Gamma is one of the 5 Greeks which can give options traders deeper insight into the behavior of delta as the price of the underlying changes. In this article, we will break down what gamma in options is, how it behaves as the price of the stock changes and why it’s useful.

Summary

- Gamma is used to measure the rate of change in delta for a $1 move in the stock

- The value of gamma can be positive as well as negative

- The gamma is at it’s highest point for at-the-money options

- Gamma approaches zero the further out-of-the-money it gets

What is Gamma?

Gamma measures the rate of change in an option’s delta for a single $1 move in the underlying price of the stock. Delta measures the change in the options premium for a single dollar move in the underlying.

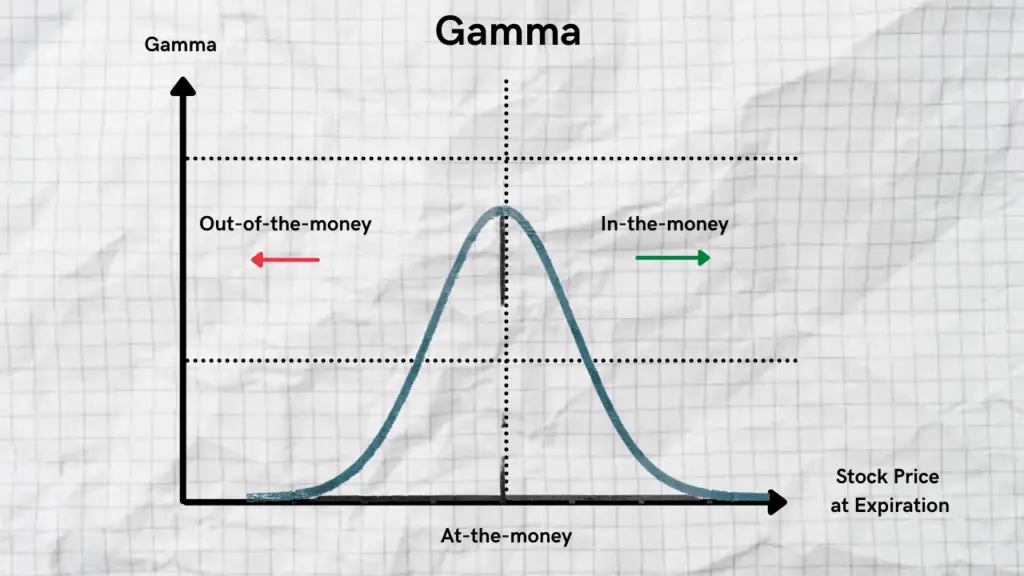

Both of these Greeks change as the price of the stock fluctuates. Gamma is an important derivative of the delta because it can give us insight into the sensitivity of an options delta. The graph above can help you make sense of gamma as the price of the stock fluctuates. As you can see from the graph:

- Gamma approaches zero the further out-of-the-money it gets

- The gamma is at it’s highest point for at-the-money options

- Higher gamma indicates that the options delta can change significantly with a very small change in the price of the stock

- Lower gamma means that the options delta won’t change much with a change in the price of the underlying

As the stock options expiration date approaches, the gamma of options contracts near-the-money will increase. This is due to the fact that the time value of an options contract decreases and the option slowly begins to lose it’s extrinsic value. Grasping this concept is important when it comes to understanding gamma.

Understanding Gamma in Options Trading

To further make sense of gamma, we have understand it’s positive and negative counterparts.

Positive Gamma

When purchasing options, either calls or puts, the gamma value of your options position will be positive. If the price of the stock goes up, the positive gamma of your call options will become more positive and move closers towards +1.0. If the price of the stock falls, the delta of your call options decreases and gets closer towards 0. The opposite is true on the negative side of gamma.

Negative Gamma

When traders sell options, the value of gamma will always be negative. A short call option with negative gamma will have a delta that gets more negative if the price of the stock goes up. If the price of the stock falls, the short gamma options position will have a higher delta value.

Understanding how positive and negative gamma works will help you make sense behind the sensitivity levels of stocks. This is key if you manage a large portfolio of equities for clients.

Gamma and Time to Expiration Relationship

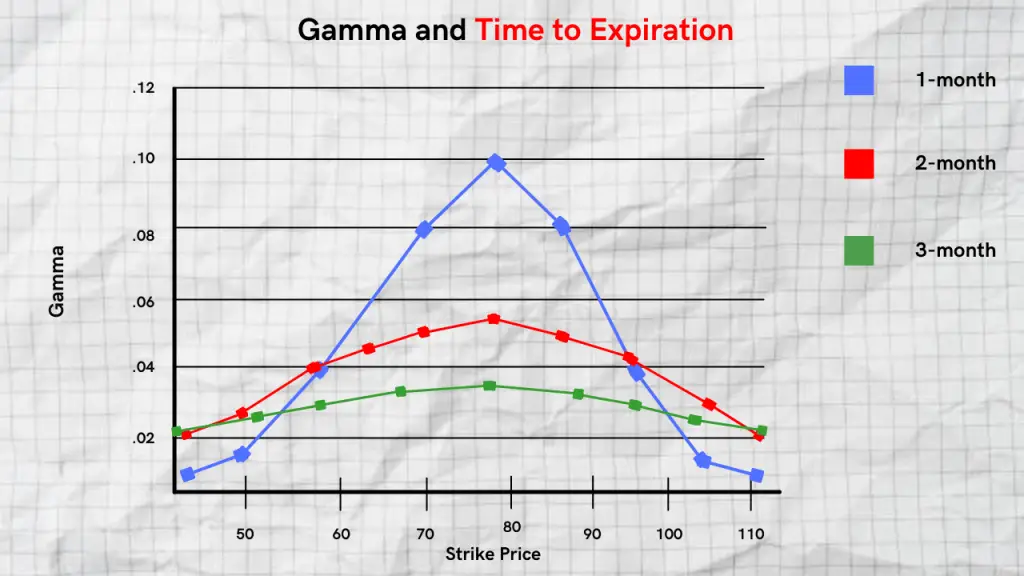

Another important relationship to understand is between gamma and time to expiration. As the options expiration approaches, the gamma value of at-the-money options will increase.

