It’s important to have a solid understanding of inflation as a consumer and as an investor. Inflation impacts people, businesses, the economy, government policy, and so much more. As a consumer, it impacts the costs of goods and services you use every single day. As an investor, it will impact your investment options and the decisions you will make. There are different types of inflation that carry different effects. As such, it’s important to understand the different types of inflation better prepare for your financial future.

Summary

- Inflation measures the rate of rising prices for goods and services in our economy

- The three main types of inflation are demand-pull, cost-push, built-in inflation

- The different categories of inflation include creeping inflation, galloping inflation, hyperinflation, stagflation, and deflation

- Inflation can be controlled by the Federal Reserve by increasing the federal funds’ interest rate

- The Consumer Price Index (CPI) is the main measure of inflation in the United States

Inflation Explained

Inflation is an economic metric that measures the rate of rising prices for goods and services in our economy. It causes a decrease in the purchasing power of consumers and is measured as a percentage. Generally, the public sees inflation as a negative economic effect because it makes the money you save today less valuable in the future.

It reduces consumers’ purchasing power and can cause overall economic growth to contract. Inflation also can impact employment, supply chains, investments, retirement, and more.

Inflation can take place in different economic industries such as energy, housing, food, medical care, automotive and more. It can have a trickle-down effect throughout the economy and can lead to serious economic problems if central banks fail to adapt their policies. To fully understand the economic impact of inflation, it’s important to get familiar with the 3 main types of inflation.

The 3 Main Types of Inflation

Below are the three main types of inflation.

Demand-Pull Inflation

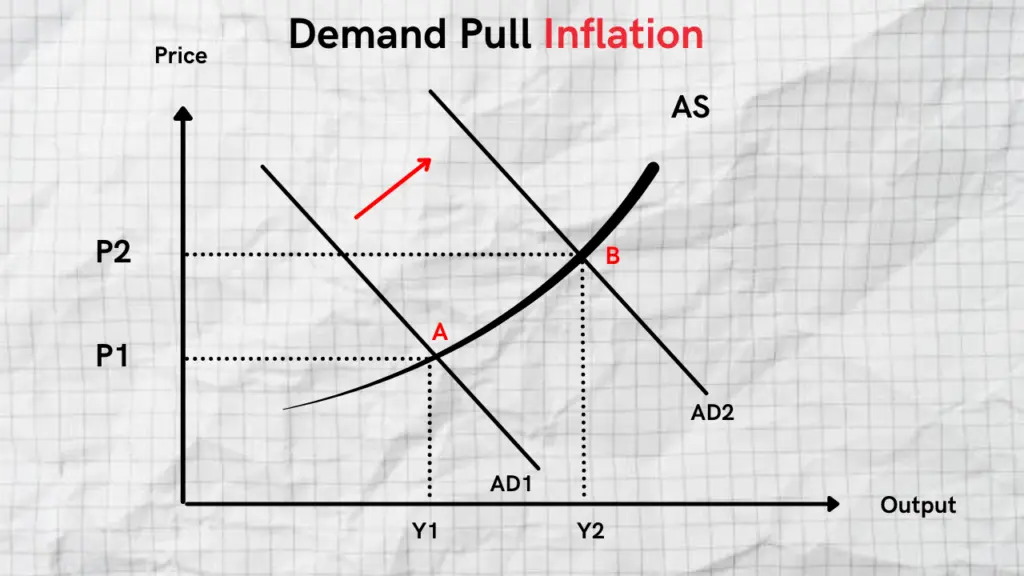

A demand-pull inflation occurs when the demand for goods and services is higher compared to the production capacity. This is illustrated by the graph below as demand increases from AD1 to AD2.

The difference between the supply of goods and services and the demand causes a rise in prices. As companies begin to respond to higher demand levels with an increase in production, the cost of each output increases as can be seen by the change from P1 to P2. This type of inflation can occur when supply chains are disrupted.

