sell order, they would fill your trade at a higher price than you requested.

- For example, you submit a buy order to purchase 100 shares of Apple stock at $145.50 a share. By the time you receive a fill back from your broker, the price slides down to $145.40.

- Your broker fills your trade at the better rate of $145.40. This results in a $0.10 price improvement or a total of $10 ($.10 x 100 shares).

Again, this will depend on your broker and most brokers chose not to pass on price improvements to retail clients unless they do enough volume and hold enough funds.

Negative Slippage

At this point, you’re familiar with how negative slippage works. You receive a worse price than your original request. This means that is it slightly more expensive for you to purchase your stock. If you compound negative slippage over several years of trading, the costs can add up significantly. This is, even more, the case if you trade day trade.

- For example, you submit a buy order to purchase 100 shares of Apple stock at $145.50 a share. By the time you receive a fill back from your broker, the price goes up to $145.60.

- Your broker fills your trade at the better rate of $145.60. This results in a $0.10 negative slippage or a total of $10 ($.10 x 100 shares).

- This made the purchase 100 shares of Apple stock $10 more expensive.

If you trade multiple times a day, you can see that the slippage costs can quickly add up. As a trader controlling your costs is extremely important for long-term profitability.

Factors that Impact Execution Slippage

If you want to reduce or eliminate execution slippage it’s important to be aware of all the different factors that can cause it. Below are factors that can impact execution slippage.

- Order Type Used

- Order Size

- Bid/Ask Spread

- Time of day

- Stock Gaps

- Volatility

- Liquidity

- News events

One of the best methods to completely avoid execution slippage and improve your fills on your trades is by using limit orders.

Slippage and Different Order Types

A buy limit order and a sell limit order prevent traders from experiencing negative slippage. By design, limit orders are executed at the requested price or better. This however creates risk because the trade may never get executed if the price never hits the set limit price. A limit order guarantees price but not execution.

A buy stop order and sell stop order can however experience execution slippage. This is because a stop order activates and turns into a market order when the set stop price is hit. By design, stop orders can experience slippage, but will always fill if the set price is activated.

What is Slippage Tolerance?

Now that you have a better understanding of market dynamics that can impact execution, it’s important to have a proper understanding of slippage tolerance.

Slippage tolerance is more popular in crypto and Defi trading, however, some brokers allow you to configure slippage tolerance on stocks and options trades. Slippage tolerance represents the percentage amount that you are comfortable receiving slippage on. As the name implies, it’s the amount you are willing to tolerate for worse execution.

Slippage tolerance is especially useful if you trade highly volatile financial products that may have natural slippage as a result of their erratic price behavior. It will allow you to receive fills on your trades but within a reasonable tolerance.

Ways to Reduce and Eliminate Slippage

One of the easiest ways to reduce execution slippage is to avoid trading low-volume stocks. Stocks that have healthy liquidity levels have more stable pricing and an overall better market.

Another way to reduce execution slippage is to avoid trading during volatile periods such as the market open, news events, and towards market close.

Lastly, one of the most effective ways to completely eliminating slippage is by using limit orders. You may not get a fill if your limit price isn’t hit, but at least you won’t experience slippage on any level.

As a trader and investor, it’s important to be fully aware of how your trading fees and execution impact your returns. Traders and investors should perform a cost analysis on their trades. This can help them discover where they can improve to reduce their overall cost basis when trading.

Over many years, the impacts of slippage on your returns can stack up more than you can imagine. Focus on identifying how you can improve your executions and your overall returns will improve.