And as you can see from our graph below, the gamma value of in-the-money and out-of-the-money options reduces as time to expiration gets closer. Gamma also increases towards expiry because there is a higher visible change in the delta value for shorter-term options. This is a fundamental relationship that is key for making sense of gamma changes.

From our graph above, gamma sensitivity is higher for shorter-term options. And gamma is lower for longer-term expiration cycles.

Gamma vs Implied Volatility

If you’re a portfolio or fund manager understanding implied volatility is crucial. Knowing how changes in implied volatility can impact your returns is very important when managing a large portfolio of funds. Understanding the relationship between gamma and different implied volatility levels can help you hedge exposure more effectively.

High Implied Volatility

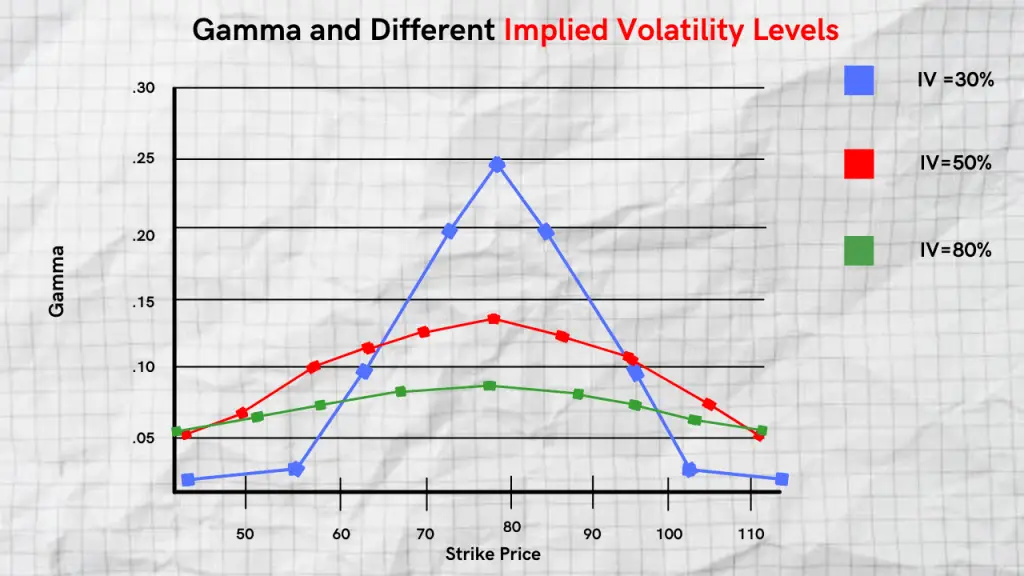

If volatility is high, gamma will usually be more stable across all options strike prices. The reason is that when volatility is high, the time value component of deep in-the-money and deep out-of-the-money options is already very high.

High Vol = More Stable and Less Sensitive Gamma

As such, when there is an increase in the time value of the options as they get closer to the money, gamma is less sensitive and will remain more stable.

Low Implied Volatility

On the contrary, when implied volatility is low, gamma will be more sensitive across strike prices. Gamma will be the highest for at-the-money options and approach 0 for deep-in-the-money and deep-out-of-the-money options.

Low Vol = More Sensitive Gamma

The reason this occurs is that when volatility is low, the time value component of options is low, but will rise significantly as the stock price gets closer to the strike price. As supported by our graph, you can see the spike in gamma towards at-the-money strike prices and how it approaches 0 the deeper you go out-of-the-money and deeper you go in the money.

For strategies like gamma scalping, knowing how changes in implied volatility impact different values can help you manage your stock options positions more effectively.

Gamma Squeeze Explained

The concept of a “gamma squeeze“ was made popular with meme stocks like GameStop and AMC. In traditional investing, you may have previously heard of a “short squeeze”. A short squeeze is a market phenomenon that occurs when investors or traders who are short the stock are forced to liquidate their positions by buying back the shares they borrowed. They are forced to liquidate their positions due to the price of the stock rallying against them.

A gamma squeeze applies to options trading and requires the right conditions to stack up in order for it to happen. The “squeeze” starts off with bets that the price of the stock will rally in the short term. There will typically be large buying of short-dated call options during a gamma squeeze, usually on weekly expirations. As the squeeze heats up, investors are forced to buy actual shares in the underlying stock which ends up sending prices even higher.

You will often see the value of gamma get more and more positive during a squeeze along with significant changes in the delta. However, it’s worth noting that a gamma squeeze is a short lived event that does not sustain for a long period of time.

Conclusion

As you can see, gamma can be a very useful metric to use if you want to further understand the sensitivity of delta. Options traders don’t have to always use it in their strategy, but understanding its changes can be important when managing exposure.