The bull put spread is a popular options trading strategy used by investors who want to collect premium from their options as well as take a slight directional bias in the price of the stock.

Summary

- The bull put spread is a limited-risk, limited profit options trading strategy

- Used when investors believe that the price of the stock will rise modestly over a specified period of time

- Bull put spreads reach maximum profit if the price of the stock expires above the higher strike price

What Is the Bull Put Spread Strategy?

The bull put spread is a limited-risk, limited-profit strategy that is used by investors who have a directional bias in the price of a stock. It’s used by investors when they expect the price of the stock to rise modestly within a specified period of time.

The strategy uses put options to create a “spread” which gives the options trader limited risk to the downside and also limited upside.

Bull Put Spread Construction

The bull put spread consists of selling 1 put options contract closer to the price of the stock and buying 1 put options contract further away from the price of the stock for the same expiration date. Since you receive a net credit as a result of creating the trade, it is commonly referred to as a “bull put credit spread”.

It’s worth noting that bull credit spreads can be created out-of-the-money, as well as in-the-money.

OTM Bull Credit Spread ( Low to Moderate Directional Bias)

- Sell 1 OTM put option ( closer to the price of the stock)

- Buy 1 OTM put option ( further away from the price of the stock)

ITM Bull Credit Spread ( High Directional Bias )

- Sell 1 ITM put option

- Buy 1 ITM put option

Out of the money bull credit spreads tend to have a higher probability of profit and earn less credit. In the money bull put spreads have a lower probability of profit, but bring in more credit. ITM bull put spread should be used when you have a strong conviction that the price of the stock will rally within a specific time period.

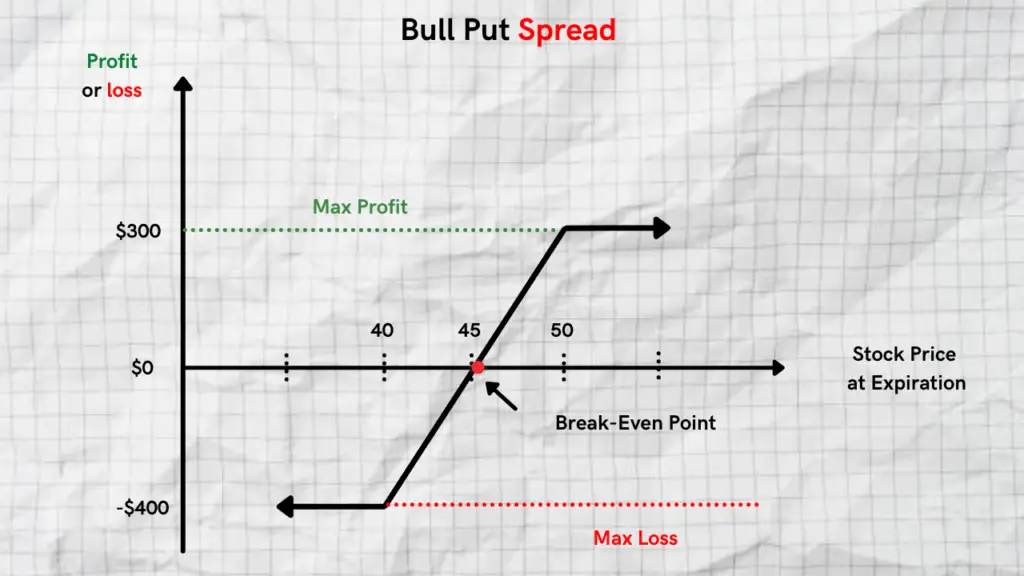

Bull Put Spread Payoff Diagram

As you can see from the payoff graph, the max loss associated with a bull put credit spread is larger than the max profit potential. These amounts will also vary depending the width of your strikes and how far out-of-the-money you decide to create the spread.

Bull Put Spread Risk Profile

Before getting into a bull put spread, it’s important to be aware of its risk components.

Before getting into a bull put spread, it’s important to be aware of its risk components.

Limited Profit Potential

A bull put credit spread is a great way to capture some premium while taking a directional bias in the trade. However, the max profit potential is limited to the credit you receive as a result of writing the spread minus trading commissions.

Max Profit = Premium Received – Brokerage Commission

The max profit for a bull put spread occurs when the price of the stock expires above the strike price of the short put.

Limited Loss Potential

An advantage to trading bull put spreads is the fact that they have defined risk. If the price of the stock drops below the lower put strike price the trade will incur a maximum loss.

Max Loss = Strike Price of the Short Put – Strike Price of the Long Put + Net Credit Received

It’s worth noting that the max loss for a bull put spread is always larger than the max profit potential.

Break-Even Point

It’s also important to be aware of the break-even point for a bull put spread.

Break-even = strike price of the short put – net credit received

Bull Put Credit Spread Example

Let’s assume that you believe the price of AAPL, currently at $175, is going to modestly go up within the next month. You decide to do a bull put spread. Below is the trade you enter.

Example Trade

- Sell 174 Put (+3.50)

- Buy 172 Put (-2.50)

As a result of writing this spread, you receive a net credit of $1.00.

Max Profit

Your max profit on this trade is the amount of premium you took in as a result of writing the spread which is $1.00.

Max Loss

The max loss you can have on this trade is the total width of your two strike prices plus the credit you received as a result of writing the spread. In this situation your max loss $1.00 or $100 ($1 x 100).

Short put strike price= $174

Long put strike price = $172

Credit received = $1

Max Loss = $1

Break-Even Point

The break-even point on this trade is the short put strike- the premium you received. In this instance, your break-even point is $173.

Short put strike = $174

Premium Received = $1

Break-even Price = $173

Knowing where all of the risk points of your options trade are is important in managing your risk.

Pros and Cons of Trading Bull Put Spreads

| Pros | Cons |

| Defined Risk | Limited Profit Potential |

| You earn credit instead of paying out a debit | Your potential loss is greater than your potential profit |

| Benefit from time decay | Assignment risk if you don’t get out of the trade before the expiration date |

Closing Bull Put Spread Before Expiration

It’s important to note that to mitigate the potential assignment risk associated with spreads, it’s important to close your trade before the expiration date.

With a bull but spread, If the price of the stock happens to expire in between your short put strike price and the long call strike price, you will be assigned 100 shares of stock at the short put strike price.

From our example, if the price of the stock happened to expire at $173 (between $174 and $172), you would get assigned 100 shares of AAPL stock from your broker and have to put up the necessary funds to purchase them.

FAQ’s

Is a bull put spread a better options strategy than an iron condor?

These are two separate strategies that are to be used in different trading environments. An iron condor is better suited for a low volatility environment in which you expect the price of the stock to remain in a narrow trading range. Also, with an iron condor you stand to earn more premium, but run the risk of having two different ways to lose a trade.

Can you sell a bull put credit spread before expiration?

You can close both legs of your bull put spread before expiration. It’s worth noting that if you close your trade before expiration, you will have to pay another round of commissions to your broker. If you don’t close before expiration, you won’t have to pay the fees, but you run the risk of possible assignment.

Related Reading