Cost-Push Inflation

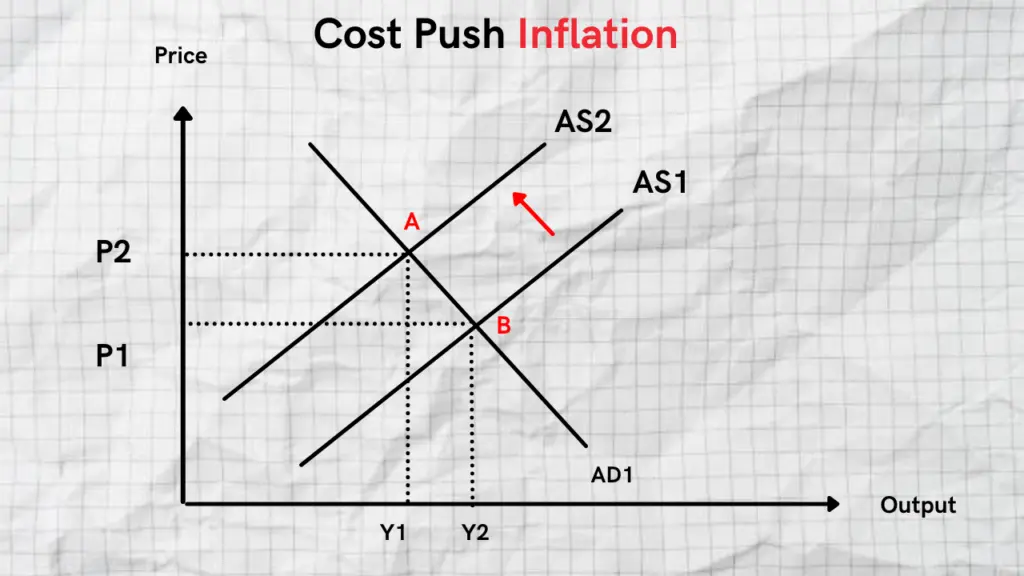

This type of inflation occurs when production costs increase. Once the costs associated with producing products ( raw materials, labor, transportation) increase, the extra cost is passed on to the final price of the product. Higher input prices cause the aggregate supply (AS) to shift to the left, while aggregate demand remains the same. See from AS1 to AS2 in the graph below.

The increase in costs can decrease the aggregate supply in the economy. The demand for goods and services remains the same with cost-push inflation and the price increase ends up getting passed on to the consumer.

Built-In Inflation

This is the expectation that there will be future inflation that will take place. It is considered as expected inflation due to a general rise in prices. The general rise in prices results in higher wages to support a higher cost of living. This in turn leads to higher costs of production which increases the prices of products for the end consumers.

These are the three main types of inflation. In addition to these, there are five expanded types of inflation that can give us further insight into how inflation behaves.

Expanded Types of Inflation

Creeping Inflation

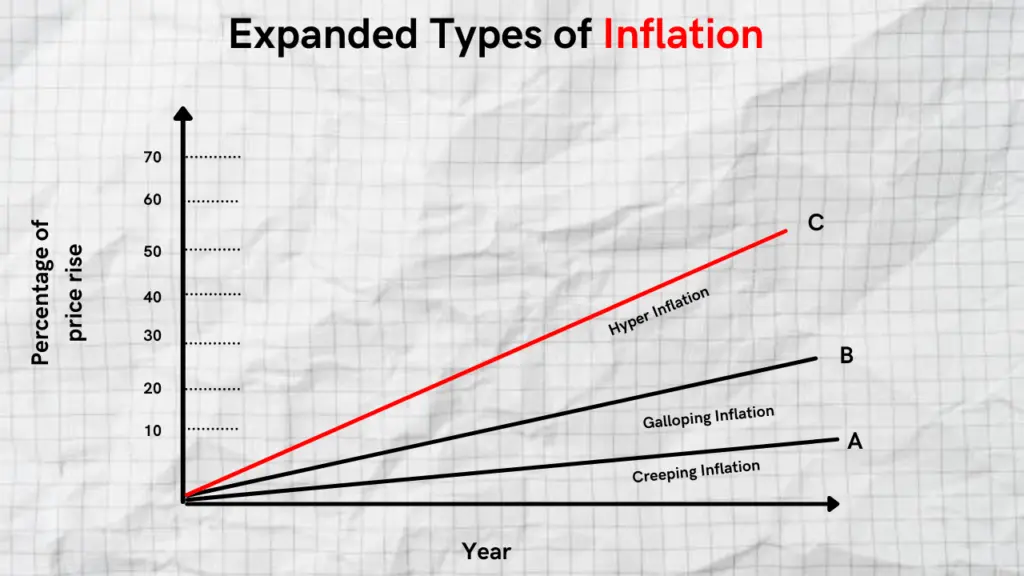

- This type of inflation is considered a moderate level of inflation which is generally expected as a result of normal economic conditions. It occurs when the price of goods and services increases consistently for a period of time at a moderate rate. When the rate of inflation is in the single digits annually, (less than 10%) it is mild or moderate.

