If you have experience trading a poor man’s covered call, you have more than likely run into the scenario of the stock price moving sharply against you or blowing through your short call strike price. If you haven’t experienced this before, chances are that at some point you will.

As such, knowing the correct steps to manage your options position can help you offset your losses and improve your profitability. Let’s take a look at how to roll a poor man’s covered when different scenarios occur with the price of the stock.

Summary

- Rolling a poor man’s covered call is a way to manage your poor man’s covered call when the price of the stock moves sharply against you or goes above your short call strike price

- By rolling your covered call you can reduce your break-even price and also reduce your max loss on the trade if it turns against you

- PMCC is an acronym for poor man’s covered call

Poor Man’s Covered Call Explained

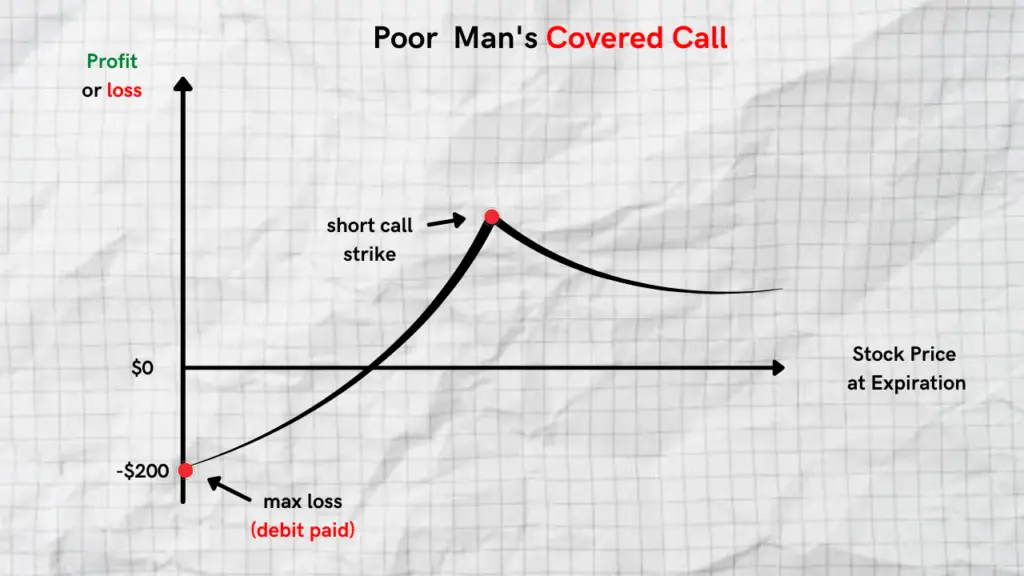

Before we discuss how to roll your poor man’s covered call (PMCC), it’s important to understand how a poor man’s covered call works in the first place. The poor man’s covered call is an alternative options strategy that is done to replicate a regular covered call. It consists of buying an in-the-money call option with a further expiration and simultaneously selling an out-of-the-money call option with a closer expiration date.

- Buying an in-the-money (ITM) call option

- Selling an out-of-the-money (OTM) call option

One of the benefits of doing a poor man’s covered call over a regular covered call is the reduced capital required to enter the trade. With a standard covered call, you have to purchase 100 shares of the underlying stock and sell an out-of-the-money call option.

This requires a large capital investment depending on the price of the stock you’re trading. The poor man’s covered call is great because it mimics the same properties of a covered call with much less capital. The theta decay from the short call option offsets the cost associated with the long call option.

Different Ways to Roll a Poor Man’s Covered Call

Rolling a poor man’s covered call is a way to manage your options position if the price of the stock moves sharply to the downside or goes through your short call strike price. Just like rolling a covered call, you have different ways in which you can roll a poor man’s covered call. Below are five different ways in which you can roll a poor man’s covered call.

How you roll your poor man’s covered call will depend on where the stock price is relative to your long call strike price and your short call strike price.

Rolling Up

Rolling up your PMCC is done if the price of the stock has gone above your short call strike price or is very close. This is done by simultaneously:

- Buying back your short call option

- Selling a higher strike price with the same expiration date

When you roll up your PMCC, you shift the short call up to a higher strike price. This allows your long call to gain further intrinsic value instead of facing assignment. There is a net debit cost associated with rolling up your PMCC. But this allows you to open up your trade to higher profit potential by shifting your short call out to a higher strike price.

Rolling Down

Rolling down your PMCC is done if the price of the stock moves to the downside or drops below your long call strike price. The price of the stock can drop sharply early on in the trade due to unexpected news announcements or earnings releases. Rolling down your PMCC is done by simultaneously:

- Buying back your short call option

- Selling a lower strike price with the same expiration date

By rolling down your short call strike, you reduce your break-even price since you will be collecting more options premium. As a result of rolling down your short call strike, you will receive a net credit. This further offsets the net cost of your long call option. However, you significantly reduce your profit potential because your short call strike is now much closer to your long call option.