Galloping Inflation

- Galloping inflation is considered anything in the double-digit range. This is when mild or controllable inflation is not properly managed by governments and ends up exceeding 10% annually.

- Galloping inflation can have a serious economic impact and cause financial issues for businesses, individuals, and local governments. Although economies can still function under galloping inflation, it creates a very challenging environment from all aspects.

Hyperinflation

- Hyperinflation is an extremely high level of inflation that can have a catastrophic impact on the economy. An economy with an inflation rate of over 50% annually is considered to be labeled hyperinflation. Hyperinflation is caused by an increase in the money supply and demand-pull inflation.

- It tends to occur in periods of economic disaster or depression. One of the most recent cases of hyperinflation was in Venezuela, where prices rose over 41% in 2013 and by 2018 inflation was over 60,000% [1]. This was catastrophic for the economy which prompted the government to increase its money supply in order to combat

- hyperinflation.

Stagflation

- When stagflation takes over, there is slow economic growth, high levels of unemployment along with rising prices. It is a result of poor economic policy and very strict regulatory policies which restrict a free market from operating normally. This can include tariffs on imports, strict regulation in specific industries, and more.

Deflation

- Deflation is simply a sustained decline in prices for goods and services. During a “deflationary period” the cost of capital, labor, goods, and services fall while consumer prices remain the same. It benefits consumers because their purchasing power increases.

- Deflation is caused by a decrease in the money supply which is controlled by the Federal Reserve. It is essentially considered the reverse of inflation and occurs when the annual inflation rate drops below 0%. If the inflation rate drops below zero, it increases the real value of money.

Now that you have a better understanding of the different categories and versions of inflation, let’s take a look at some of the main causes of inflation.

What Are the Main Causes of Inflation?

Many different factors can drive inflation. Generally, inflation comes from increased demand for products or services or an increase in the production costs of goods and services. Let’s take a look at some of the different causes of inflation.

Higher Demand For Goods and Services

When consumer demand for products and services is high and supply is low, it can cause an increase in price. When there is widespread economic demand for products and services, prices tend to go up. The demand for computer chips in 2021 and heading into 2022 is very high and companies simply don’t have the supply. This demand has caused the prices of cars, and consumer electronic goods to go up.

A Rise in Production Costs

Another cause of inflation is a rise in production costs. Production costs can include raw materials, transportation, and wages. The general demand for goods and services remains the same, but the supply of those goods and services declines due to higher production costs.

The additional production costs are then passed down to the consumer who has to pay a higher price for goods and services. This is most often seen with an increase in commodity prices since metals, energy, and oil are considered major production inputs.

Financial Policies and Regulations

Certain financial and government policies can cause a demand-pull or cost-push inflation to occur. When the government decreases interest rates, it makes the cost of borrowing lower. This tends to push real estate prices higher and can cause the overall supply of houses on the market to decrease.

Currency Devaluation

Currency devaluation is an adjustment in a country’s exchange rate, which will result in a lower value for a country’s currency. If a country devalues its currency it will reduce the price of its exports and encourage other countries to buy more of their goods.

Currency devaluation also makes foreign products more expensive compared to the country that devalued their currency. The main reason is to encourage consumers and countries to buy more domestic products over foreign products.

Which Industries Are Measured When Inflation is Calculated

The Consumer Price Index (CPI) is the official measure of inflation in the United States. It measures the average change in prices over time that consumers will pay for goods and services. There are over 200 different categories of businesses and industries that are measured inside the CPI. It is split up into the following groups below.

- Food and beverage

- Housing

- Transportation

- Apparel

- Medical Care

- Recreation

- Education and communication

- Energy

Each group carries its own weight with regards to how much it impacts the inflation rate. For a more comprehensive view of the different categories check out the Consumer Price Index by category breakdown.

How Can Inflation Be Controlled?

Each government has its method of controlling inflation. The most popular way for controlling inflation in the United States is by contractionary monetary policy. The goal is to reduce the money supply by increasing interest rates and decreasing bond prices.

In the U.S. this is done by the Federal Reserve. They reduce the federal fund’s interest rate. This is the rate at which banks can borrow funds from the government. Once the government raises its interest rates, financial institutions and banks follow suit and pass on the increase to consumers. This in turn reduces the number of people that want to borrow money because it costs more. As a result, this reduces spending, prices drop and so does inflation.

Who Benefits From Inflation?

Typically, inflation hurts people who keep cash savings and who are on a fixed income. Consumers are negatively impacted by inflation. As the price of goods and services goes up, their purchasing power goes down.

Recommended Reading: Inflation and Stocks – The Impact of Inflation on Stocks

Inflation benefits people who hold large debts with fixed payments. This can include businesses and households with large outstanding debt. During periods of higher inflation, there is an increased demand for assets such as land, real estate, gold, and silver. People who hold these assets tend to do well during periods of high or unexpected inflation.

What is the Inflation Rate Formula?

The inflation rate formula allows us to see the percentage increase or decrease in cost between a specified period of time. It’s important to be aware of how costs are changing year by year so you can better plan your finances.

Inputs

A = Starting Cost ( past CPI )

B = Ending Cost ( current CPI)

Inflation Rate = ((B-A)/A) X 100

From our formula above, A represents the starting cost of a good or service (Consumer Price Index) based on a specific period. And B represents the current cost of a good or service.

Calculating the Inflation Rate

For example, let’s assume we wanted to find out the inflation rate for a dozen eggs between 2000 to 2021. If we use the CPI average data for eggs, you will see that in 2000 the cost of a dozen eggs was $0.97 and at the end of 2021 they cost $1.71.

In this case, our inputs would be:

A = $0.97 (starting cost ) – 2000

B= $1.71 ( ending cost) – 2021

Inflation rate = (($1.71 – $0.97)/$0.97 x 100)

Inflation rate = ($0.74)/$0.97)) x 100

Inflation rate = (.76) x 100

Inflation rate = 76%

Annual Inflation rate = 76%/21

Annual Inflation rate = 3.61%

The price of a dozen eggs has gone up by 76% since 2000 with an annual inflation rate of 3.61% .This is a moderate level of inflation.

What is the Current Inflation Rate In the U.S.?

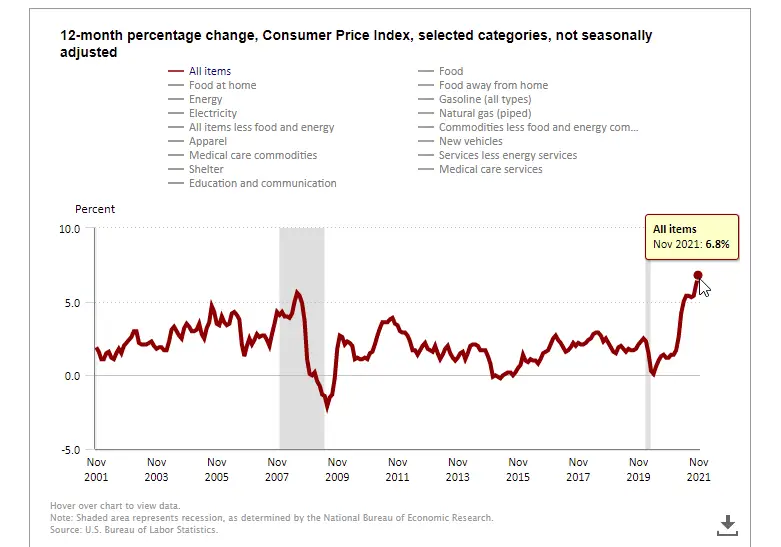

Per the latest CPI results for November 2021, the current inflation rate in the United States is 6.8% which is the highest it’s been in the last 20 years.

This is partly due to COVID and the low-interest-rate environment held by the Federal Reserve for the past three years. Inflation is expected to increase heading into 2022 and 2023. To combat inflation the Federal Reserve is expected to increase the federal funds rate up to three times in 2022.

Conclusion

As you can see, inflation plays a significant role in our economy and impacts every business and consumer in some way shape, or form. It impacts global financial markets all over the world and sets the standard for how a government is managing it’s economy. As such, it’s important for consumers and investors to understand inflation in order to make better investment and purchasing decisions.

Article Sources

[1] Venezuela Hyperinflation https://www.imf.org/en/Countries/VEN