Important Note: You don’t want to roll down your short call prematurely if the price of the stock has moved down sharply without any supporting news or reason. Sometimes it’s worth it to wait a few days to make the right decision about rolling down. Remember, patience is key when it comes to managing your options trades.

Rolling Out

If the trade is going as planned, rolling out our PMCC is another effective way to manage your trade and collect more premium. Rolling out is done by simultaneously:

- Buying back your short call option

- Selling the same strike price with a further expiration

Rolling out is usually done if the price of the stock hasn’t changed much since your original entry. Going out to a further expiration allows you to collect more options premium and reduce the cost basis associated with your long call option.

Rolling out to a further expiration can result in either net debit or net credit. This depends on how close the price of the stock is to the short call strike. We recommend rolling out only if it results in a net credit.

Rolling Up and Out

Rolling a PCMM up and out is done if investors have gotten more bullish on the price of a stock and want to shift out their profit targets. It is done by simultaneously:

- Buying back your short call option

- Selling a call with a higher strike price and longer expiration

This is usually done if the stock price has advanced aggressively to the upside in a short period of time and has gone above the short call strike price. Shifting the short call to a higher strike price and longer expiration allows you to capture more profit on your long call option and expand the profit potential of your overall trade. This is best done if a stock makes new highs or breaks key resistance levels. Knowing when these levels are approaching can help you get ahead of the trade.

Rolling Down and Out

Rolling a PCMM down and out is done if a trader wants to reduce the cost basis of the long call significantly or has changed their opinion on the price of the stock. This is done by simultaneously:

- Buying back the original short call

- Selling a call with a lower strike price and a longer expiration

In most cases, this type of roll is done as a way to reduce the loss on the long call due to the price of the stock moving sharply to the downside and below the long call strike price. Since the max loss of poor man’s covered call is limited to the net debit paid, rolling down to a lower strike and longer expiration allows the trader to collect more options premium. This helps to reduce the net cost of putting on the original trade.

Rolling a Poor Man’s Covered Call Example

Let’s assume the following scenario to illustrate an example of rolling a PCMM.

The current price of AMD stock is $100 per share and you have reason to believe that the stock is going to trend up in the next 90 days. As a result, you decide to purchase the June $94 call with 90 days till expiration and sell the April $105 call with 30 days till expiration.

Initial Poor Man’s Covered Call Example

| Example Scenario | AMD is trading at $100 per share 90 days until the expiration |

| Initial Trade | Buy 1 ITM June $94 call @$10.50 Sell 1 OTM April $105 call @$2.50 |

| Net Debit | $8.00 |

Trade Breakdown: The net debit to enter this trade is $8.0. This is calculated by subtracting the net debit cost of the long call ($10.50) from the net premium received from selling the short call ($2.50). The max possible loss from this trade is the net debit paid to enter the trade.

Post-trade: In the next 20 days, the price of AMD moves up and goes above the $105 strike and is now at $110 per share. Your long call option now has significantly more intrinsic value. As a result, you are now more bullish on AMD and don’t want to face an assignment at $105. So you decide to roll up the trade to the $120 strike.

Rolling up the Poor Man’s Covered Call Example

| Post Trade Scenario | AMD is now trading at $110 per share 70 days remain until your long call expiration 10 days remain until your short call expiration |

| Rolling Up The Trade | Buy Short call back @8.50 Sell 1 OTM April $120 call @$3.50 |

| Additional Net Debit | $5.00 |

To roll up this trade to a higher strike price you had to pay an additional $5.00. However, this adjustment now allows you to earn an additional $15 per share on your initial long call.

You pay an extra $5.00 for the opportunity to make an additional $15.00 per share on your overall trade. You also reduce your probability of assignment at the $105 strike price and increase your max profit potential by moving to the $120 strike price.

Pros and Cons of Rolling a Poor Man’s Covered Call

Pros

- Rolling your trade gives you flexibility in managing your position effectively

- Investors can enhance the profitability of their trade by effectively rolling it

- In certain situations, rolling your trade can reduce your break-even price and the cost basis of your long call

Cons

- There are additional trading costs associated with rolling your position

- Prematurely rolling your trade can cause you to lose out on longer-term profit potential

- Liquidity and spreads at higher strike prices and longer-term expirations are worse

Conclusion

Effectively managing your PMCC is extremely important if you want to improve your profitability and reduce your cost basis. It’s worth noting that you shouldn’t roll your poor man’s covered call prematurely. Rolling prematurely can significantly reduce your profit potential and cost your additional trading fees. It should be done when there is a sustained move in the price of the stock that significantly impacts your trade.

Related Reading

Rolling a Covered Call Option

Covered Call Options Trading Strategy Explained

Gamma Scalping Options Strategy